- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Delek Gulps Poison Pill After Icahn Buys 14.8% Of Its Stake

Delek US Holdings, Inc. (NYSE:DK) recently announced its adoption of a limited-duration stockholder rights plan and declared a dividend of one "Right" for each outstanding share of Delek common stock payable to its shareholders of record on Mar 30, 2020. Shares of Delekjumped 30% in Friday’s trading following this news. The move comes after Icahn Enterprises L.P. (NASDAQ:IEP) had accumulated a 14.86% stake in the company and held talks with management.

Activist investor Carl Icahn purchased a portion in Delek with an intention to combine the refiner CVR Energy (NYSE:CVI) , in which it held 71% ownership, with the company. This is because the merger of both will strengthen the footprint of this geographically-varied inland refiner with greater availability of crude at more reasonable value in Cushing, OK and the Permian where Delek owns the Big Spring refinery besides Canada.

Per Delek, the rights pact was followed as the company's present share value does not mirror its inherent long-term worth, thanks to the coronavirus pandemic that turned most sectors topsy-turvy until now.

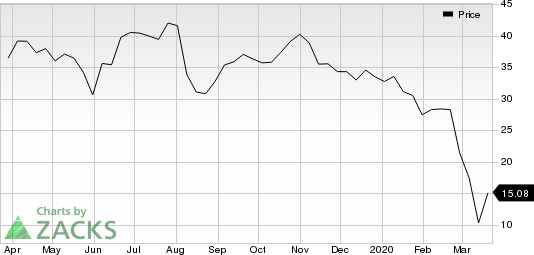

China's fuel demand is visibly crippled in the aftermath of large-scale travel bans imposed globally. To worsen matters, oil prices plummeted as Saudi Arabia waged a price war and ramped up its oil production significantly in retaliation to Russia’s resistance to lower its crude production at the OPEC meeting. As of Thursday, Delek stock has lost 65.6% year to date compared with 62.2% decline of the industry it belongs to.

Management at this Brentwood, TN-based confirmed that the rights plan will be exercised when an investor accumulated more than 15% of a stock, contingent upon customary conditions. The plan will provide stockholders with the right to purchase shares at a discounted price, which will dilute the stock and prevent a hostile takeover.

In a separate press release, earlier this month, a source informed that activist investor Carl Icahn expanded his interest in Occidental Petroleum (NYSE:OXY) to almost 10% and doubled down on a fight to take control of the oil producer.

About the Company

Delek is an independent refiner, transporter and marketer of petroleum products. This Zacks Rank #4 (Sell) company’s operations are organized under three reportable segments: Refining, Logistics and Retail.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Icahn Enterprises L.P. (IEP): Free Stock Analysis Report

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

CVR Energy Inc. (CVI): Free Stock Analysis Report

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.