EUR/USD remains under pressure ahead of risky key events

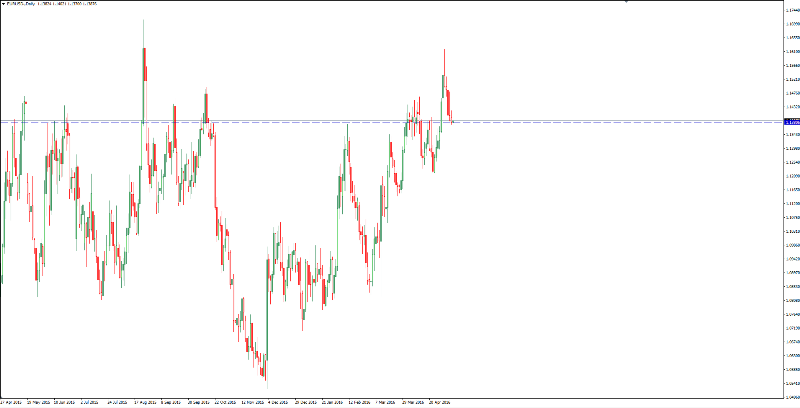

The US dollar was extremely strong despite weak US payroll data and despite shrinking Fed rate hike expectations. The EUR/USD is awaiting the Greek GDP and British inflation reports this week. A close below the 23.6% Fibonacci retracement 1.1357 will strengthen the bearish movement and will open a lower leg toward 1.1330, 1.1290 and 1.1270 respectively.

However, the EUR/USD is awaiting further ECB actions and needs a push above 1.1455 in order to put an end to the bearish movement. This will open the door for an upward movement to reach next resistance levels 1.1485 and 1.1535.

Disclaimer: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.