Macroeconomic overview

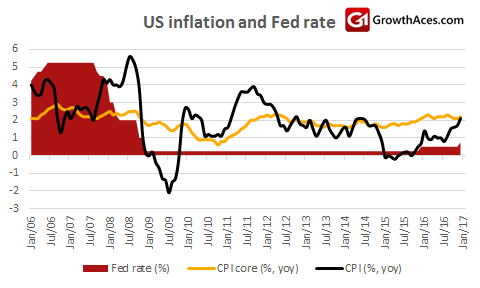

Fed Chair Janet Yellen said that it "makes sense" for the U.S. central bank to gradually lift interest rates with the U.S. economy close to full employment and inflation headed toward the Federal Reserve's 2% goal. The Fed chief added that she and other Fed policymakers expected the central bank to lift its key benchmark short-term rate "a few times a year" through 2019, putting it near the long-term sustainable rate of 3%. That pace could change depending on how the outlook for the economy develops, Yellen cautioned.

She added that dramatic rate hikes probably would not be necessary because slow U.S. productivity growth is holding back economic growth. She said she expected a drag of stronger dollar on exports to continue. That is why we do not think that her comments should be interpreted as undoubtedly hawkish.

Dallas Fed President Robert Kaplan said that with the U.S. economy nearing full employment and inflation making progress toward the Federal Reserve's 2% goal, the U.S. central bank should be able to raise rates "in a gradual and patient manner".

Words “gradual” and “patient” are increasingly often used by Fed policymakers, which should not be interpreted as a hawkish language, especially if they additionally point to the USD strength as an obstacle for economic growth.

The Fed in its latest Beige Book reported that U.S. economic activity continued to expand at a modest pace from late November through the end of last year. Labor markets were reported to be tight or tightening, with wages growing modestly.

The Federal Reserve said on Wednesday industrial output rose 0.8% last month after a downwardly revised 0.7% decline in November. The market had expected a 0.6% increase. The bulk of December's increase was due to the 6.6% rise in the utilities index, which had been hampered the previous month by unseasonably warm weather.

Manufacturing output edged up 0.2% and mining production was unchanged. With overall output increasing in December, the percentage of industrial capacity in use rose 0.6 percentage point in December to 75.5%, from a slightly downwardly revised 74.9% in November. Fed officials look to capacity use as a signal for how much further the economy can accelerate before sparking higher inflation.

The Labor Department said U.S. CPI rose 0.3% last month after gaining 0.2% in November. In the 12 months through October, the CPI increased 2.1%, the biggest year-on-year gain since June 2014. The CPI rose 1.7% in the year to November. The data were in line with market expectations.

The so-called core CPI, which strips out food and energy costs, rose 0.2% last month after the same increase in November. As a result, the core CPI increased 2.2% in the 12 months through December, from 2.1% in November.

The most important event today is the ECB decision and press conference. We do not expect new policy announcement. Therefore, the monetary policy framework will remain the same as announced on 8 December: EUR 80 billion of monthly asset purchases until March, with a slowdown to EUR 60 billion per month in the remaining nine months of the year. We think that ECB President Draghi will sound constructive, but dovish.

In this regard, separating short from medium-term developments may be an important part of his communication strategy. He will probably acknowledge that risks in the short term are moving towards faster-than-expected headline inflation and a more balanced growth assessment. Importantly, however, we also expect Draghi to emphasize that uncertainty remains elevated and the medium-term outlook – most relevant for monetary policy – has not changed much from last month. Therefore, the ECB still wants financial conditions to remain very loose.

The ECB may acknowledge recent progress on the price front, but is unlikely to be impressed by survey-base evidence, especially after having systematically revised down its core CPI and wage growth projections over the last several quarters.

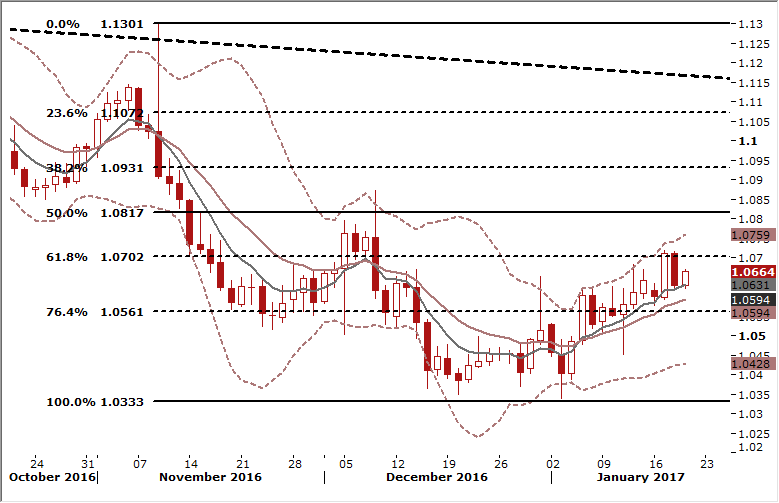

Technical analysis

Yesterday’s EUR/USD fall was stopped just above 7-day exponential moving average. Today’s recovery suggest that yesterday’s move does not mean a begin of a downward trend, but the outlook may change if the ECB is surprisingly dovish today. From the technical analysis point of view we expect the upward EUR/USD move to be continued in the short term. A close above resistance area of 1.0715/18 will open the way to our target at 1.0770.

