It’s been a bad couple of weeks for crude oil bulls. The price had been steadily climbing for months, up over 300% since late-April. In the last days of August, WTI crude oil reached almost $44 a barrel. By September 8th, however, the price was below $36.50.

This 17% drop can be explained with the not-yet-fully-recovered economy. However, such after-the-fact explanations are of little use to traders, who need to be able to anticipate such moves. That is why we prefer to ignore the news altogether and focus on the Elliott Wave patterns instead.

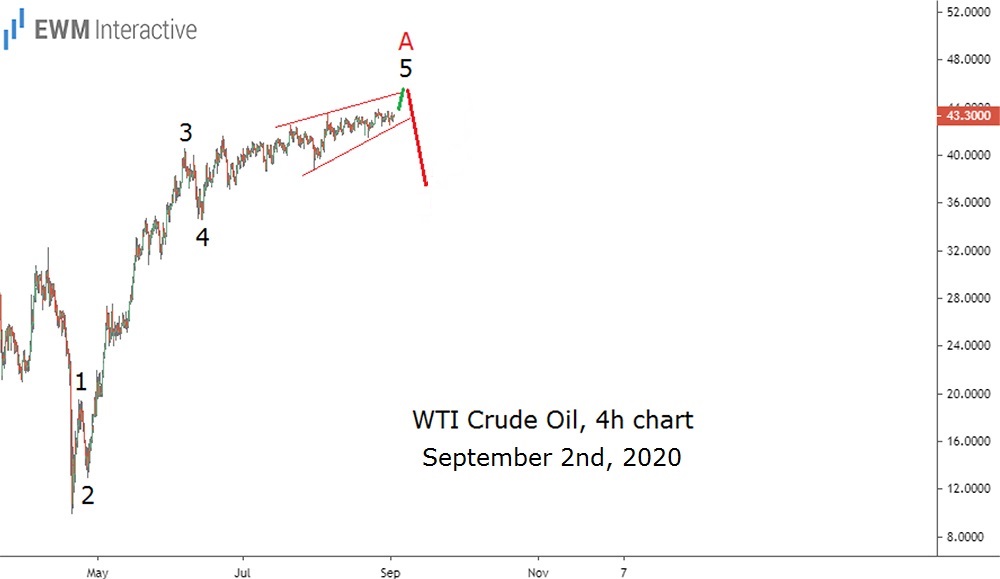

The chart above, sent to subscribers on September 2nd, revealed one such pattern. A five-wave impulse, labeled 1-2-3-4-5, was visible on crude oil’s 4-hour chart. According to the theory, a three-wave correction follows every impulse.

Therefore, once the ending diagonal in wave 5 was over, a bearish reversal could be expected. Despite the significant progress the bulls made over the past five months, the beginning of September was not the time to join them.

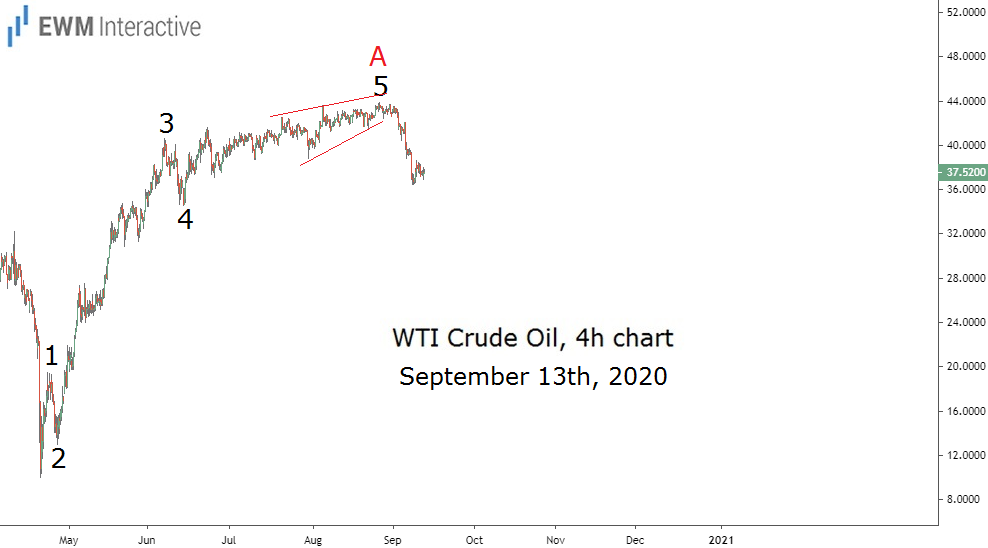

The updated chart below shows how things look now, ten trading days later. The price of WTI crude oil started falling almost right away. On September 11th, the market closed at $37.52, up $1.10 from the bottom, but still down 14.4% from the top of wave 5. And while economic uncertainty and demand concerns continue, we are going to keep relying on the Elliott Wave patterns for guidance.