US Congress reaches a budget agreement!

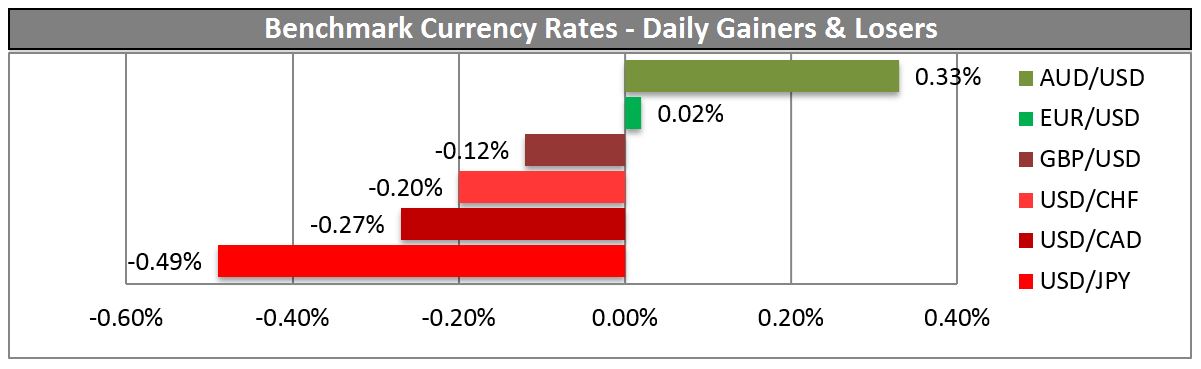

USD was mixed once again, gaining against SEK, NZD and GBP but declining against five of the other G10 currencies (it was unchanged vs EUR). The biggest decline was vs JPY, as might be expected with not only Tokyo stocks but also Asian stock markets down uniformly. Yet AUD and CAD also gained against the US currency too, indicating that this is more than just risk-off. However the dollar was starting to turn up again in early European trading after US lawmakers reached agreement on a budget deal for the next two years. That eliminates the risk of another government shutdown next month and hence removes some of the risk premium from the USD.

The end of fiscal risk should also make it easier for the Fed to begin tapering off its monthly bond purchases, although that seems to be pretty well discounted by the market already, as we’ve discussed. A poll taken last week by Bloomberg showed 34% of economists surveyed expected the Fed to begin tapering this month, with 26% expecting it at the January meeting and 40% at the March meeting – in other words, 100% expecting it to start by March. So far though that prospect has not been particularly USD-supportive. However I would expect the (relatively) peaceful resolution of this potential flashpoint to be a USD-positive point today and to see the dollar rebound, particularly against JPY. I should caution though that the technicals say otherwise (see below).

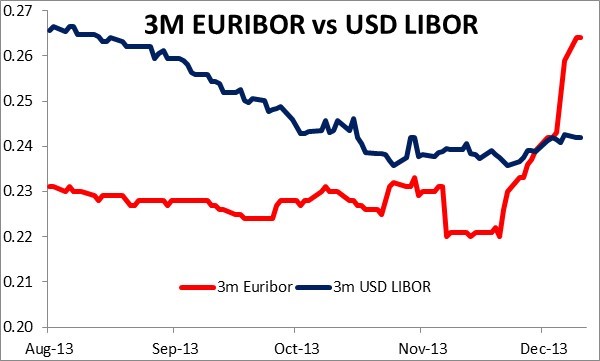

As Fed Funds futures remain steady and US bond yields eased further yesterday (10yr yields down 3 bps), the dollar is getting no more interest-rate support. On the other hand, as European banks repay their LTRO funds and move into the market for funding in preparation for the Asset Quality Review (AQR), 3m Euribor continues to fix higher. It hit a 12-month high of 0.26% last night, slightly above the comparable USD rate (0.24%), which makes it possible to put on EUR/USD carry trades. The reluctance of the ECB to take any further action to improve liquidity last week is increasing the pressure, which comes at a particularly unfortunate time as we move into year-end. The pressure on short-end EUR rates is likely to remain at least until the year end and may well support the EUR until that hurdle is over. As the combination of rising rates and a stronger EUR is harmful to the Eurozone economy, I would expect to see the ECB take some action eventually, if nothing else than verbal intervention by ECB Council members. We have to listen closely to what they say about the supply of liquidity.

