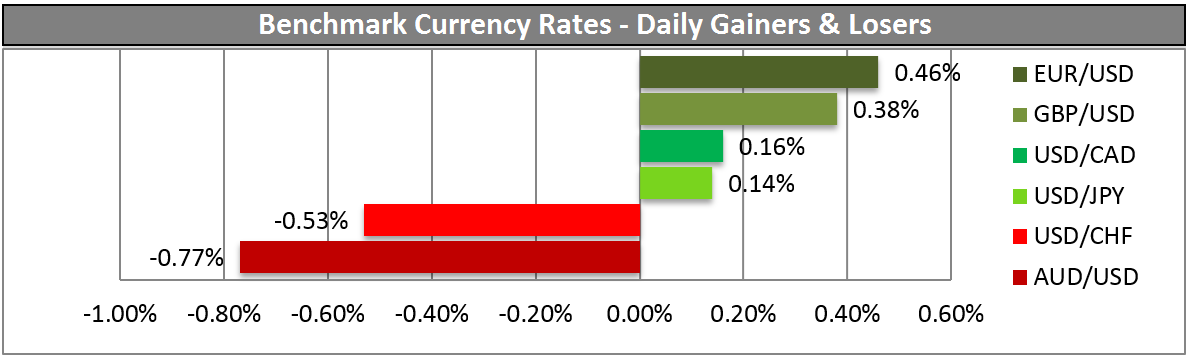

Yesterday’s market was easy to understand: currencies followed the data in logical fashion. Better-than-expected jobless claims, surprising strength in the Chicago PMI and an upward revision to the U of Michigan consumer confidence figure sent US interest rates higher, Fed Funds expectations up sharply, and pushed the dollar up vs most of its G10 counterparts (the main exception being GBP, which remained firm). The leading index was also higher than expected (albeit lower on the month) and MBA mortgage applications seem to be bottoming. The only major disappointment was in the durable goods orders for October: non-defense capital goods orders excluding aircraft, a barometer of companies’ investment intentions, was particularly disappointing – but that didn’t seem to bother the market, perhaps because the government shut-down in October would naturally make companies reluctant to invest at that time. The upward revision to the U of M consumer sentiment index suggests that sentiment was recovering by the latter half of November, so the market can afford to ignore some disappointing October data. As long as the US data continues to show a steady economy, thoughts of tapering will not be far from the market and USD should gain, especially at the expense of EM currencies.

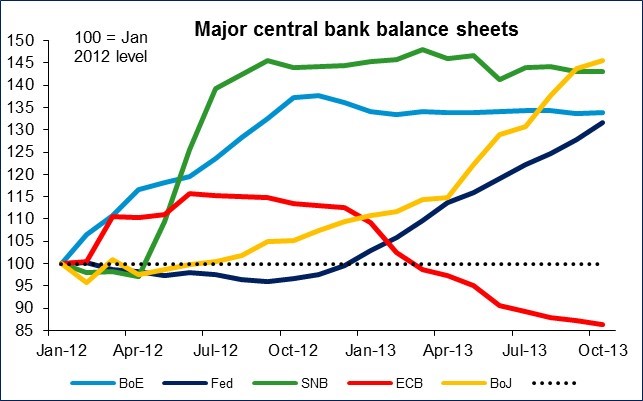

There is talk in the market that the ECB may be considering a new long-term refinancing operation (LTRO) aimed at improving liquidity to companies. It would lend money to the banks on the condition that the money be lent to the private sector. That would help to reverse some of the contraction in the ECB’s balance sheet, which may be one factor pushing EUR/USD higher recently. However, ECB Vice President Constancio played down that idea, saying that lenders aren’t under the same pressure as when the ECB did the extraordinary round of 3-year LTROs in late 2011. He also tried to dampen speculation about negative rates, saying “we are not really near a decision on that” and that any such decision would be taken “only in quite extreme situations.” EUR/USD has tended to move lower as ECB Council members held out the possibility of such moves, but denials like this would tend to push it back up. We will get further clarification next Thursday, following the ECB meeting. That meeting will include the ECB’s new forecasts, which many analysts had expected to be the trigger for the rate cut that actually came at the November meeting. I would expect to hear further dovish comments from ECB President Draghi, but given the difference in views on the board, I don’t expect any further measures. The absence of any fresh initiatives is likely to push the EUR/USD higher ahead of that meeting, in my view.