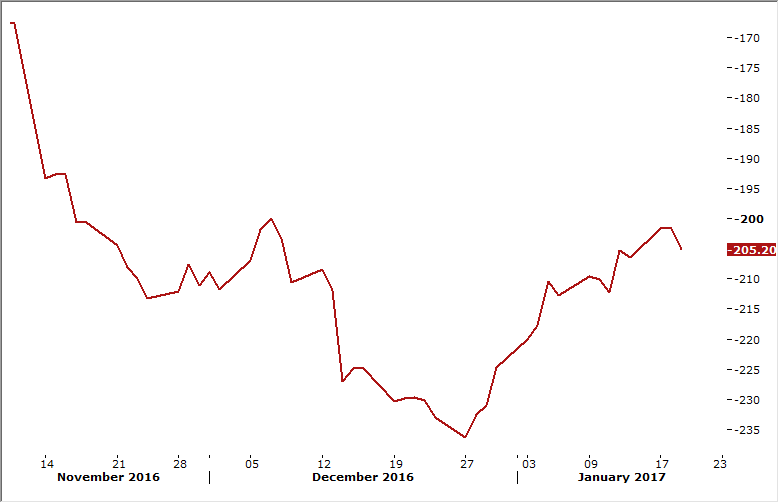

Yield spread between German and U.S. 10-year bonds

Trading strategy

(GrowthAces.com)

AUD/USD: Aussie supported by better-than-expect jobs report

Macroeconomic overview

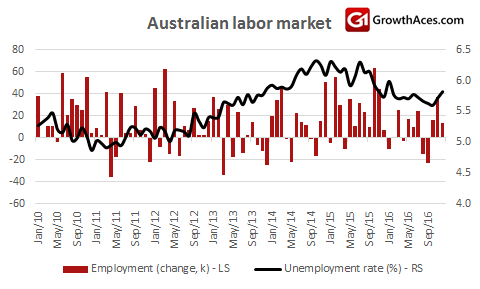

Thursday's data from the Australian Bureau of Statistics showed employment rose a net 13.5k in December, just topping forecasts of 10k and a third month of gains. The unemployment rate edged up a tenth of a percentage point to 5.8%, though that remains within the tight range that has held for the past year.

One bright spot was that full-time jobs rose another 9.3k on top of November's hefty 38.4k jump, bringing gains made since September to a healthy 95k. That went some way to reversing a shift to part-time work that bedeviled the labour market for much of last year. The Reserve Bank of Australia has highlighted uncertainty over the labour market as a key concern for 2017. So far, futures markets have all but priced out the chance of another easing and instead imply a one-in-three chance rates might be hiked at the end of the year.

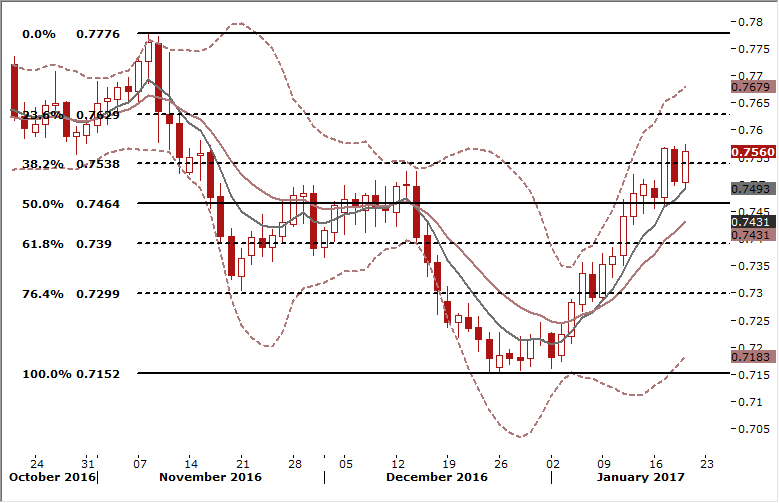

Technical analysis

The AUD/USD remains above 7-day exponential moving average, which keeps our bullish view intact.

