Hawaiian Holdings Inc. (NASDAQ:HA) is slated to release third-quarter 2017 earnings numbers on Oct 19, after the market closes.

Last quarter, the company delivered a positive earnings surprise of 3.3%. Also, it has an impressive earnings history, beating the Zacks Consensus Estimate in three of the last four quarters with an average of 7%.

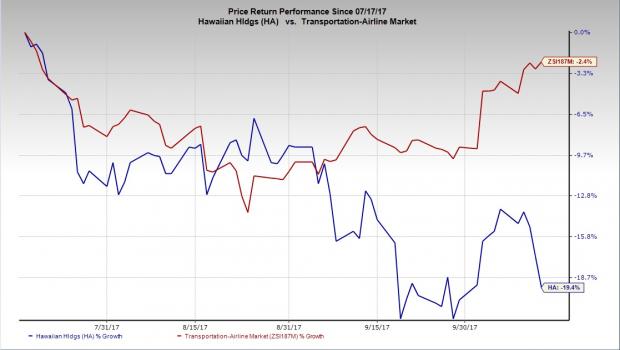

However, hurt by the recent hurricanes, airline stocks are lying low. Shares of Hawaiian Holdings have lost 19.4% of its value over the past three months, underperforming the industry’s 2.4% decline.

Let’s see how things shape up for this earnings.

Factors at Play

Unit costs, excluding fuel, are projected to rise significantly in the third quarter primarily due to higher labor costs. This is likely to hurt the company’s bottom line. Also, rising fuel costs have caused the carrier to recently project third-quarter economic fuel cost per gallon between $1.65 and $1.75 (previous guidance had estimated the metric between $1.55 and $1.65).

The Zacks Consensus Estimate for third-quarter operating cost per available seat mile (CASM Ex-fuel) stands at $8.86, while average fuel price per gallon is estimated at $1.62.

There is also negativity surrounding the stock, evident from the Zacks Consensus Estimate for the soon-to-be-reported quarter earnings being revised 3.1% downward over the last 60 days.

However, the carrier’s performance with respect to unit revenues is encouraging. The metric is expected to register substantial year-over-year growth in the third quarter. The Zacks Consensus Estimate for third-quarter passenger revenue per available seat mile (PRASM) is pegged at 12.85 cents, much higher than the 12.53 cents reported in the second quarter of 2017 .

Earnings Whispers

Our proven model does not conclusively show that Hawaiian Holdings is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as elaborated below.

Zacks ESP: Hawaiian Holdings has an Earnings ESP of +0.87% as the Most Accurate estimate is pegged at $1.88, marginally higher than the Zacks Consensus Estimate of $1.87. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Hawaiian Holdings’ Zacks Rank #5 (Strong Sell) acts as a spoiler. The bearish rank combined with a positive Earnings ESP leaves the surprise prediction inconclusive.

Hence, we caution against all Sell-rated stocks (#4 or 5) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Investors interested in the broader Transportation sector may consider SkyWest, Inc. (NASDAQ:SKYW) , Norfolk Southern Corporation (NYSE:NSC) and Expeditors International of Washington, Inc. (NASDAQ:EXPD) , as our model shows these stocks to possess the right combination of elements to surpass estimates in their next releases.

SkyWest has an Earnings ESP of +1.03% with a favorable Zacks Rank #3. The company will report third-quarter earnings numbers on Oct 25.

Norfolk Southern has an Earnings ESP of +0.67% and a Zacks Rank of 3. The company will report third-quarter 2017 results on Oct 25.

Expeditors is a #3 Ranked stock with an Earnings ESP of +1.68%. The company will report third-quarter 2017 financial numbers on Nov 7. You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Hawaiian Holdings, Inc. (HA): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Norfolk Souther Corporation (NSC): Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD): Free Stock Analysis Report

Original post