- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Crude Oil Is Testing Major Support After Worries Of Weak Demand

There was no shortage of strong movements in the markets on Wednesday. However, a short-lived dip on the stock market was quickly bought back. In contrast, moves on the currency and commodities markets were one-sided.

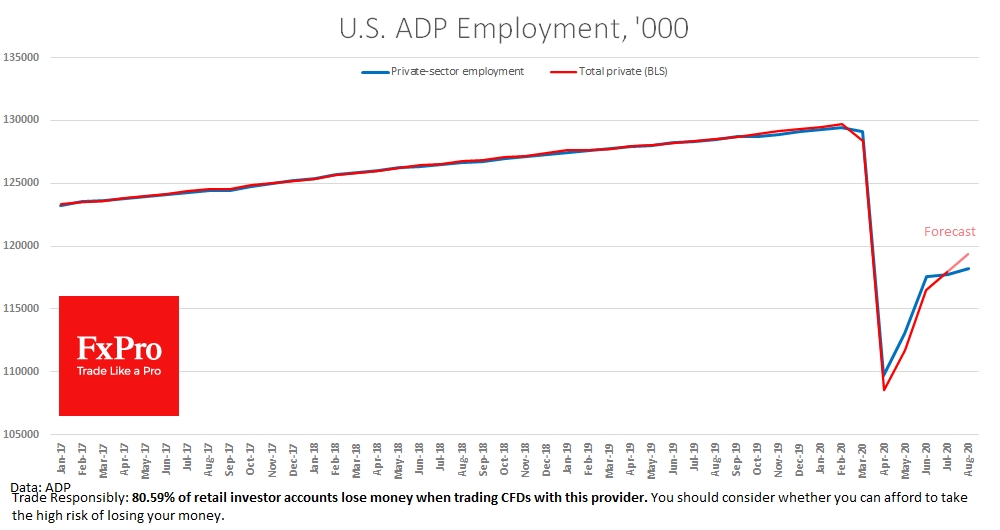

Brent and WTI prices lost over 3% on Wednesday. The decline in Oil coincided with the release of weak US labour market data from ADP, which showed an increase of 438,000 jobs in contrast to the expected 1.25 million increase.

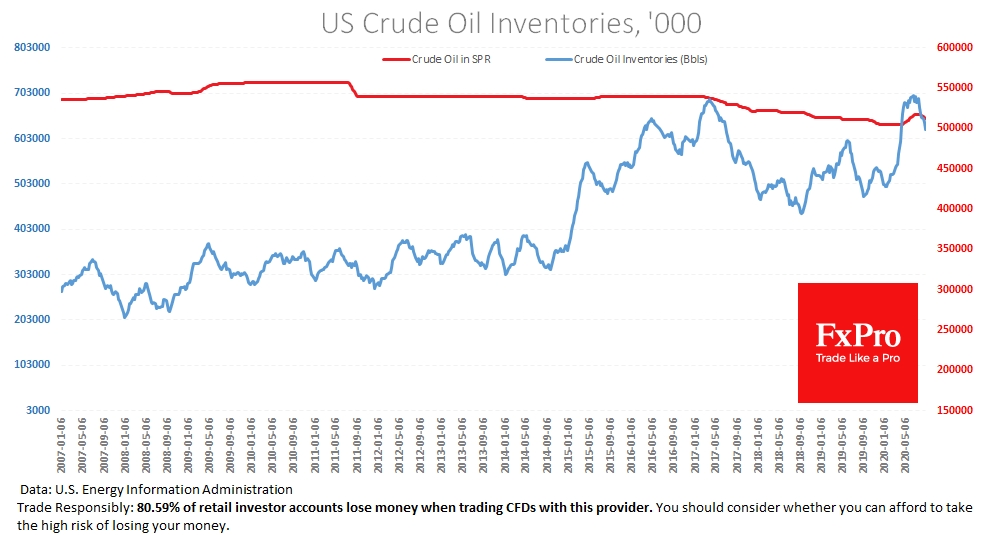

The Oil pressure increased with the release of weekly assessments of reserves and production in the USA. The failure of production from 10.8 million to 9.7 million barrels per day was due to a hurricane that paralysed output in Texas and the Gulf of Mexico last week. Reserves have declined by 9.3 million, but the decline seems small given the production collapse. Still, it was 17.8% higher than this week one year ago. This has alerted us to a recovery in demand for Oil.

