- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BofA (BAC) Keeps The Trend Alive, Beats On Q3 Earnings

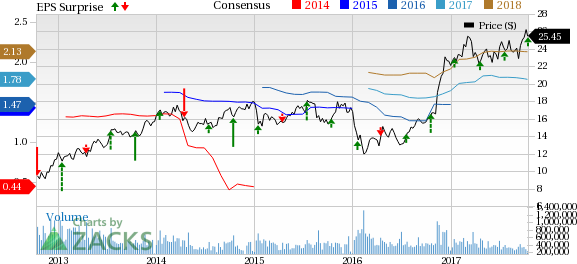

Despite trading slowdown, loan growth and higher interest rates drove Bank of America Corporation (NYSE:BAC)’s (NYSE:C) third-quarter 2017 earnings of 48 cents per share, which outpaced the Zacks Consensus Estimate of 46 cents. The figure was 17% higher than the prior-year quarter.

Markets also seem to be happy with BofA’s results. In pre-market trading, the company’s shares were up nearly 1.4%. The price reaction during the full trading session will provide a better picture about how the investors accepted the results.

Impressive net interest income growth, marginal increase in equity trading income and a slight rise in investment banking fees supported revenues. Operating expenses also recorded a decline. Further, credit costs decreased despite rise in loans.

However, a fall in trading revenues (as expected) and mortgage banking losses were the undermining factors.

Overall performance of the company’s business segments, in terms of net income generation, was decent. All segments witnessed improvement in net income except Global Markets.

Loan Growth Supports Revenues, Expenses Down

Net revenues amounted to $22.1 billion, up nearly 1% from the prior-year quarter. Also, the top line beat the Zacks Consensus Estimate of $22 billion.

Net interest income, on a fully taxable-equivalent basis, grew 9% year over year to $11.4 billion. Further, net interest yield rose 13 basis points (bps) year over year to 2.36%.

Non-interest income declined 7% from the year-ago quarter to $10.7 billion. The decrease was mainly due to lower trading income and mortgage banking loss.

Non-interest expenses were $13.1 billion, down 3% year over year. The fall in expenses reflects reduced operating costs and lower litigation expenses.

Credit Quality Improves

As of Sep 30, 2017, ratio of nonperforming loans, leases and foreclosed properties was 0.75%, down 22 bps year over year. Also, provision for credit losses fell 2% year over year to $834 million, reflecting lower losses in consumer real estate and lower energy exposure.

However, net charge-offs increased 1% from the year-ago quarter to $900 million, indicating higher losses in commercial loans.

Strong Capital Position

The company’s book value per share as of Sep 30, 2017 was $23.92 compared with $24.19 as of Sep 30, 2016. Tangible book value per share as of Sep 30, 2017 was $17.23, up from $17.14 as of Sep 30, 2016.

As of Sep 30, 2017, the company’s common equity tier 1 capital ratio (Basel 3 Fully Phased-in) (Advanced approaches) was 11.9%.

Our Take

BofA’s efforts to realign its balance sheet and focus on core operations will likely support bottom-line growth. Further, the bank is well positioned to benefit from higher interest rates. As expected, fixed income trading declined. Further as interest rates move higher, mortgage refinancing is expected to continue falling.

Currently, BofA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

Amid an expected trading slump and lower underwriting fees, rising rates and loan growth drove JPMorgan Chase & Co.’s (NYSE:JPM) third-quarter 2017 earnings, which easily outpaced the Zacks Consensus Estimate. Further, higher advisory fees and a slight fall in operating expenses acted as tailwinds. On the other hand, a decline in mortgage banking income was a headwind.

Despite weak fixed income market revenues, Citigroup Inc. (NYSE:C) delivered a positive earnings surprise in third-quarter 2017 on prudent expense management. Overall top-line strength was reflected, driven by higher banking and consumer banking revenues. Moreover, expenses declined on efficiency savings by the bank.

U.S. Bancorp (NYSE:USB) is scheduled to report third-quarter 2017 earnings on Oct 18.

4 Stocks to Watch after the Massive Equifax (NYSE:EFX) Hack

Cybersecurity stocks spiked on recent news of a data breach affecting 143 million Americans. But which stocks are the best buy candidates right now? And what does the future hold for the cybersecurity industry?

Equifax is just the most recent victim. Computer hacking and identity theft are more common than ever. Zacks has just released Cybersecurity! An Investor’s Guide to inform Zacks.com readers about this $170 billion/year space. More importantly, it highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

U.S. Bancorp (USB): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.