Silver Non-Commercial Positions:

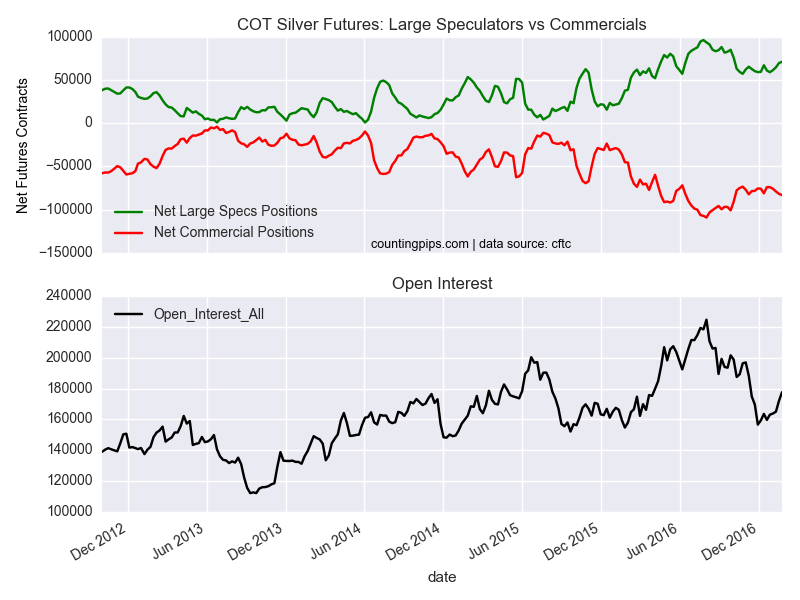

Large speculators and traders continued to add to their bullish net positions in the silver futures markets last week for a fourth straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex silver futures, traded by large speculators and hedge funds, totaled a net position of 71,021 contracts in the data reported through January 24th. This was a weekly gain of 1,539 contracts from the previous week which had a total of 69,482 net contracts.

Silver Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -83,084 contracts last week. This is a weekly change of -1,348 contracts from the total net of -81,736 contracts reported the previous week.

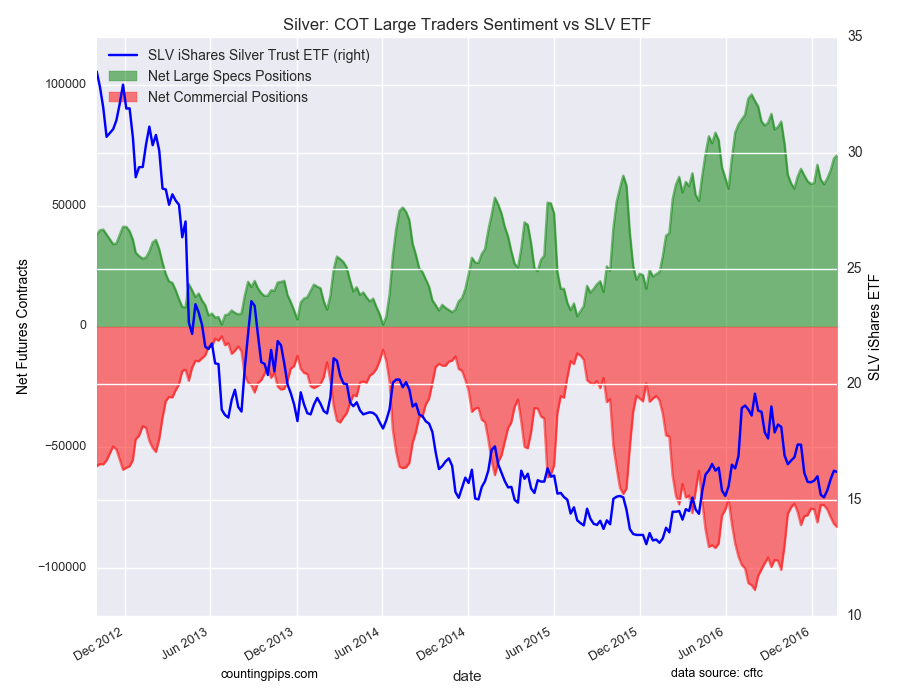

Silver ETF (NYSE:SLV):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SLV ishares ETF, which tracks the price of silver, closed at approximately $16.22 which was an edging lower of $-0.06 from the previous close of $16.28, according to ETF financial market data.