The dollar rose against most major currencies on Monday, after a top Federal Reserve official boosted expectations of an additional rate hike this year, saying that rising wages would help lift inflation closer to the central bank’s target.

On Monday, New York Fed President William Dudley said that halting interest rate increases could be dangerous for the economy, adding that continued progress in the jobs market will push wages higher, reviving the recent slowdown in inflation.

The rise in the dollar pegged back the euro and the pound as Dudley’s upbeat comments come amid the official start of Brexit negotiations between the UK and the EU.

Investors are focusing on the UK government's stance in the talks, after the setback and uncertainty brought by this month's election.

For today, Bank of England Governor Mark Carney is due to speak at the Mansion House dinner, in London.

Later in the day, Fed Vice Chair Stanley Fischer, Boston Fed Presid

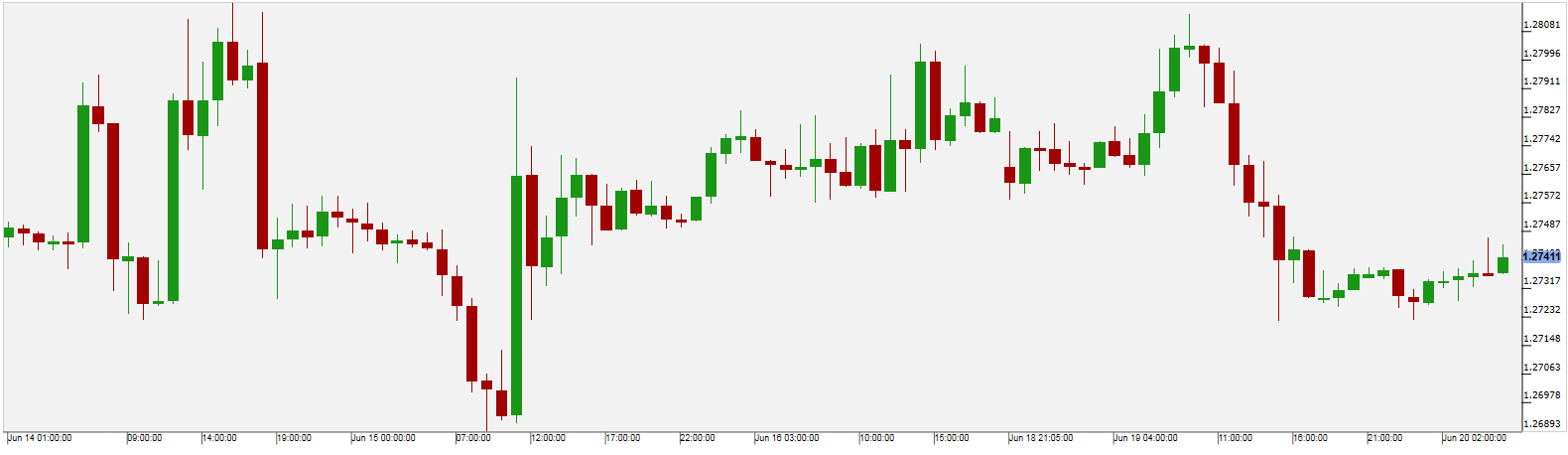

Despite comments by UK Brexit Secretary David Davis who said negotiations got off to a “promising start”, the sterling fell against the dollar on Monday, trading close to $1.2735.

Sterling has been through a turbulent month, sinking to a near two-month low of $1.2636 on June 9 on the British election shock, but rallying last week as the Bank of England came close to hiking rates after a split vote in its monetary policy committee.

For today, Bank of England Governor Mark Carney is due to speak at the Mansion House dinner, in London.

Pivot: 1.2765

Support: 1.272 1.269 1.266

Resistance: 1.2765 1.279 1.2815

Scenario 1: short positions below 1.2765 with targets at 1.2720 & 1.2690 in extension.

Scenario 2: above 1.2765 look for further upside with 1.2790 & 1.2815 as targets.

Comment: a break below 1.2720 would trigger a drop towards 1.2690.