There are few indicators worth noting today. In the US we only have the weekly MBA mortgage applications. Overnight the Reserve Bank of New Zealand meets. It’s widely expected that the Bank will keep its rate unchanged at 2.50%, so the focus will be on RBNZ Governor Wheeler’s press conference after the decision and what he says about the currency (probably that it’s too high, which is why NZD is lower this morning). We have two speakers during the day. ECB vice president Vitor Constancio speaks at an IMF book presentation and BoE policy maker Martin Weale speaks on “Forward Guidance and its Effects”.

The Market

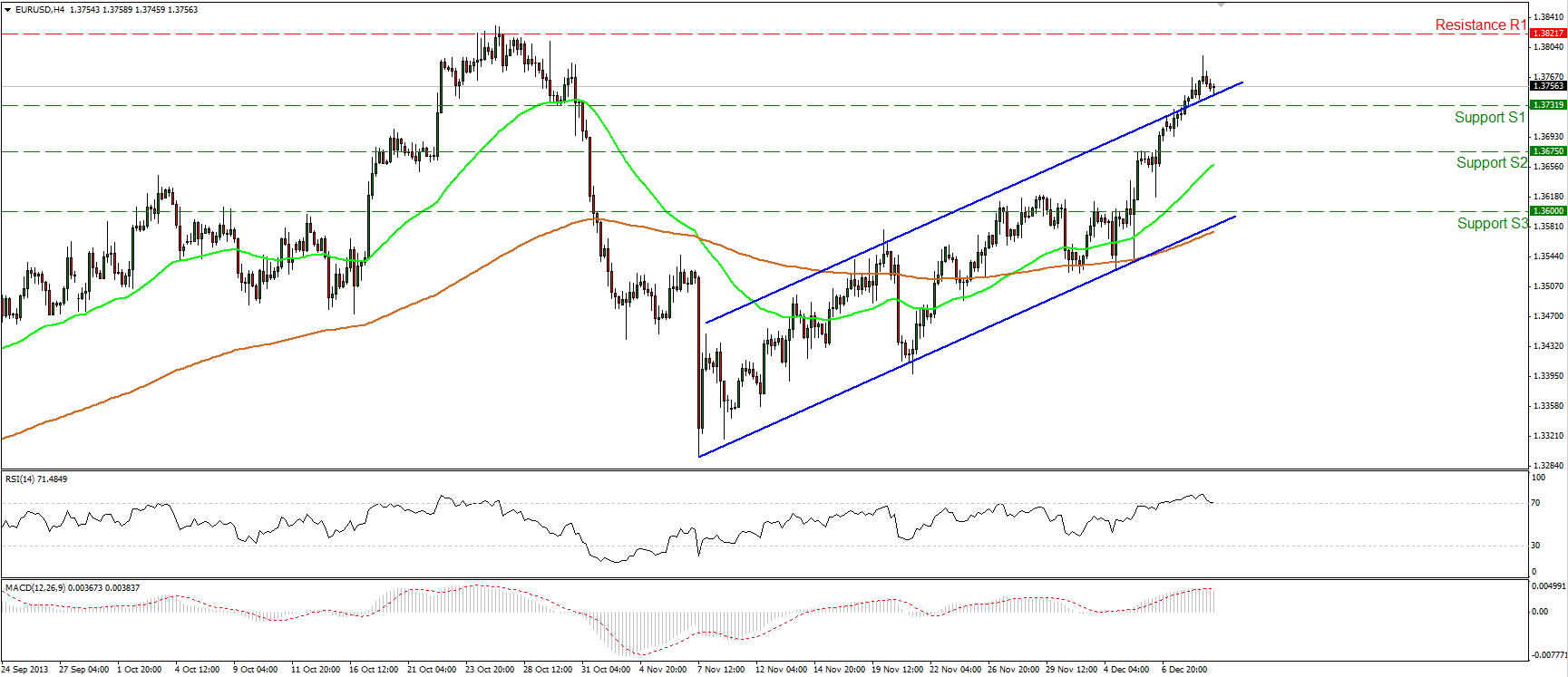

EUR/USD  EUR/USD" title="EUR/USD" height="747" width="1729">

EUR/USD" title="EUR/USD" height="747" width="1729">

• EUR/USD moved slightly lower yesterday and is now currently testing the upper boundary of the channel, which is now acting as a support. I still expect the bulls to extend their move and target October’s highs at 1.3821 (R1). However, the MACD crossed below its trigger line while the RSI moved lower and is now testing its 70 level, thus a price pullback within the channel cannot be ruled out. The bias remains to the upside since the pair is printing higher highs and higher lows, thus I consider any possible corrective wave as a renewed buying opportunity.

• Support: 1.3731 (S1), 1.3675 (S2), 1.3600 (S3)

• Resistance: 1.3821 (R1), 1.3935 (R2), 1.4200 (R3).