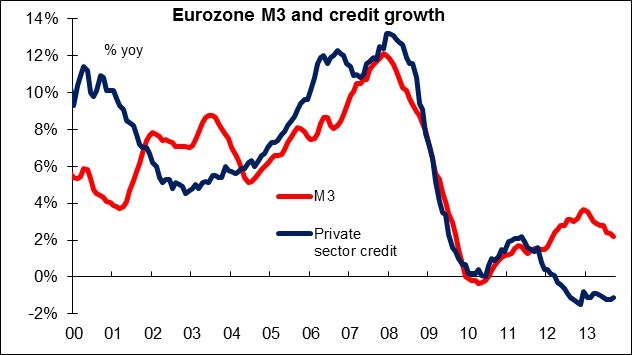

Today we have Germany’s unemployment rate and preliminary CPI, both for November. The unemployment rate is estimated to remain unchanged at 6.9%, while the preliminary CPI for November is expected to rise to 1.3% yoy from 1.2%. An outturn like that, showing less deflationary pressure in Europe’s largest economy, could be positive for the euro. On the other hand, Eurozone M3 growth is expected to continue decelerating to 1.7% yoy in October from 2.1% yoy, slowing the 3-month average to 2.0% from 2.2%. That would add to the deflationary pressures in the Eurozone and hence be EUR-negative. The bigger problem for the ECB is the divergence between the money supply, which is growing modestly, and bank lending and private sector credit creation overall, which are shrinking. Problems like this with the transmission mechanism explain why the ECB might want to look at more direct ways to encourage banks to lend rather than simply lowering rates. Finally, the forecast for Eurozone’s final consumer confidence for November remains the same as the initial estimate at -15.4.

The US will be closed for the Thanksgiving holiday. In Canada, Q3 current account deficit is estimated to be effectively unchanged at CAD 14.4bn vs CAD 14.6bn in Q2.

Besides the indicators, the Bank of England publishes its Financial Stability report and Gov. Carney will present it at a press conference. Finally, ECB’s Asmussen speaks for a third consecutive day.

Overnight, New Zealand’s building permits for October are forecast to be up 1.7% mom from 1.4% mom in September, showing continued strength in the housing sector. That may be NZD-positive as the RBNZ searches for ways to cool the housing market. From Japan, the jobless rate for October is expected to ease to 3.9% from 4.0%. National CPI is expected to rise 1.1% yoy in October, the same as in September, while the Tokyo CPI rate is expected to accelerate to 0.7% yoy from 0.6% yoy. Excluding food and energy, inflation is expected to be 0.2% yoy, up from 0% in September. This would be the first positive figure for core inflation since Oct. 2008. That could take some pressure off the BoJ to ease further and therefore be JPY-positive. Japan preliminary industrial production for October is estimated to rise 2.0% mom, accelerating from +1.3% in September. From UK we get the Gfk consumer confidence, which is expected to improve modestly to -10 in November from -11 in October.

The Market:

EUR/USD  EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="644" height="401">