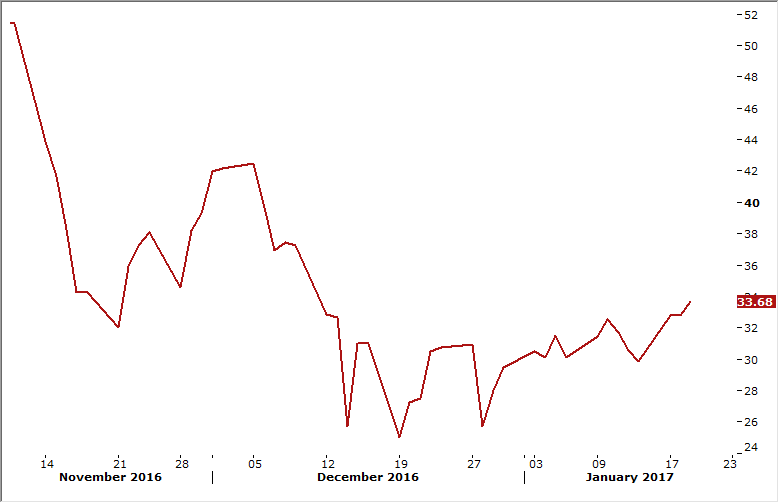

Yield spread between Australian and U.S. 10-year bonds

Trading strategy

(GrowthAces.com)

USD/CAD: BoC kept rates on hold, but statement was surprisingly dovish

Macroeconomic overview

The Bank of Canada kept interest rates on hold yesterday, but said that an interest rate cut remains on the table if the risks facing the country are realized, warning there would be "material consequences" if U.S. President-elect Donald Trump enacts protectionist policies.

The bank reiterated there is material excess capacity in the Canadian economy and "significant" labor market slack. Still, it lifted its 2017 growth forecast to 2.1% citing higher oil and base metals prices and a boost from government spending.

We think that dovish statement from the Bank of Canada was aimed to weaken the loonie, that has appreciated recently on higher commodities prices. We do not believe in interest rate cuts in Canada, especially when the Fed is tightening its policy.

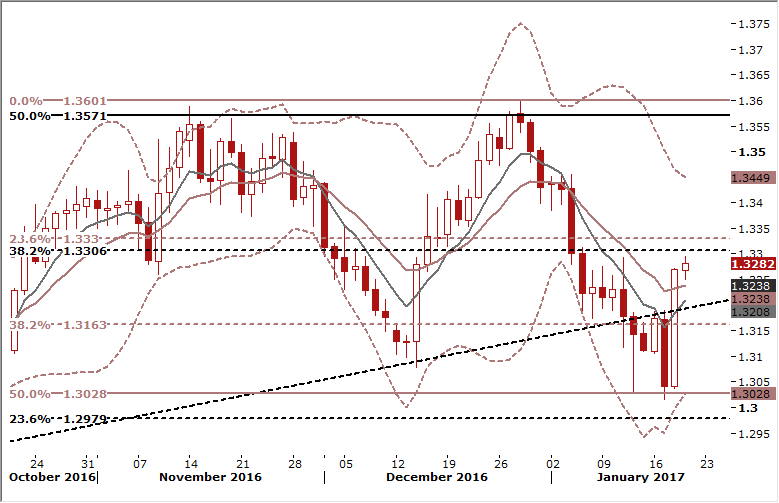

Technical analysis

The USD/CAD has reversed recent losses, but we think that the potential for further rise is limited. The nearest resistance area is 1.3300/30, which we think will not be broken unless we have big news supporting the USD.

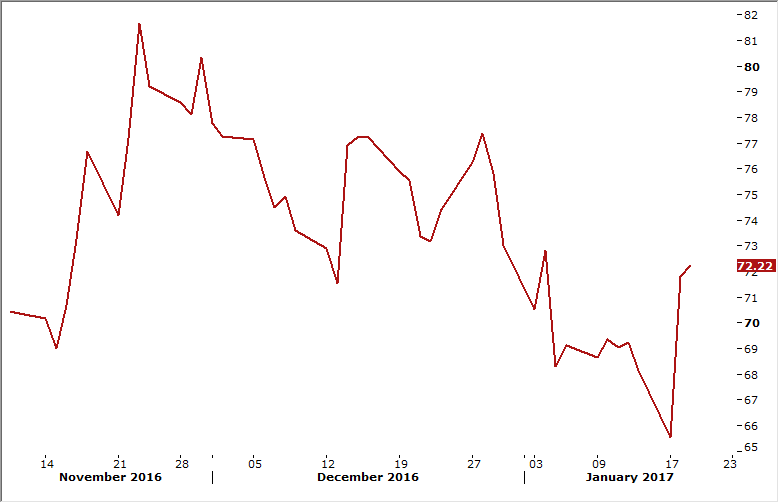

Yield spread between U.S. and Canadian 10-year bonds

Trading strategy

(GrowthAces.com)