Constellation Brands Inc.’s (NYSE:STZ) shares rose 2.2% in pre-market trading hours after it reported stellar first-quarter fiscal 2017 results. The company’s top and bottom lines posted double-digit growth year over year and also exceeded expectations.

Results were backed by the company’s effective integration and growth of its recently acquired brands, higher margins across its portfolio along with strong consumer demand that was helped by its superb marketing and sales strategies for its core, higher margin and premium brands. Further, strength in the company’s beer business, improving trends at its wine and spirits business and solid overall depletion trends helped the beat.

Q1 Highlights

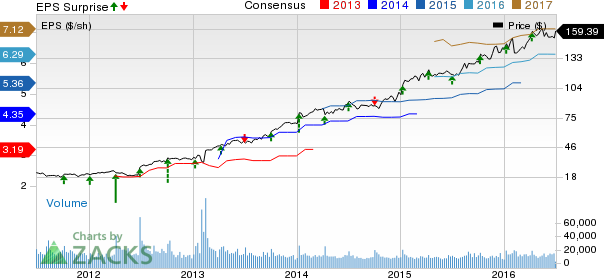

The company’s adjusted earnings for the first quarter of fiscal 2017 jumped 22% year over year to $1.54 per share, faring better than the Zacks Consensus Estimate of $1.51. This marked the company’s seventh straight quarter of positive earnings surprise.

Net sales increased 15% to $1,872 million, driven by strong organic sales growth and gains from the Meiomi and Ballast Point acquisitions. On a currency adjusted basis, consolidated organic sales grew 10%. Moreover, the company’s top line exceeded the Zacks Consensus Estimate of $1,827.4 million.

Sales also benefited from strong volumes and favorable pricing at the beer business, which drove 19% sales growth at the segment. Organic net sales for the segment grew 15%. Also, the segment witnessed a 10% rise in depletions, backed by the success of its '120 Days of Summer' selling season. Depletions at Ballast Point were outstanding with over 60% growth witnessed in the first quarter.

Wine and spirits’ sales improved 8% year over year benefiting from the Meiomi acquisition and organic net sales growth. On a constant currency basis, organic sales were up 3% mainly driven by increased volumes and a favorable mix. On the other hand, Meiomi reported over 90% IRI dollar growth and reached double-digit depletion growth in the quarter.

Cost and Margin Performance

Adjusted gross profit for the fiscal first quarter rose 19.6% year over year to $881.3 million, while adjusted gross profit margin expanded 190 basis points (bps) to 47.1%.

Constellation Brands' comparable operating income escalated nearly 21% to $548.7 million, with the comparable operating margin expanding 150 bps to 29.3%. This was backed by solid operating income growth at both the beer (22%) and wine and spirits (17%) businesses. The beer segment gained from higher organic volume, effective pricing and gains from the Ballast Point acquisition, while growth at the wine and spirits segment was attributed to the Meiomi acquisition, increased organic volumes and a favorable mix.

Financial Position

Constellation Brands ended the quarter with cash and cash equivalents of $167.3 million. As of May 31, 2016, the company had $6,690.6 million in long-term debt (excluding current maturities) and its total shareholders’ equity was $6,988.6 million.

In the fiscal first quarter, Constellation Brands generated $345.9 million in cash from operations and free cash flow of $177 million.

On Jun 29, 2016, the company declared a quarterly dividend of 40 cents per share for Class A and 36 cents for Class B shares. The dividend is payable on Aug 24, to shareholders on record as of Aug 10.

Other Developments

In Apr 2016, the company successfully completed the acquisition of The Prisoner Wine Company brands portfolio from Huneeus Vintners for about $285 million. Also, the company reached a key milestone at its Nava brewery as the facility’s total capacity expanded to 20 million hectoliters.

Fiscal 2017 Outlook

With double-digit earnings and sales growth achieved in the fiscal first quarter, the company is optimistic of its fiscal 2017 performance. Management reiterated its adjusted earnings guidance in the range of $6.05–$6.35 per share, compared with $5.43 recorded for fiscal 2016.

On a reported basis, earnings per share for fiscal 2017 are now anticipated in the range of $5.98–$6.28 against $5.18 reported for fiscal 2016. The current guidance is slightly lower than the company’s earlier forecast of $6.00–$6.30 per share.

Further, the company expects both net sales and operating income for the beer segment to grow in the 14–17% range, accounting for the gains coming from the recent Ballast Point acquisition. Further, the company’s wine and spirits’ sales growth is projected in the mid single-digit range, while operating income is expected to grow in the mid-to-high single-digit range, including gains from the Meiomi and Prisoner acquisitions.

Certain other factors were taken into consideration before providing the earnings guidance. These include an interest expense expectation of $325–$335 million, an approximate tax rate of 29% and weighted average diluted shares outstanding of approximately 206 million.

Further, the company anticipates capital expenditure in the range of $1.25–$1.35 billion for fiscal 2017, as it continues to progress with the expansion of its Mexican beer business.

The company’s free cash flow expectation ranges between $250 million and $350 million for fiscal 2017, while operating cash flow is projected in the range of $1.5–$1.7 billion.

Zacks Rank

Constellation Brands currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the same industry include Compania Cervecerias Unidas S.A. (NYSE:CCU) and Molson Coors Brewing Company (NYSE:TAP) , which sport a Zacks Rank #1 (Strong Buy), and Ambev S.A. (NYSE:ABEV) , which carries a Zacks Rank #2 (Buy).

MOLSON COORS-B (TAP): Free Stock Analysis Report

CERV UNIDAS-ADR (CCU): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

AMBEV-PR ADR (ABEV): Free Stock Analysis Report

Original post

Zacks Investment Research