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="644" height="401">

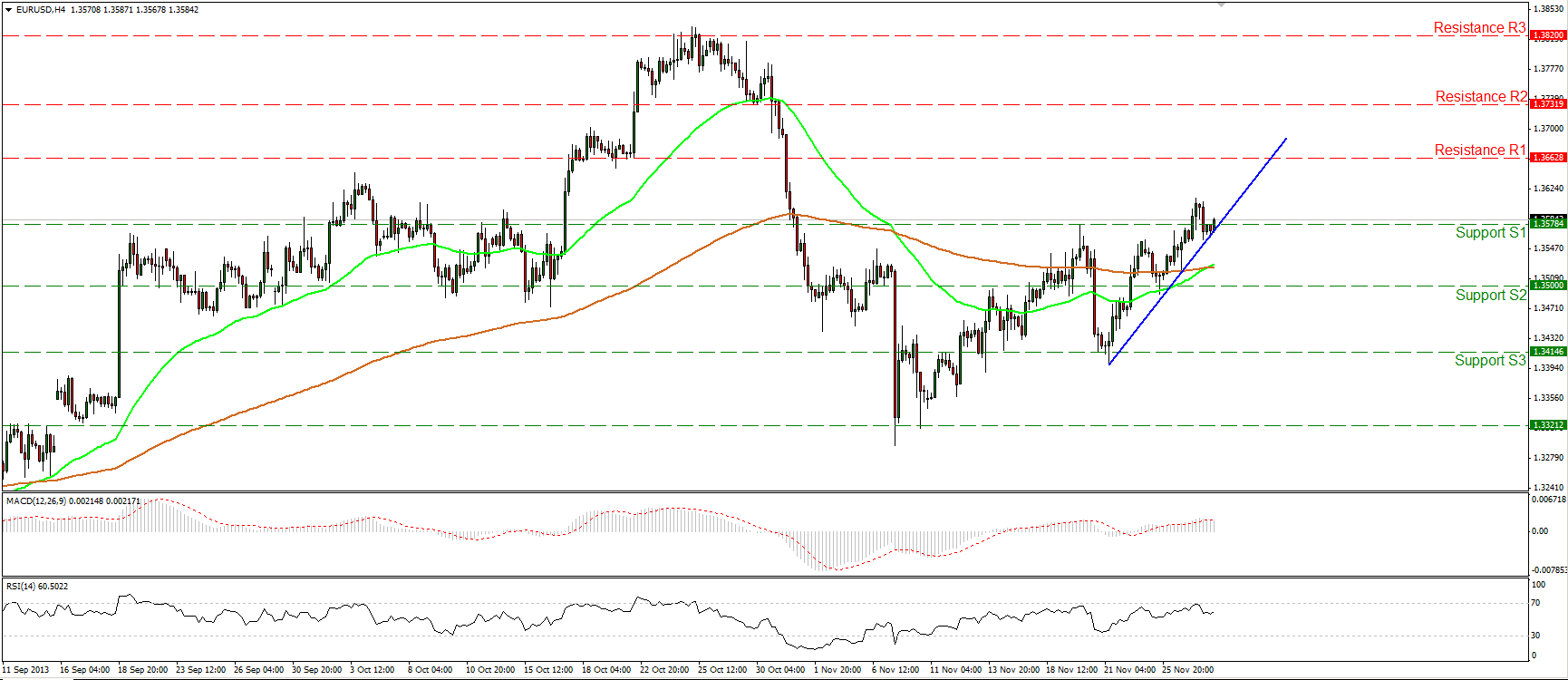

The EUR/USD moved lower, but found support near the blue uptrend line and the 1.3578 (S1) barrier. If the bulls manage to maintain the price above that area, they may drive the battle higher, targeting the resistance of 1.3662 (R1). The 50-period moving average poked its nose above the 200-period moving average, adding significance to the short-term uptrend. On the daily chart the 14-days MACD oscillator lies above its trigger line and seems ready to get a positive sign.

• Support: 1.3578 (S1), 1.3500 (S2), 1.3414 (S3)

• Resistance: 1.3662 (R1), 1.3731 (R2), 1.3820 (R3).

EUR/JPY EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="644" height="401">

EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="644" height="401">

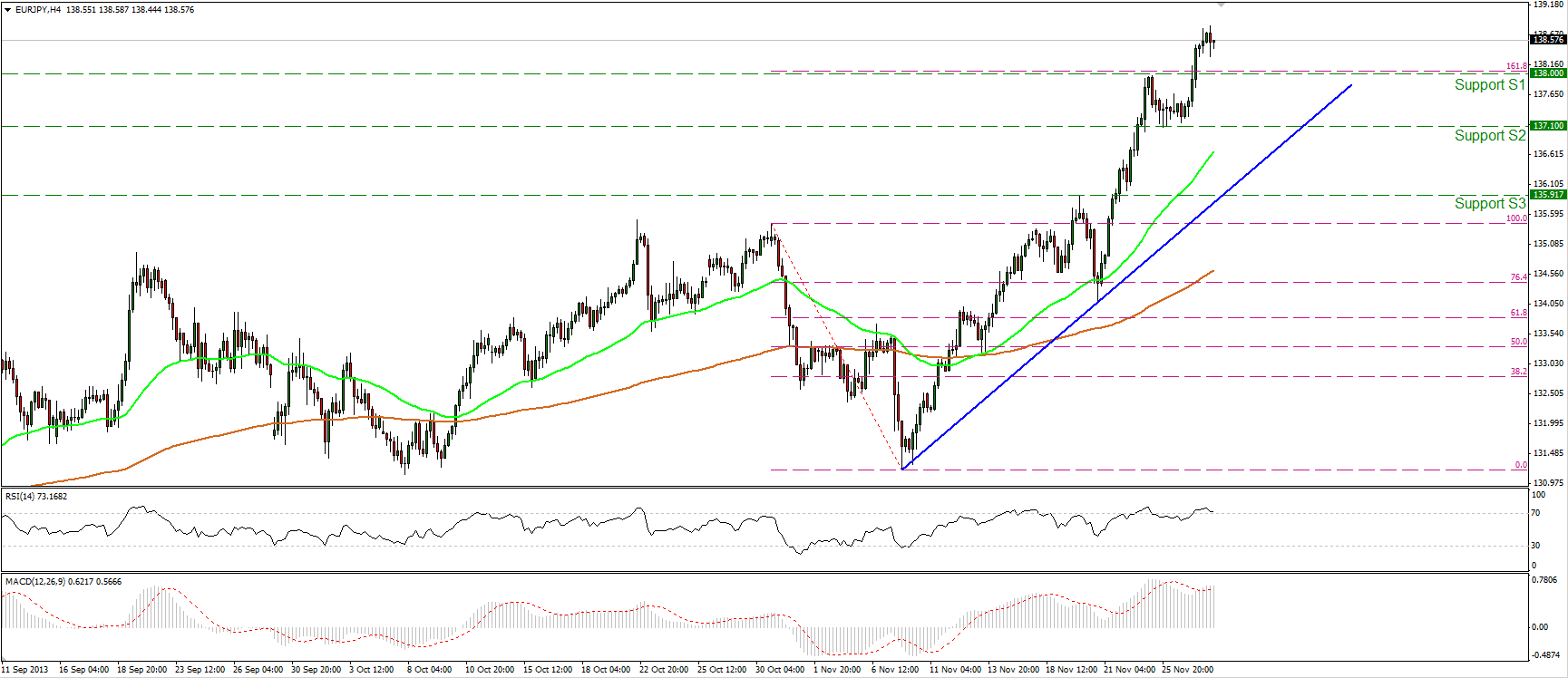

The EUR/JPY continued moving higher, breaking above the 138.00 barrier (yesterday’s resistance) which coincides with the 161.8% Fibonacci extension level of the 30th Oct.-11th Nov. downward wave. The pair is now trading at highs last seen back in 2009. I expect the longs to challenge the resistance barrier of 139.57 (R1). The uptrend is confirmed by the blue trend line, and by the fact that the 50-period moving average lies above the 200-period moving average, providing support to the price action.

• Support: 138.00 (S1), 137.10 (S2), 135.91 (S3).

• Resistance: 139.57 (R1), 142.53 (R2), 146.82 (R3).

GBP/USD GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="644" height="401">

