- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

DICK'S Sporting (DKS) Likely To Deliver On Q4 Earnings View

We expect DICK’S Sporting Goods Inc. (NYSE:DKS) to beat expectations when it reports fourth-quarter fiscal 2017 results on Mar 13. In the previous quarter, the company reported positive earnings surprise of 15.4%. Moreover, the company’s earnings have surpassed the Zacks Consensus Estimate in two of the trailing four quarters, with an average beat of 3.4%.

The current Zacks Consensus Estimate for the quarter under review is $1.20 per share, reflecting a year-over-year decline of 9.1%. We note that the Zacks Consensus Estimate for the quarter has been stable in the last 30 days. Analysts polled by Zacks expect revenues of $2.73 billion, reflecting 9.8% growth from the prior-year quarter. Let’s see how things are shaping up ahead of the upcoming release.

Factors at Play

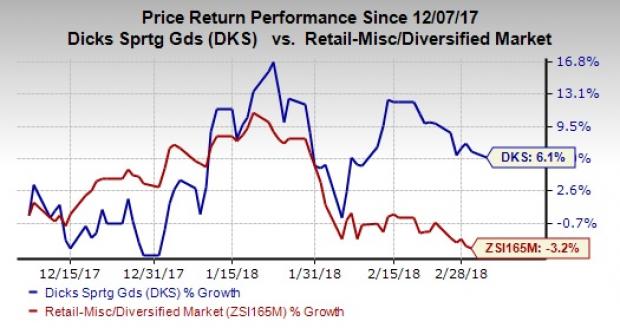

We note that DICK’s Sporting has outperformed the industry in the past three months. The company’s shares rose 6.1%, against the industry’s decline of 3.2%. The stock has been doing well because of its unique merchandising strategy, sturdy e-commerce business along with continued focus on developing ways to generate greater sales.

Additionally, the company’s investments in e-commerce, store technology and store payroll, as well as DICK'S Team Sports HQ and private brands, are likely to enrich customers’ experience and augment the top line. Also, it remains confident about driving market-share growth in the fourth quarter and fiscal 2018, owing to its current strategy and initiatives.

Moreover, the company’s outlook for the fourth quarter and fiscal 2017 remains encouraging. For the fiscal fourth quarter, the company envisions earnings to lie in the band of $1.12-$1.24 per share, based on the low single-digit decline in comps.

For fiscal 2017, management projects adjusted earnings in the range of $2.92-$3.04 per share, including nearly 5 cents from the additional 53rd week. GAAP earnings per share are expected in the range of $2.95-$3.07. Comps for the fiscal are anticipated between flat and low single-digit decline.

However, the company expects the retail environment to be extremely promotional in the fourth quarter and fiscal 2018. This, along with excess inventory, broadened distribution strategies from some vendors and lack of innovation and novelty, is likely to keep margins under pressure.

Despite the margin pressures, we remain optimistic about the company’s results in the to-be-reported quarter, mainly due to the robust earnings outlook and strength in its initiatives.

What the Zacks Model Unveils

Our proven model shows that DICK’S Sporting is likely to beat earnings estimates this quarter. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Earnings ESP of +6.79% and the company’s Zacks Rank #2 make us reasonably confident of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks Poised to Beat Earnings Estimates

Here are some other companies you may want to consider as our model shows that these, too, have the right combination of elements to post an earnings beat:

American Eagle Outfitters Inc. (NYSE:AEO) has an Earnings ESP of +0.53% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zumiez, Inc. (NASDAQ:ZUMZ) has an Earnings ESP of +0.56% and a Zacks Rank #2.

Dollar Tree, Inc. (NASDAQ:DLTR) has an Earnings ESP of +1.41% and a Zacks Rank #2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.