- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Deere (DE) On Acquisition Spree, Inks Deal To Buy King Agro

Deere & Company (NYSE:DE) , the world’s largest farm equipment manufacturer, has recently entered into a definitive agreement to acquire King Agro, a privately-held manufacturer of carbon fiber technology products. Financial terms of the transaction have not been disclosed.

King Agro is a family-owned business with headquarters at Valencia, Spain, and a production facility in Campana, Argentina. In agriculture, the company has targeted innovative designs that improve productivity and lower costs.

The Deere - King Agro alliance dates back to 2015 when both companies decided to develop and distribute carbon fiber booms for the John Deere application equipment in agriculture. The deal offered significant advantages of carbon fiber's versatility, strength and durability in self-propelled spraying equipment to growers.

Post acquisition, Deere’s customers will benefit from King Agro's unique knowledge, designs, and expertise in carbon fiber technology. King Agro will retain its brand name, trademark, and commercial relationships post closure of the deal.

Acquisitions to Drive Growth

Deere has been active on the acquisition front, of late. In December 2017, the company acquired the leading global road-construction equipment maker — Wirtgen — for $5.2 billion in cash and debt. This buyout will enable Deere’s North America-centric construction business to expand globally and also catapult it to the position of an industry leader in road construction.

In September 2017, Deere acquired Sunnyvale, CA-based Blue River Technology, a pioneer in bringing machine learning to agricultural spraying equipment. Blue River’s technology has aided precision agriculture by shifting farm-management decisions from the field level to the plant level.

Moreover, Deere is poised to gain from higher housing starts in the United States, stabilizing oil prices and strong order activity.

Share Price Performance

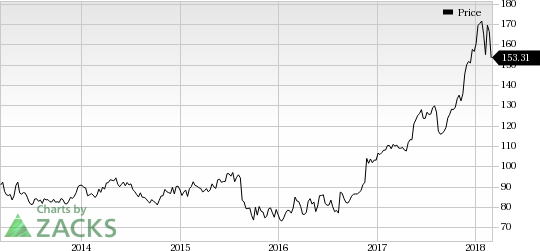

Deere has outperformed its industry with respect to price performance in a year’s time. The stock has appreciated around 38%, while the industry has recorded growth of 32% during the same time frame.

Zacks Rank and Other Key Picks

Currently, Deere carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the same space include Dover Corporation (NYSE:DOV) , W.W. Grainger, Inc. (NYSE:GWW) and H&E Equipment Services, Inc. (NASDAQ:HEES) . While, Dover and Grainger sport a Zacks Rank #1 (Strong Buy), H&E Equipment carries the same rank as Deere. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dover has a long-term earnings growth rate of 13%. Its shares have rallied 14%, over the past six months.

Grainger has a long-term earnings growth rate of 9.7%. The company’s shares have been up 55.8% during the same time frame.

H&E Equipment has a long-term earnings growth rate of 14.4%. The stock has gained 62% in six months’ time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

W.W. Grainger, Inc. (GWW): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.