An additional pressure factor in the commodity and currency markets was the strengthening dollar. As there are no risks of an increase in US rates on the horizon, the demand for USD can be explained by a lower risk demand and concerns about weak consumer and business activity.

The Chief Economist of the ECB drew attention to the exchange rate, which central banks and politicians are trying to avoid. The 12% appreciation of the euro against the dollar in the previous four months is a threat to Europe's recovery, where many economies have lost more than the US in Q2 but struggled to recover as euro growth promises to suppress exports.

The ECB's attention to the euro a week before the monetary policy decision should be seen as a signal of a softening tone or new easing, which is good for stock markets and negative for the single currency.

Presumably because of this, stock purchases have remained strong, which indicates investor optimism. This optimism may also return to previous trends in the form of a weakening dollar and a recovery in oil prices.

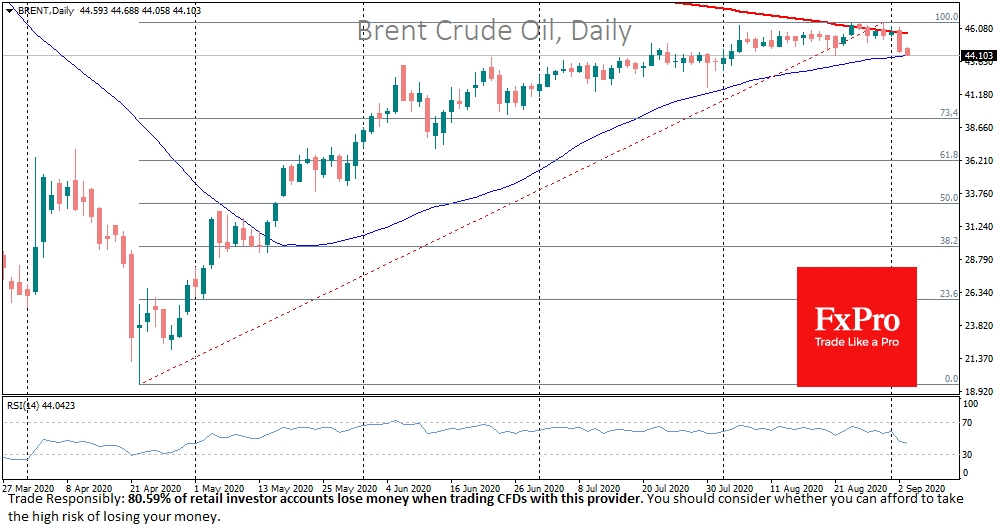

On the technical side, Brent is now testing a 50-day average from top to bottom and has not managed to exceed 200 days. The bear attack from an important technical level indicates medium-term pessimistic expectations.

Brent sustained drop below $44 could be a signal of a deeper and longer-term correction with potential targets at $36. The baseline scenario is still more optimistic with support close to current levels and a reversal to growth with targets around $50 by the end of the year.

The FxPro Analyst Team

Related Articles

Oh man, can President Trump’s leadership move markets. President Trump’s deal-making and negotiating skills are changing the hearts and minds of world leaders as he leaves his...

Gold Gold (XAU/USD) continues to hit heavy selling pressure on every rally, as we established a week ago. Yesterday we collapsed to support at 2904/00 but longs were stopped...

Energy prices are under pressure amid demand concerns and improving prospects for a Russia-Ukraine peace deal. But tariff risks continue to hit metal markets Energy-WTI Below...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.