- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus Bumps Up Grocery Stores Stocks: 3 Best Bets

Homebound Americans are fueling strong demand for groceries as they avoid stepping outdoors over fears of contracting the novel coronavirus. In addition, the majority of companies in the country advised their employees to work remotely, compelling the corporate crowd to stay put and opt for online food delivery services rather than visit restaurants and bars.

This increased demand has led to shares of companies operating in the said arena to edge higher over the past month, despite the broader markets being hit hard. One could take a look at these stocks from an investment perspective, as shifting consumer preference toward new trends could support these equities.

Supermarkets Surge Amid a Market Gone Berserk

In just a month, the three major indexes of the country have shed more than 25% each, slipping into recession. The Dow Jones industrial Average declined 33.9%, the broader S&P 500 lost 27.8% and the tech-laden Nasdaq Composite shed 25.3% since Feb 23.

After all, smooth operations of businesses and supply chains are disrupted, given the government’s attempts to contain the virus by imposing lockdowns. Amid the shutdown of educational institutions and companies, such as Alphabet Inc. (NASDAQ:GOOGL) asking about 100,000 of its staff across the United States and Canada to work from home earlier in March, major automakers too now joined the club.

Last week, Detroit’s Big Three automakers, namely Ford Motor Co. (NYSE:F) , Fiat Chrysler Automobiles N.V. (NYSE:F) and General Motors Co. (NYSE:GM) announced that they temporarily planned to close all factories across North America from Mar 19 through Mar 30, per a CNBC report. In addition, restaurants and bars across at least 19 states stalled their operations as more “social-distancing” measures are in place.

In a situation like this, homebound Americans are only stepping out to nearby supermarkets for stashing their pantries. A growing number of consumers have now resorted to ordering their groceries and meal kits online as well. The online grocery shopping space exploded in recent weeks with downloads of Instacart, Walmart (NYSE:WMT)'s grocery app and Shipt rising 218%, 160%, and 124%, respectively, on Mar 15 from the registered 2019-level, as CNN cited.

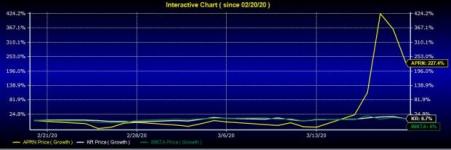

In fact, shares of supermarkets and food delivery services, such as The Kroger Co. (NYSE:KR) , Ingles Markets, Inc. (NASDAQ:IMKTA) and Blue Apron Holdings, Inc. (NYSE:APRN) have moved north in the past month given the uptick in demand for the food products they offer. This development is in clear contrast to the broader markets’ performance in the same time frame.

Since there is no definitive idea regarding the duration of the quarantine, one could very well deem the trends to last long.

3 Stocks to Consider

We rounded up three stocks that offer food items and groceries, all carrying a Zacks Rank #2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Blue Apron offers ready-to-cook meal kits, which have witnessed strong demand in recent weeks as more Americans are homebound. The Zacks Consensus Estimate for Blue Apron’s next-year earnings has moved 5% north in the past 60 days. The Zacks Food - Miscellaneous industry company’s expected earnings growth rate for the current year is 4.3%. Blue Apron carries a Zacks Rank #2. Shares of the company gained 227.4% in the past one month.

Kroger operates supermarkets and marketplace store that offer combination food, natural and organic food etc. The Zacks Consensus Estimate for Kroger’s next-year earnings has moved 2.1% north in the past 60 days. The Zacks Retail - Supermarkets industry company’s expected earnings growth rate for the current year is 7.3%. Kroger carries a Zacks Rank #3. Shares of the company gained 6.7% in the past one month.

Ingles Markets is the operator of a chain of supermarkets. Ingles Markets offers a wide range of food products, produce, frozen foods, dairy and meat etc. The Zacks Retail - Supermarkets industry company’s expected earnings growth rate for the current year is 6.7%. Ingles Markets carries a Zacks Rank #3. Shares of the company gained 6% in the past one month.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU): Free Stock Analysis Report

Ingles Markets, Incorporated (IMKTA): Free Stock Analysis Report

Blue Apron Holdings, Inc. (APRN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.