Symantec Corp. (NASDAQ:SYMC) recently unveiled a new offering that will enable its Cloud Workload Protection (CWP) solution and Amazon’s (NASDAQ:AMZN) GuardDuty to provide automated remediation and advanced threat intelligence for AWS workloads and storage.

The new service will enable AWS customers to automate and streamline key components of cloud security.

Additionally, Symantec introduced cloud security innovations for its Integrated Cyber Defense Platform, including full-stack container security, Data Loss Prevention, cloud forensics and incident response technology to AWS customers.

Talking about the new update, AWS management was quoted saying, “With APN Partners such as Symantec, we are able to extend enhanced cloud security to our customers, ensuring that they can expand their cloud footprint while maintaining the highest standards of cyber security.”

Rationale Behind Cloud Security Efforts

Transition of critical workloads and information to the cloud has several concerns — the most important being security issues, which IT departments are struggling to cope with. Per Gartner, 50% of enterprises will unknowingly directly expose some of their IaaS storage services, network segments, applications or APIs to public by 2021, up from 25% in 2018.

Moreover, a recent survey by Symantec revealed that 70% of companies are concerned about data breaches in the cloud, and 83% of IT personnel believe they are not equipped to effectively tackle cloud security incidents.

To efficiently address security concerns associated with the cloud, automation is required. CWP works with Amazon GuardDuty to automatically detect security threats and infrastructure issues in AWS workloads and storage. Also, it suggests necessary changes and automate workflow to remediate security gaps. The service further features automatic protection mode, which triggers cloud APIs for automated response to policy violations.

Integrated Cyber Defense Platform: A Key Growth Driver

Amid growing cloud security concerns, complexities of using different security solutions are best avoided. Symantec aims to address the security and compliance issues related to enterprises’ transition to cloud with its Integrated Cyber Defense Platform. The platform’s security solutions include a suite of IaaS, PaaS and SaaS technologies.

In October 2018, Symantec announced upgrades on its cloud security portfolio to offer better protection to organizations’ cloud generation applications and infrastructure.

Moreover, in February this year, Symantec announced the acquisition of Luminate Security to extend the power of Symantec’s Integrated Cyber Defense Platform in the cloud generation.

Although Cloud Access Security Broker tools contribute a small portion of the business, it’s gaining momentum rapidly. Continued add-on service orders, with the deployment of cloud security products at the client’s workplace, is a positive.

Also, the company’s partnership with major cloud service providers like Microsoft’s (NASDAQ:MSFT) cloud platform, Azure and Oracle (NYSE:ORCL) has expanded its reach to different markets at a lower cost.

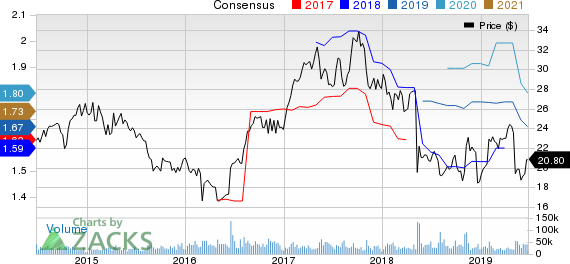

Currently, Symantec carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Symantec Corporation (SYMC): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Original post

Zacks Investment Research