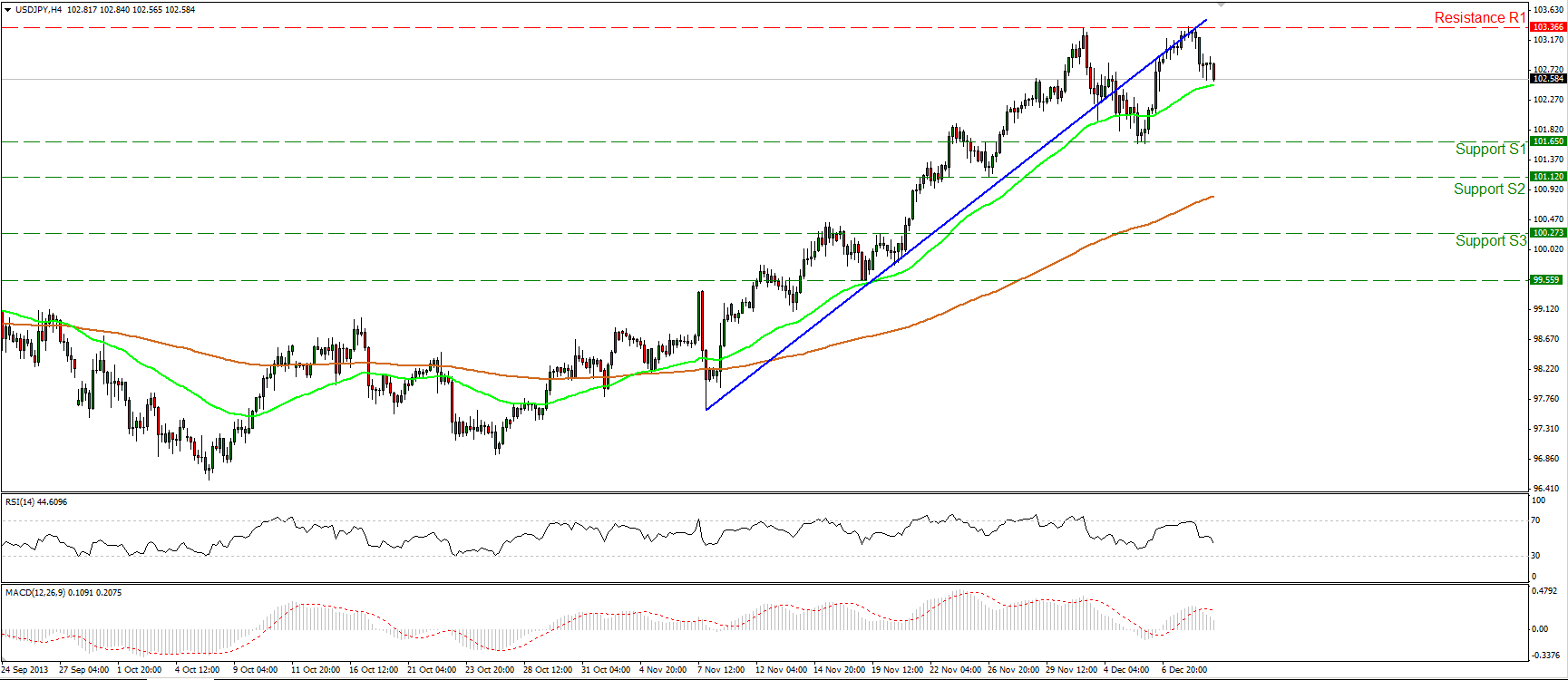

USD/JPY USD/JPY" title="USD/JPY" height="747" width="1729">

USD/JPY" title="USD/JPY" height="747" width="1729">

USD/JPY moved significantly lower after finding resistance at the prior uptrend line and the 103.36 (R1) resistance barrier. I would start assuming further decline upon a decisive break below the 101.65 (S1) support level, which would signal the completion of a double top reversal formation. At the moment, the rate is trading above both moving averages. A rebound near the area of the 50-period moving average may give the chance to the bulls to challenge one more time the hurdle of 103.36 (R1).

• Support: 101.65 (S1), 101.12 (S2), 100.27 (S3).

• Resistance: 103.36 (R1), 105.24 (R2), 106.87 (R3).

