The world markets are under pressure on Wednesday morning. Negotiations on stimulus packages in the US remain at a standstill, and hopes for a coronavirus vaccine are leading investors to revise their strategies in favour of companies most affected earlier by quarantine restrictions.

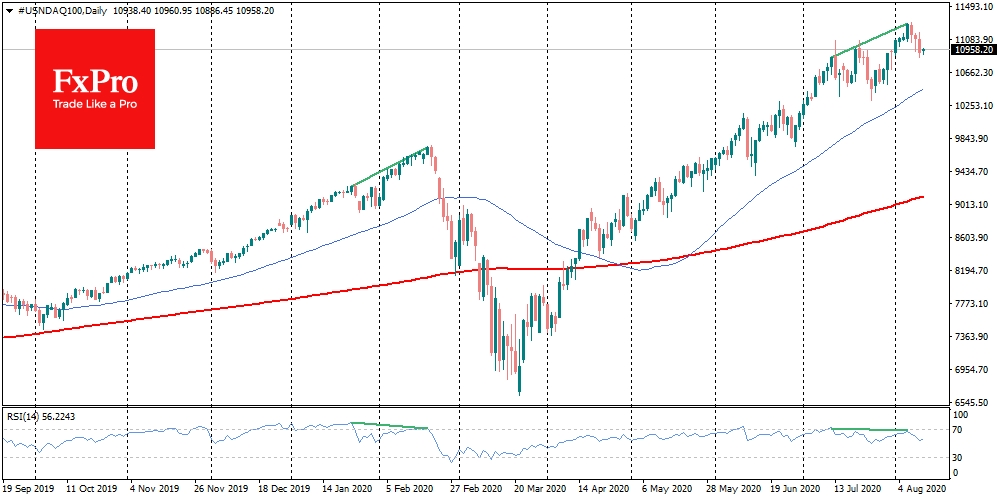

The S&P 500 lost 0.8% on Tuesday, interrupting consistent daily growth since July 29, and on Wednesday morning is holding its positions near the previous close. Nasdaq fell 1.5% on Tuesday, adding to 3.3% drop from the top. Asian indices are losing about 0.8%, according to the MSCI Asia Pacific index.

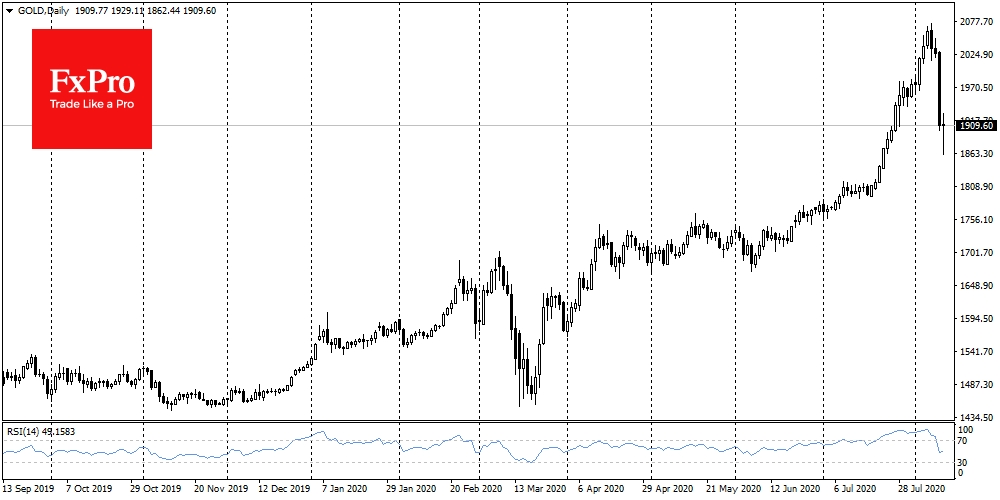

Gold and silver were the antiheroes of the previous session. They remain under pressure on Wednesday, losing a total of 7.3% and 17% in two days respectively.

Earlier in the morning, silver dropped below $23.50, flirting with the bear market territory: losses from recent highs exceeded 20%. The total drop in gold from the local peak is half as much. The bear market line, in this case, passes through $1660, which is noticeably lower than the current $1880.

Investors interpreted news about the Russian vaccine as a signal that it is worth reconsidering the investment idea of recent months. The reports about the coronavirus vaccine are considered a trigger for metal prices and affected the stock market.

Since large IT companies have started to occupy a massive weight in the indices, their decline puts pressure on major indexes, increasing pessimism. FAANG, the five largest shares, carry a combined weight of over 20% in the S&P500 index.

For Nasdaq 100, which includes mostly high-tech companies, the correction of the largest of them is an even stronger negative.

Another, more general, reason for the pressure is the impasse in the negotiations on the support package in the USA. With the recent Trump executive orders, the markets are counting on certain injections of money into the economy: workers will receive tax reliefs on wages, and unemployed will get extra checks above secured payments.

Both Republicans and Democrats want to give away more money, but they cannot agree on how to do it. As a result, markets now face less stimulus than earlier expected, which constrains the demand for risk assets.

The short-term technical picture is on the bears’ side for the stocks and metals, and on the bulls’ side for the dollar. The key indices moved back from the overbought area, which often precedes a more substantial correction. The US currency is moving in the opposite direction, coming out of the oversold zone and taking advantage of the steady demand, keeping the potential for a further rebound.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cold Shower For Overheated Gold And IT Stocks

Published 08/12/2020, 05:27 AM

Updated 03/21/2024, 07:45 AM

Cold Shower For Overheated Gold And IT Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.