Yum! Brands | Consumer Discretionary, Hotels, Restaurants & Leisure | Reports February 3, After Market Closes.Key Takeaway

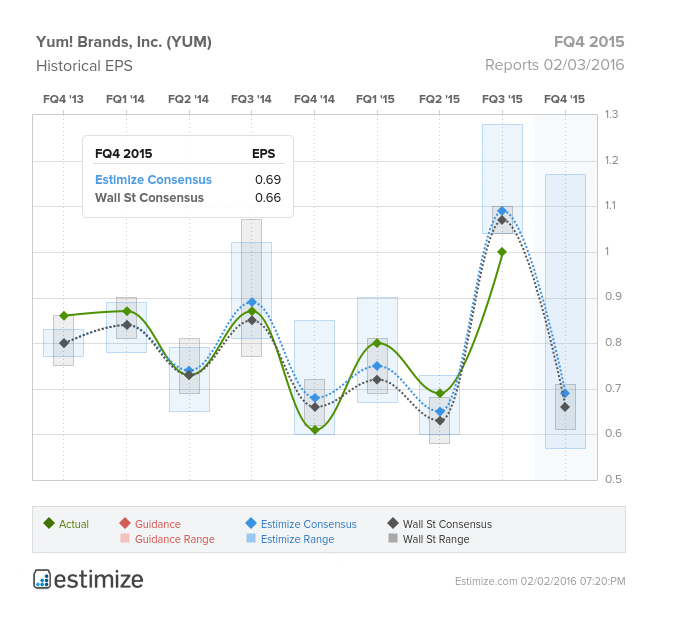

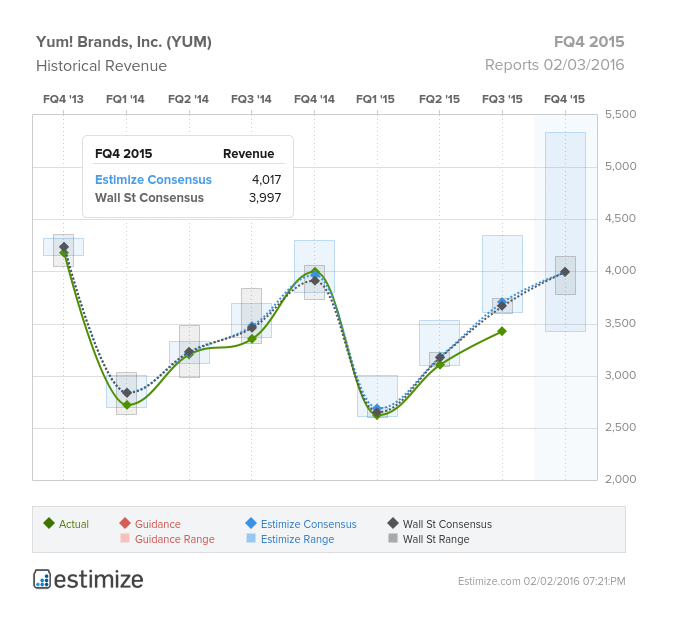

- The Estimize consensus is calling for EPS of $0.69 and revenue of $4.017 billion, slightly higher than Wall Street’s estimates

- The fast food tycoon made headlines this past quarter when they announced its intent to split its operations

- China currently contributes 56% of Yum Brand’s revenue and over 50% of its operating margins

Best known as the parent company of Taco Bell, Pizza Hut and KFC, Yum Brands (N:YUM) is scheduled to report Q4 2015 earnings February 3, after the market closes. The fast food giant made headlines this past quarter when they announced a split of its operations, featuring a sole China division. Until Yum completes the Yum China spinoff, China is still what matters most to Yum, representing 35% of its current operating income. On top of weakness in China, macroeconomic concerns, including foreign exchange headwinds and contaminated poultry have put pressure on the company’s bottom line. Even with so much hinging on China, Yum is expected to report modest gains in key metrics such as same stores sales and revenue. The Estimize consensus is calling for EPS of $0.69 and revenue of $4.017 billion, slightly higher than Wall Street’s estimates. Compared to Q4 2014, this represents a projected YoY increase in EPS and revenue of 14% and 1%, respectively. Since the announced split, Yum estimates have seen heavy downward revisions to the tune of 17% and 4% declines in EPS and revenue, respectively.

Like a number of multinational restaurants brands, Yum faces macroeconomic headwinds from a strong dollar, weakness in China, health concerns and wage increases. Naturally, all eyes will be on China, which contributes 56% to Yum Brands' revenue. With such a high exposure to China, it is no surprise that revenue growth has been volatile. Sales in China have continued to falter due to waning public perception and a contamination scares with one of its largest suppliers. That said, Yum still plans to open 700 additional units on top of the 6,900 already existing stores in China.

Amongst its three core brands, Pizza Hut continues to struggle with flat revenue and same store growth. Fortunately, the Pizza Hut brand accounts for less than 10% of Yum’s revenue. On the other hand, KFC and Taco Bell are expected to make same store sales gains thanks to a robust value oriented menu. Taco Bell has made a remarkable recovery from its 2006 E. Coli outbreak and is now a huge catalyst to Yum’s success. Armed with great brands, Yum has the ingredients to overcome the recent economic turmoil.