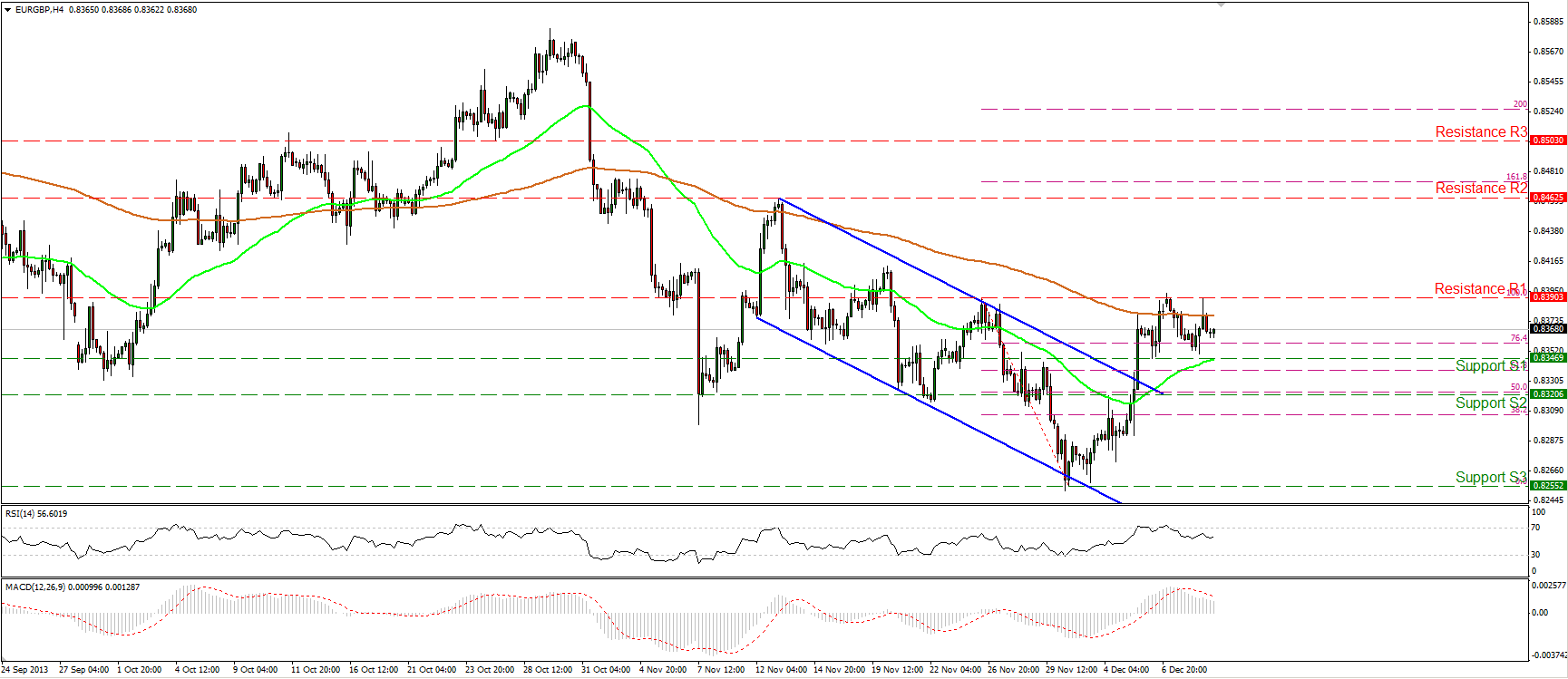

EUR/GBP EUR/GBP" title="EUR/GBP" height="747" width="1729">

EUR/GBP" title="EUR/GBP" height="747" width="1729">

• EUR/GBP moved lower after failing for a second time to overcome the 0.8390 (R1) resistance barrier. Both momentum studies confirm the weakness of the price. The MACD, although in a bullish territory, lies below its trigger line, while the RSI exited its overbought zone and is moving lower. If the longs appear stronger in the near future and manage to overcome that obstacle, they may continue pushing the price higher, targeting the area between the 0.8462 (R2) resistance and the 161.8% Fibonacci extension level of the previous bearish wave.

• Support: 0.8346 (S1), 0.8320 (S2), 0.8255 (S3).

• Resistance: 0.8390 (R1), 0.8462 (R2), 0.8503 (R3).