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="644" height="401">

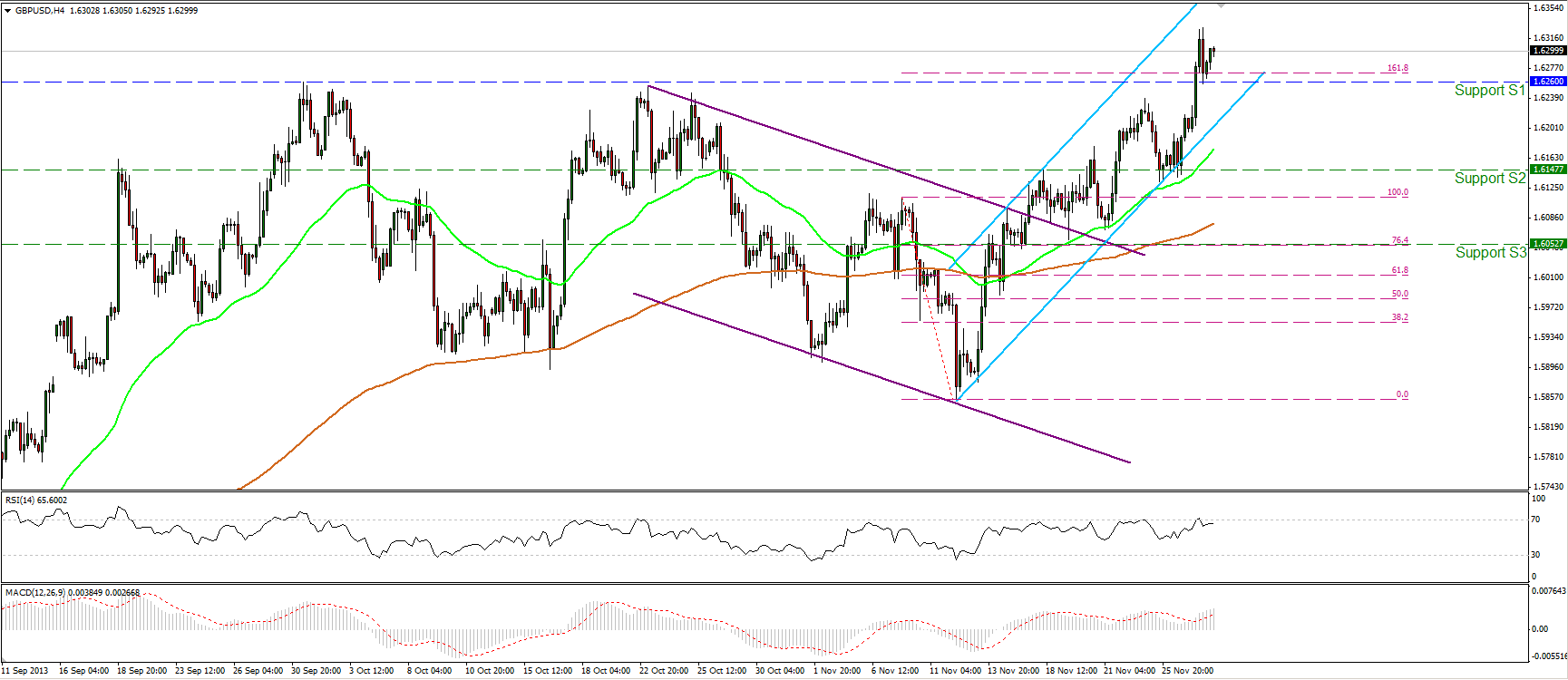

The GBP/USD surged yesterday, violating the 1.6260 ceiling and the 161.8% Fibonacci extension level of the 7th -12th Nov. downward wave. After the break, the pair moved lower to give another test to that area before continuing its advance. I expect the advance to continue, targeting the 1.6375 (R1) hurdle. The short term uptrend remains in force, since the rate is trading within the channel and the 50-period moving average remains above the 200-period moving average.

• Support: 1.6260 (S1), 1.6147 (S2), 1.6052 (S3).

• Resistance: 1.6375 (R1), 1.6442 (R2), 1.6535 (R3).

Gold XAU/USD Hourly Chart" title="XAU/USD Hourly Chart" width="644" height="401">

