- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Delta's Q2 Revenues May Be Hit By $10B Due To Coronavirus

As coronavirus continues to take its toll on air travel demand, Delta Air Lines, Inc. (NYSE:DAL) expects second-quarter 2020 revenues to be slashed by $10 billion, indicating an 80% year-over-year decline. With the large-scale damage already caused by the pandemic to the economy as a whole, the airline anticipates travel demand to take a long period of time to recover even after the virus fears are checked.

To combat the unprecedented crisis, the airline has been taking several cost-reduction initiatives. To this end, the carrier plans to reduce capital expenditures by a minimum of $2 billion this year. It is also offering voluntary short-term unpaid leaves, apart from freezing hiring. The Atlanta, GA-based airline also suspended share repurchases and its board has now voted to halt future dividend payouts as well.

Regardless of these measures, the Zacks Rank #3 (Hold) company is “burning roughly $50 million in cash each day”.Hence, to preserve cash and solidify liquidity position, the company entered into a $2.6 billion secured credit facility. Additionally, it is drawing down $3 billion under its existing revolving credit facilities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

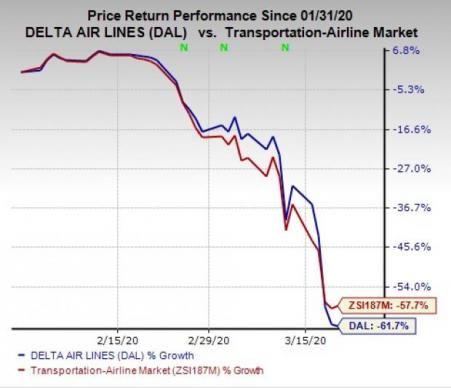

Shares of Delta have plunged 61.7% since the beginning of February, compared with the industry’s 57.7% decline, due to dwindling demand in the wake of coronavirus.

Last week, Delta decided to cut systemwide capacity to the tune of 70% until there is a recovery in air-travel demand. Notably, over the next two to three months, Delta’s international flights will be reduced to more than 80%. With shrinking air travel demand, other U.S. carriers like American Airlines (NASDAQ:AAL) and United Airlines (NASDAQ:UAL) have also slashed capacity dramatically. While American Airlines reduced international flights by 75%, United Airlines reduced international flight schedules by 90% for April. Meanwhile, LATAM Airlines (NYSE:LTM) plans to cut back capacity by 70% due to this global health peril.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian, hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.