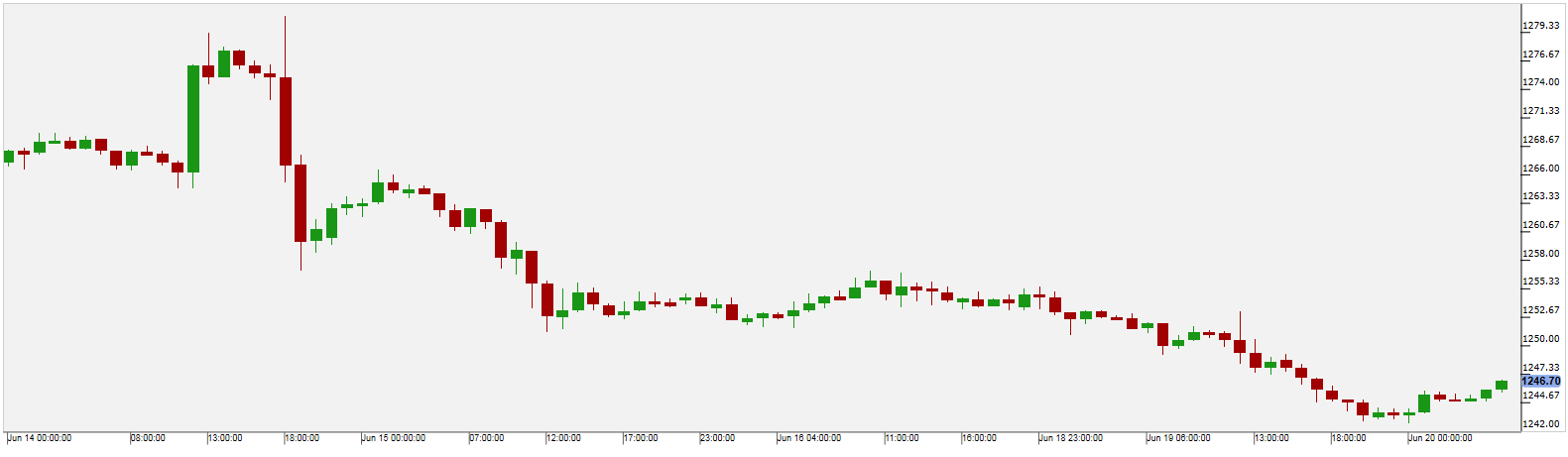

Gold

Gold prices fell on Monday, weighed by gains in the dollar after solid comments on inflation from the head of the New York Federal Reserve who increased expectations of a rate hike this year.

Following the comments, the precious metal retreated to trading around the $1243 area and heading for its third straight weekly loss.

For today, the focus remains on developments around the Brexit negotiations as well as on speeches from several Fed members.

Pivot: 1250

Support: 1240 1237.5 1232.5

Resistance: 1250 1257 1261

Scenario 1: short positions below 1250.00 with targets at 1240.00 & 1237.50 in extension.

Scenario 2: above 1250.00 look for further upside with 1257.00 & 1261.00 as targets.

Comment: as long as 1250.00 is resistance, look for choppy price action with a bearish bias.

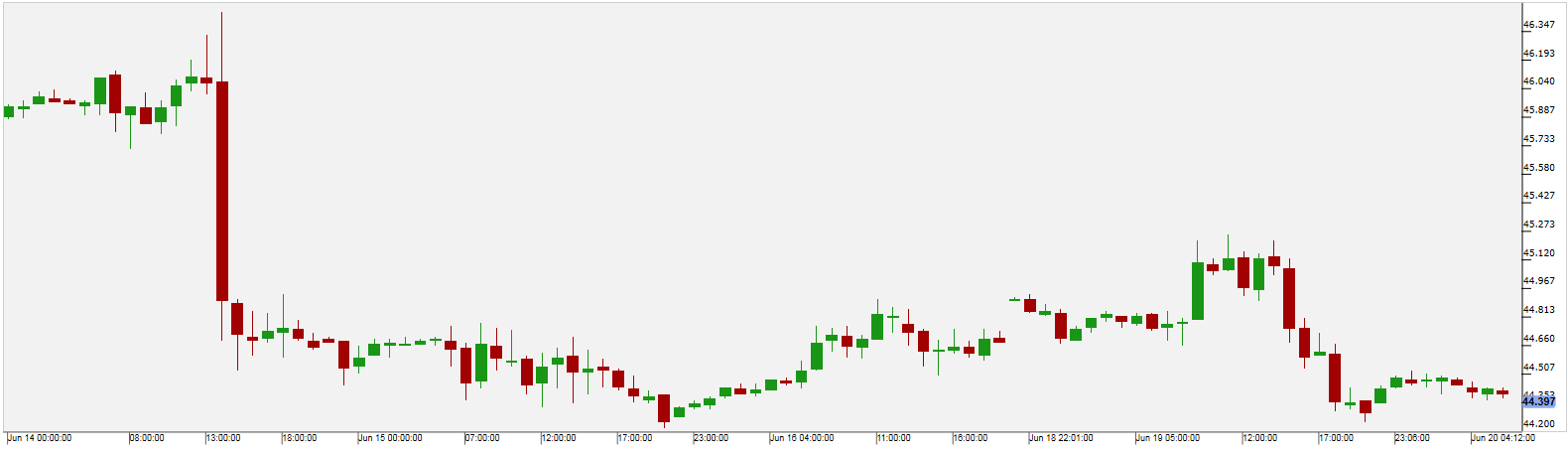

WTI Oil

Oil futures settled lower on Monday, despite comments by Saudi Energy Minister Khalid al-Falih who set out to reassure market participants that rising output from U.S. shale, Nigeria and Libya would not derail OPEC’s plan to reduce crude output, and insisted that the oil market would rebalance soon.