XAU/USD Hourly Chart" title="XAU/USD Hourly Chart" width="644" height="401">

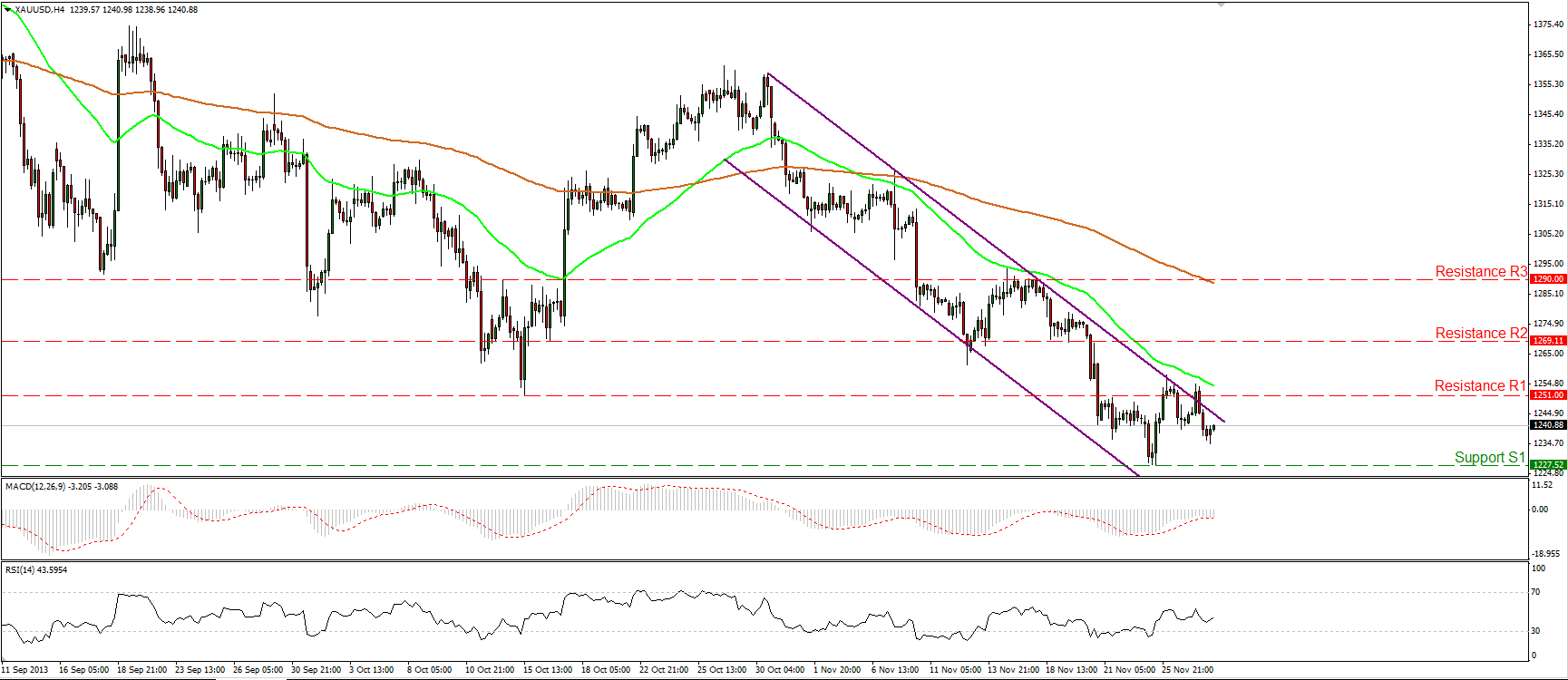

Gold found once again resistance at the 1251 (R1) resistance level and moved slightly lower. As long as the yellow metal is trading within the channel, the short-term direction is still downward. On the daily chart the price is trading slightly above the neckline of a possible head and shoulders top formation, where a downward break would have larger bearish implications.

• Support: 1227(S1), 1211 (S2), 1177 (S3).

• Resistance: 1251 (R1), 1269 (R2), 1290 (R3).

