Crude oil is making an intra-day recovery from a minor triangle located in a sub-wave b), so the primary idea is still that sooner or later prices will be higher within a wave five of an Elliott wave ending diagonal, which can stop at $44.00.

On the daily chart of Crude oil we see energy in a strong recovery, up from 7.08 lows, which can be part of a bigger, bullish reversal. We see a higher degree wave A)/1) which can be in final stages with its structure, and can look for resistance, and a reversal into a wave B)/2) correction at the $44.0 level.

The relative strength index below the chart also suggests resistance and a reversal in days ahead.

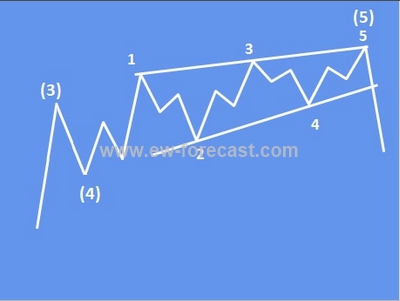

An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far too fast, as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B-C formations. In double or triple threes, they appear only as the final C wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

Ending diagonal in an uptrend:

Trade well!