- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Colfax Completes Divestment Of Fluid Handling Unit To CIRCOR

Machinery company Colfax Corporation (NYSE:CFX) announced yesterday that it has completed the sale of its Fluid Handling business to CIRCOR International, Inc for approximately $863 million. The deal was announced on Sep 27.

The company’s Fluid Handling business offered products like pumps, fluid handling systems and controls, and specialty valves. Prime brands include Allweiler and Imo. The results of this business were grouped under the company’s Gas and Fluid Handling segment (now renamed to Air and Gas Handling). In the 12 months ended Jun 30, 2017, the divested assets generated revenues of $463 million and earnings before interest, tax, depreciation and amortization of $64 million.

Divestment Details

As noted, the divestment proceeds of $863 million included cash component of $542 million and assumption of certain net pension liability. In addition, CIRCOR issued approximately 3.3 million of its common shares to Colfax. The stocks, valued at closing price of trading on Dec 8, would represent roughly 16% of CIRCOR’s issued and outstanding shares.

The company anticipates recording a material gain related with the divestiture in the fourth quarter of 2017.

Inorganic Expansion Fuels Growth

We believe that such dispositions are in sync with Colfax’s inorganic ways of strengthening its core businesses. The company aims to enhance its ESAB and Howden businesses through meaningful acquisitions. Building new business platforms is also a priority.

Notably, in second-quarter 2017, Colfax acquired TBi, a leader in robotic torch technology, and HKS, a developer of advanced process analytics and sensors. These buyouts have strengthened the company’s welding process analytics and robotic welding torches operations in the Fabrication Technology segment. Also, in October, it completed acquiring Siemens AG’s Siemens Turbomachinery Equipment GmbH business. This strategic acquisition will solidify Colfax’s Howden trading platform.

In the first nine months of 2017, Colfax’s acquired assets contributed roughly 1.3% to year-over-year sales growth.

Zacks Rank & Stocks to Consider

Colfax currently has a $4.5 billion market capitalization and carries a Zacks Rank #3 (Hold). Despite the positive aspects, we believe that company’s exposure to headwinds from uncertain global economic conditions, unfavorable forex movements and stiff competition might be concerns. In the last three months, Colfax’s shares have declined 11.8%, underperforming 9.4% gain recorded by the industry it belongs to.

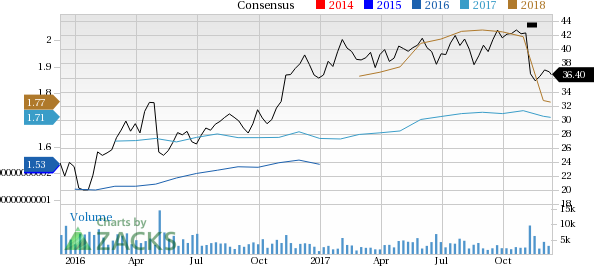

Also, over the last 60 days, the stock’s Zacks Consensus Estimate of $1.71 for 2017 has increased 1.2% from its tally 60 days ago while that of $1.77 for 2018 has decreased 7.8%.

Colfax Corporation Price and Consensus

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Kadant Inc (KAI): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Colfax Corporation (CFX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.