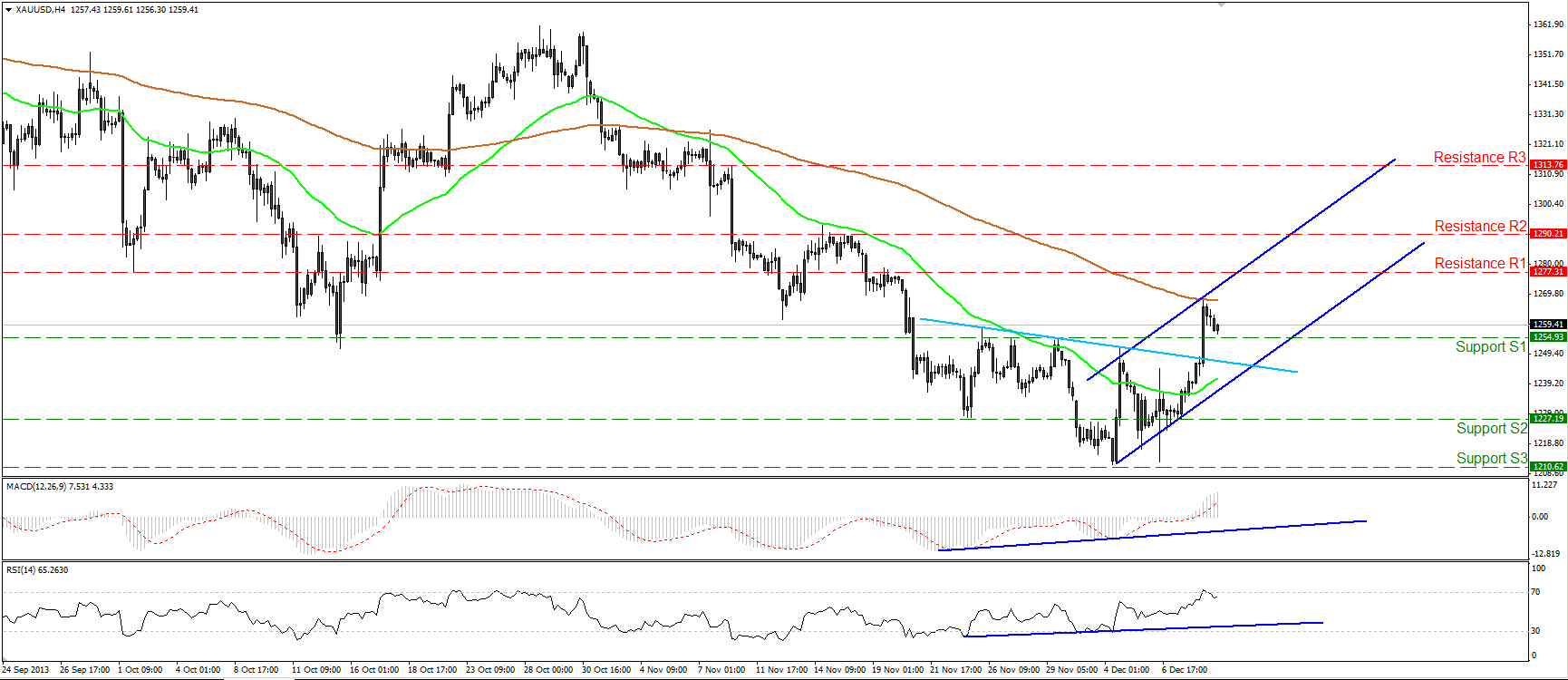

Gold XAU/USD" title="XAU/USD" height="747" width="1729">

XAU/USD" title="XAU/USD" height="747" width="1729">

• Gold surged yesterday, violating the neckline (light blue line) of a possible “complex head and shoulders bottom” formation and breaking above the 1254 barrier. The metal has formed two higher lows and two higher highs, giving us reason to assume that it’s established a new short-term uptrend. The target of the formation is found near the 1290 (R2) level, however a successful “return move” back to the neckline should not be ruled out. Usually such a move confirms the validity of the pattern.

• Support: 1254 (S1), 1227 (S2), 1210 (S3).

• Resistance: 1277 (R1), 1290 (R2), 1313 (R3).

Oil

