- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CryoLife (CRY) Beats Earnings And Revenue Estimates In Q4

CryoLife, Inc. (NYSE:CRY) reported adjusted earnings per share (EPS) of 11 cents in the fourth quarter of 2017, down 8.3% year over year. Adjusted EPS however managed to surpass the Zacks Consensus Estimate of 9 cents.

Full-year adjusted earnings came in at 40 cents, reflecting a decline of 16.7% from the year-ago figure. The figure surpassed the Zacks Consensus Estimate of 26 cents.

Revenues in Detail

Revenues in the quarter increased 17.3% year over year to $52.8 million. Moreover, the figure beat the Zacks Consensus Estimate by 10.9%. Revenues were primarily driven by double-digit revenue growth in BioGlue, On-X and tissue processing. Moreover, revenues included $4.1-million contribution from the recently-completed acquisition of JOTEC.

Full-year revenues came in at $189.7 million, up 5.2% from the year-ago period and beating the Zacks Consensus Estimate of $184.4 million

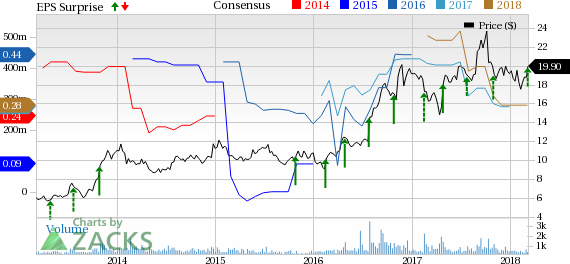

CryoLife, Inc. Price, Consensus and EPS Surprise

On a segmental basis, Product revenues increased 21.5% year over year in the fourth quarter to $35.1 million. Within the segment, 50.7% of the revenues came from BioGlue and BioFoam followed by 28.2% from On-X.

Preservation Services revenues increased 9.9% in the quarter under review from the year-ago quarter to $17.7 million. Within the segment, the company witnessed solid growth in Cardiac and Vascular tissues revenues.

On a geographical basis, the company’s revenues in the United States rose 5.2% to $34.6 million. International revenues increased 50.4% to $18.2 million.

Operational Update

CryoLife's gross profit in the reported quarter climbed 16.7% year over year to $36.4 million. However, gross margin contracted 40 basis points (bps) to 68.9%.

General, administrative, and marketing expenses in the fourth quarter rose 36% year over year to $30.2 million. Research and development expenses shot up 68.4% year over year to $6.4 million. Operating expenses totaled $36.6 million in the fourth quarter, up 40.2% year over year.

Adjusted operating loss in the quarter was $0.2 million, comparing unfavorably to operating profit of $5.1 million in the year-ago quarter.

Financial Update

CryoLife exited 2017 with cash and cash equivalents and restricted securities of $40.8 million, compared with $57.3 million at the end of 2016.

2018 Guidance

For 2018, CryoLife expects revenues in the band of $250.0-$256.0 million. The Zacks Consensus Estimate for full-year revenues stands at $263.4 million, above the guided range.

The company also expects adjusted earnings per share in the range of 29-32 cents. The Zacks Consensus Estimate for full-year earnings is pegged at 28 cents, below the company’s guided range.

Our Take

CryoLife exited fourth-quarter 2017 on a promising note. We are encouraged to note that the company has been witnessing growth in all the product lines along with strong performance in all geographies. Moreover, the company has been gaining from directly selling the products to end users. We are also optimistic about the company’s focus on product innovation through R&D and completion of the JOTEC buyout.

However, escalating operating expenses seem to be discouraging. Also, a tough competitive landscape acts as a dampener.

Zacks Rank & Key Picks

CryoLife has a Zacks Rank #3 (Hold).

A few better-ranked stocks that reported solid results this earnings season are PetMed Express (NASDAQ:PETS) , PerkinElmer (NYSE:PKI) and athenahealth, Inc. (NASDAQ:ATHN) . While PetMed and athenahealth sport a Zacks Rank #1 (Strong Buy) and PerkinElmer carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported third-quarter fiscal 2018 results. Adjusted EPS of 44 cents were up 88.3% from the prior-year quarter. Revenues rose 13.7% to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted EPS of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million in the year-ago quarter.

athenahealth reported adjusted EPS of $1.11 in the fourth quarter of 2017, up 79% on a year-over-year basis. Revenues totaled $329 million, up 14.2% on a year-over-year basis.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

athenahealth, Inc. (ATHN): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

CryoLife, Inc. (CRY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.