The Saudi Energy minister’s comments came ahead of data on Monday showing Libya's oil production has risen by over 50,000 bpd to 885,000 bpd after the state oil firm settled a dispute with Germany's Wintershal.

For today, the American Petroleum Institute will release its weekly inventory report. Initial forecasts expect a drop of 2.180 million barrels in crude oil and a build of 600,000 barrels for distillates.

Pivot: 44.75

Support: 44.75 45.2 45.5

Resistance: 43.9 43.5 43

Scenario 1: short positions below 44.75 with targets at 43.90 & 43.50 in extension.

Scenario 2: above 44.75 look for further upside with 45.20 & 45.50 as targets.

Comment: the RSI lacks upward momentum.

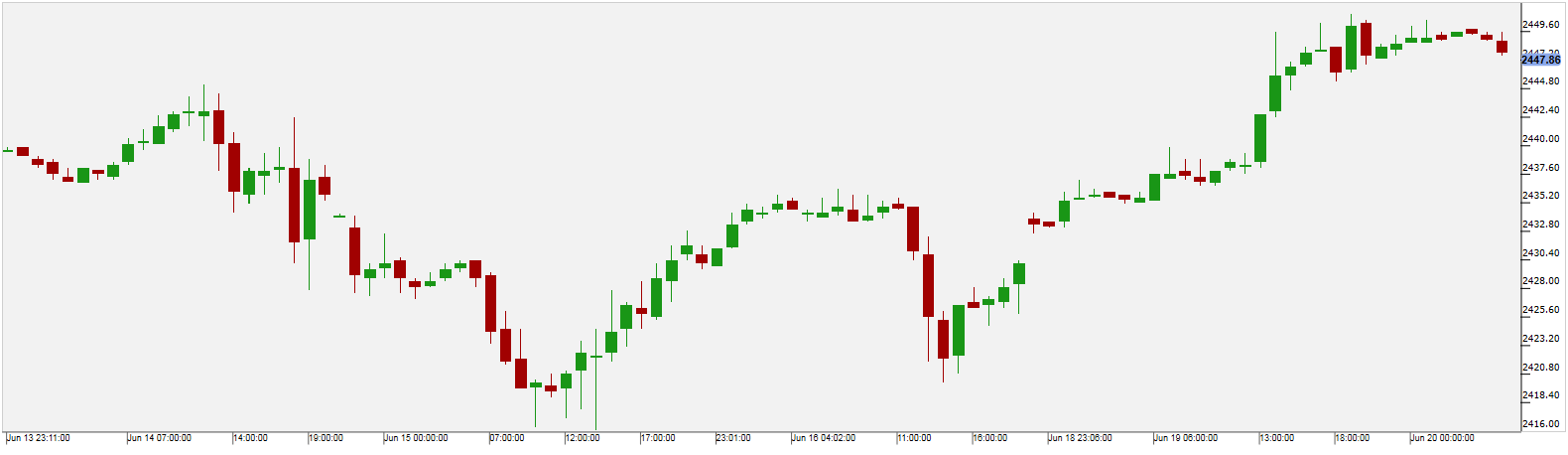

US 500

The main U.S. indices closed at record highs on Monday, as investors turned back into technology stocks, with shares of Amazon (NASDAQ:AMZN) hitting an all-time high.

Amazon’s $13.7 billion deal to buy Whole Foods was considered a bold move that investors seem to like, making it one of the best performers for this week.

Financials, mostly banks, also added to the risk-on sentiment with JPMorgan (NYSE:JPM) closing 2.2% higher on the back of upbeat comments on inflation from the head of the New York Federal Reserve William Dudely.

The S&P 500 closed 0.83% higher while the Nasdaq Composite rose to 6239.01, up by approximately 1.42%.

Pivot: 2439.5

Support: 2439.5 2435 2428

Resistance: 2454 2458 2465

Scenario 1: long positions above 2439.50 with targets at 2454.00 & 2458.00 in extension.

Scenario 2: below 2439.50 look for further downside with 2435.00 & 2428.00 as targets.

Comment: the RSI shows upside momentum.