- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cracker Barrel Benefits From Sales & Cost-Cutting Efforts

Cracker Barrel Old Country Store, Inc.’s (NASDAQ:CBRL) multiple sales boosting and cost-cutting initiatives are impressive. However, rising labor costs amid a tepid sales environment along with limited geographical presence remain potent headwinds for the company.

Recently, Cracker Barrel posted strong second-quarter fiscal 2018 results wherein both the top and bottom line surpassed the Zacks Consensus Estimate. Notably, this quarter marked the 27th successive earnings beat. However, the company reported lower-than-expected revenues in 11 of the last 12 quarters.

Sales Boosting and Cost-Cutting Initiatives are Major Tailwinds

Cracker Barrel uses seasonal promotions and limited time offers to boost its top-line performance by attracting both regular users and less-frequent guests. Moving ahead, the company aims to continue investing in new product news that will drive business frequency.

In fiscal 2018, Cracker Barrel aims to meet consumers' needs for convenience via growth in its off-premise business. Also, the company plans to enhance its off-premise platform by introducing new catering menu offering and the in-store training of hourly employees. In fiscal 2017, Cracker Barrel tested and enhanced off-premise platform in roughly 100 stores and completed its system-wide rollout of the off-premise platform by fiscal first-quarter of 2018. Apart from new product offering, the test featured value messaging across four weeks of local television and in-store advertising. Further, it intends to extend the test with additional markets and television weeks from January to March.

Coming to menu innovation, the company recently introduced a coffee platform in approximately 40 stores. It believes that the platform will complement the strength of its breakfast all day offering, drive check favorability and promote guest perceptions of menu variety. The rollout of the crafted coffee program at all stores is expected to be complete by the end of fiscal third quarter.

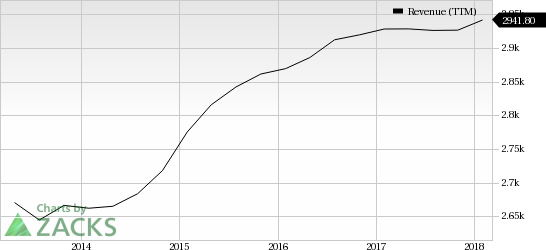

Cracker Barrel Old Country Store, Inc. Revenue (TTM)

Additionally, Cracker Barrel has an effective cost-cutting mechanism in place. In fact, the company undertakes various measures to keep costs under control. In the beginning of fiscal 2017, the company targeted to reduce annual operating cost by $15 million to $20 million. It delivered 15% above the high end of its fiscal-year target and achieved its three-year strategic goal of removing $50 million in annual cost from the business by fiscal 2017-end. For fiscal 2018, the company anticipates to deliver between $7 million and $8 million in annual cost savings.

Rising Cost and Limited Geographic Diversity Remain Overhangs

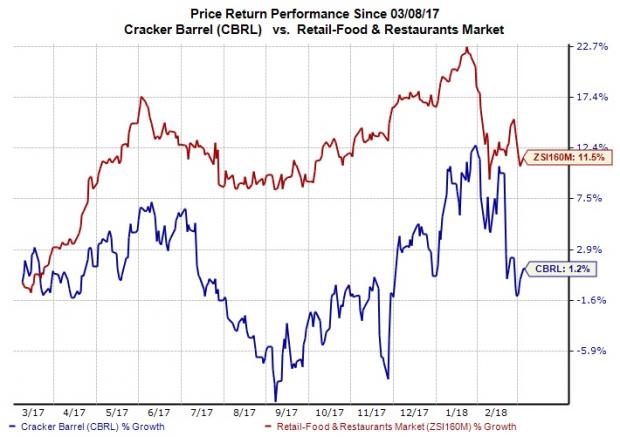

Despite the company’s efficient cost-saving methods, higher labor costs and expenses related to various sales-boosting initiatives are weighing on its margins. Subsequently, Cracker Barrel’s shares have gained just 1.2% in a year’s time, significantly underperforming the 11.5% gain of the industry it belongs to.

Although Cracker Barrel has a substantial domestic presence, it loses out on international front. While the other restaurant chains like Yum! Brands (NYSE:YUM) , McDonalds (NYSE:MCD) and Papa John’s (NASDAQ:PZZA) are pursuing aggressive global expansion strategies, Cracker Barrel seems to be weak on this front.

Furthermore, a soft consumer spending environment in the U.S. restaurant space might continue to affect traffic. Also, Cracker Barrel’s retail business has been negatively impacted by challenges in the retail industry. Thus, the company’s top line is likely to remain under pressure.

Cracker Barrel carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks’ has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Cracker Barrel Old Country Store, Inc. (CBRL): Free Stock Analysis Report

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.