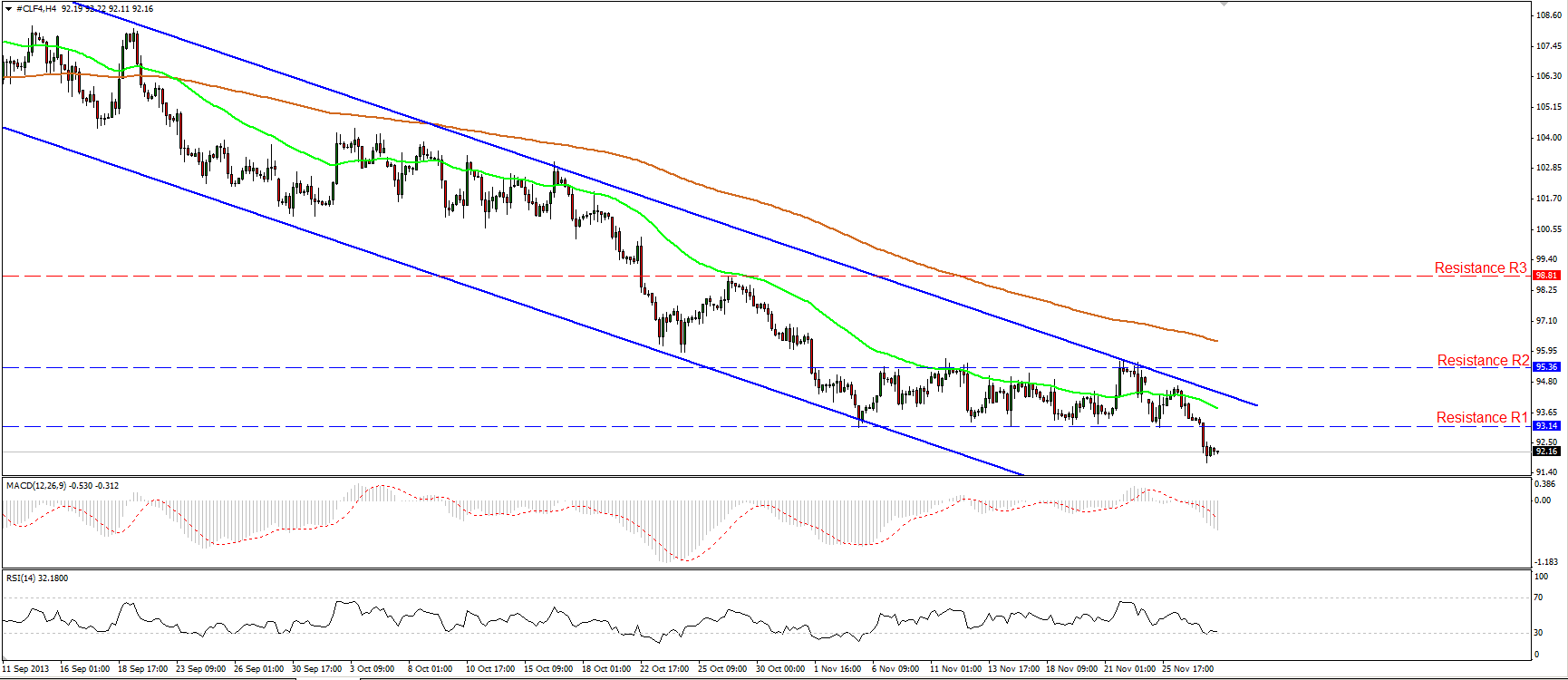

Oil

WTI moved lower yesterday, breaking below the strong hurdle of 93.14. In early European trading the price is heading towards 91.20 (S1), where a clear downward penetration would target the next support at 87.85 (S2). WTI lies within the longer-term downward sloping channel, while the bearish cross of the moving averages remains in effect since the 23rd of September.

• Support: 91.20 (S1), 87.85 (S2), 84.00 (S3).

• Resistance: 93.14 (R1), 95.36 (R2), 98.81 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

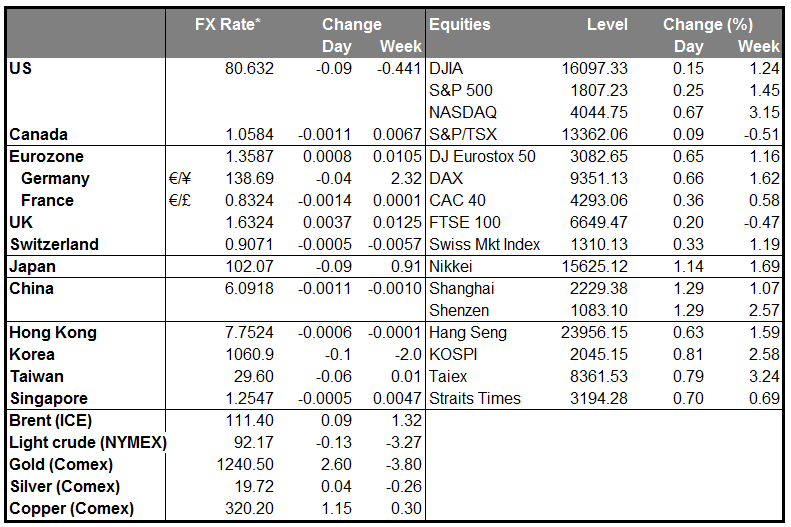

MARKETS SUMMARY