• WTI moved higher reaching the 98.81 (R1) resistance barrier. An upward penetration of that resistance would have larger bullish implications, targeting the 101.10 (R2) barrier. The 50-period moving average managed to cross above the 200-period moving average, favoring the continuation of the newborn uptrend. My only concern is that RSI found resistance near its 70 level and moved lower, thus a pullback is possible before the bulls prevail again.

• Support: 95.36 (S1), 92.00 (S2), 90.10 (S3).

• Resistance: 98.81 (R1), 101.10 (R2), 103.15 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

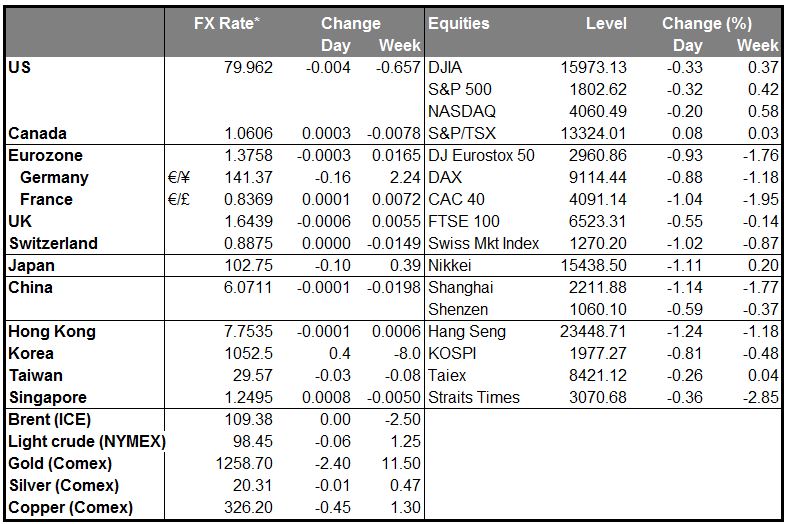

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Commentary: USD Declines Against JPY As Asian Markets Move Lower

Published 12/11/2013, 06:48 AM

Updated 07/09/2023, 06:31 AM

Daily Commentary: USD Declines Against JPY As Asian Markets Move Lower

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.