- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dax Touches Key Area

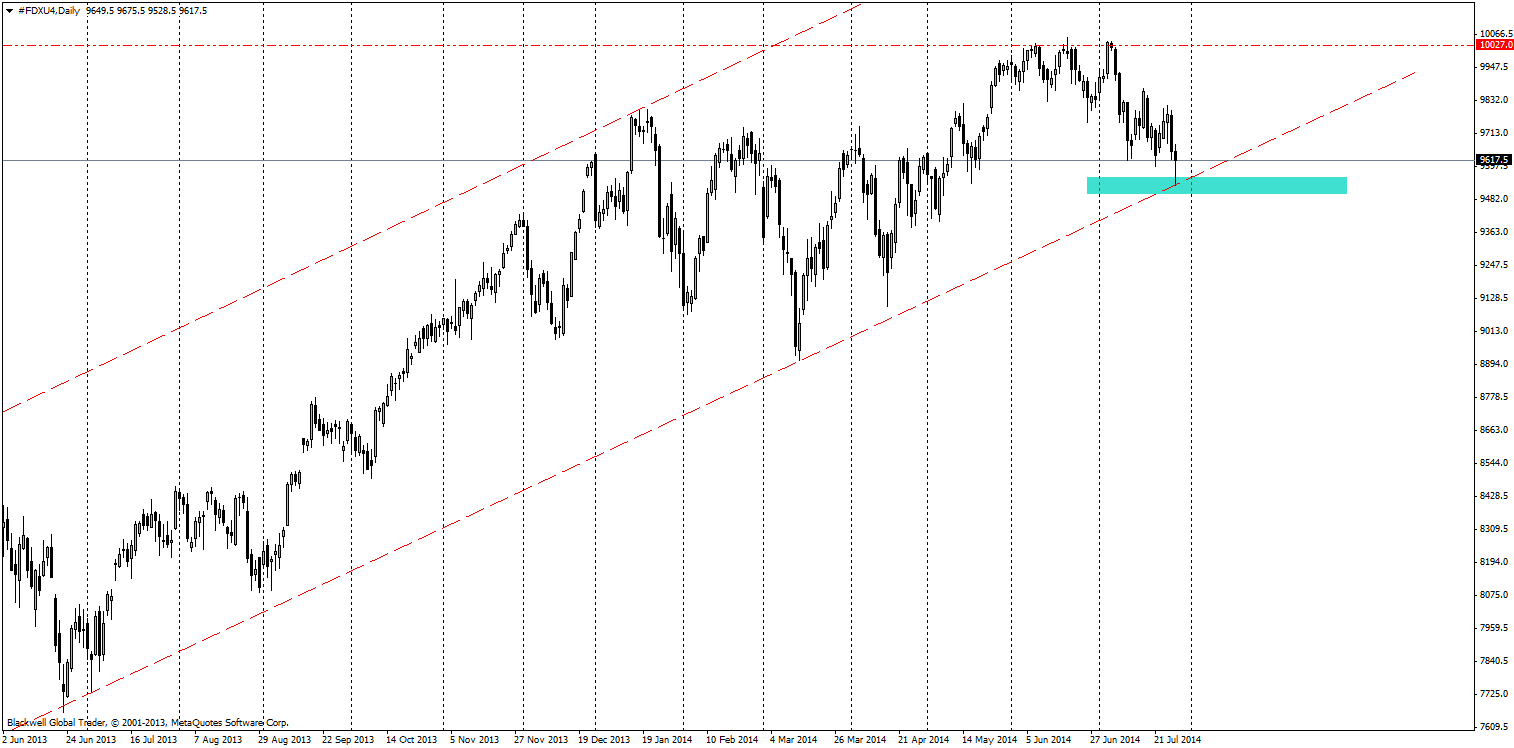

The DAX index is generally a good representation of the economy and has as of late been struggling to break through key resistance on the daily chart. After looking for it to fall further in recent articles that has certainly come true and it has dropped back sharply to touch support levels in the current channel.

So the fall that was likely to happen has happened, and indexes and commodities generally play of technicals more so than forex – so it’s much easier to watch and wait in the market.

Source: Blackwell Trader (DAX, D1)

With the DAX we can see that the trend has extended lower as markets have pushed down on the back of Draghi comments. But have managed to find support on the trend line at 9528. Markets were waiting for this point and the strong wick that we see on the candle is a result of this heavy buying pressure by markets as they still see value in the DAX, and were not keen to see it enter bullish territory.

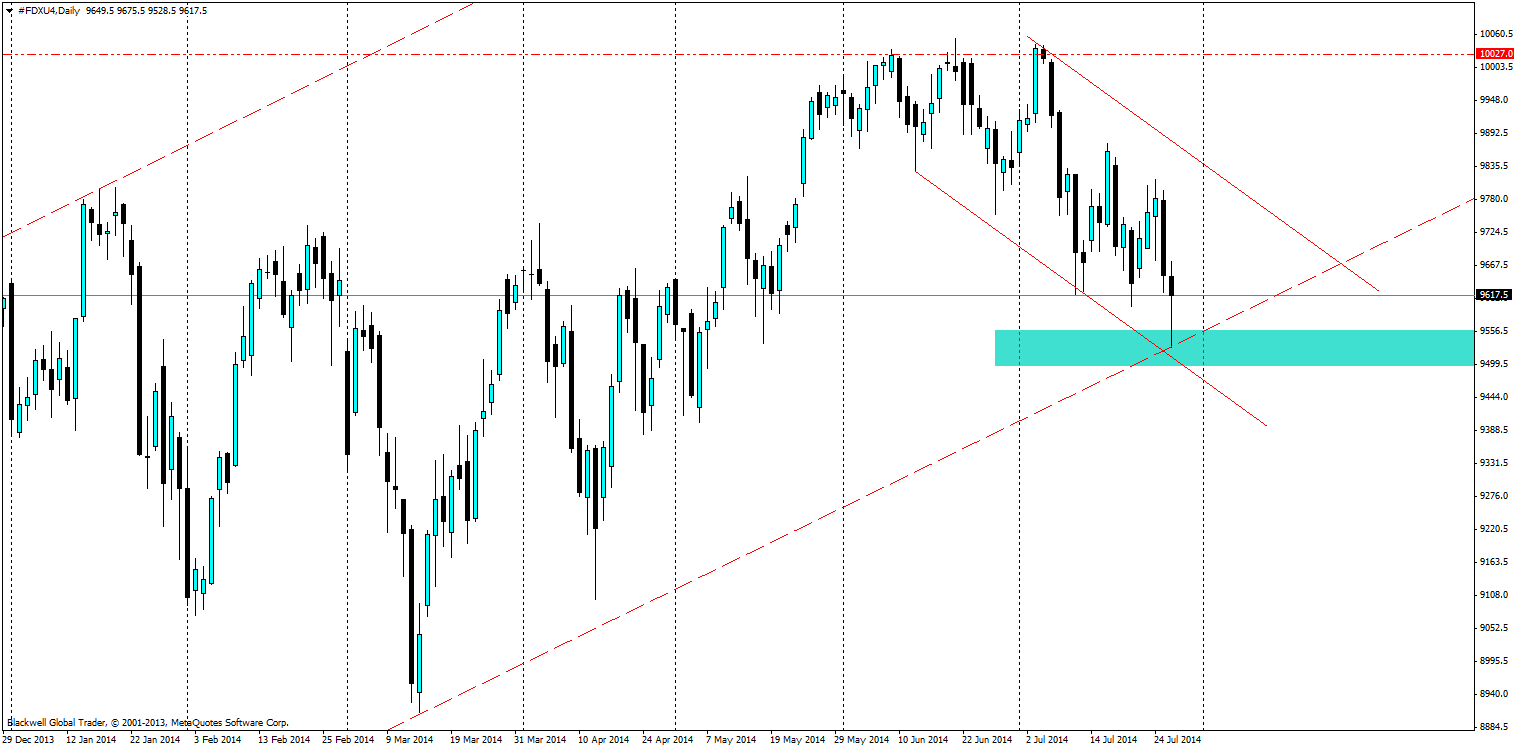

Zoomed in, it’s clear that there is a possibility of a channel forming, however, there is certainly the possibility of bullish movements higher for the DAX in the medium term.

Source: Blackwell Trader (DAX, D1)

Just like the FTSE, markets prefer equity indexes to range between defined parameters, and in this case the bullish trend line is acting as dynamic support and is likely to stay.

People looking to play this chart should look for a bullish movement higher before jumping in for another crack at the upper level of resistance at 10027. And by bullish movement I believe a rise above the present level and some bullish candles showing market desire to push higher.

While the technical patterns are strong, one must also be aware of the present situation in the Euro-zone. As a raft of data is due out this week it could negatively affect the Euro-zone and future outlook for the fragile economy. Any serious negative news could see the trend line tested and if it does push lower, it would be worth looking to catch momentum if there was a breakout to the south.

Either way, at present the DAX is providing clear opportunities for markets and the possibilities that are at hand when it comes to movements. Catching momentum either side will likely pay off in some regards, but it will be interesting to see if we have another push higher in the face of economic weakness to the present trend line. But hey, with all the money Draghi is trying to push into the system, it has to go somewhere, and American markets showed clearly that equity markets are more than happy to eat it up in the long run.

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.