- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cognizant (CTSH) Set To Acquire Digital Marketing Agency Lev

Cognizant Technology Solutions (NASDAQ:CTSH) recently announced that it has entered into an agreement to buy Indianapolis-based Lev, a privately-held digital marketing consulting firm in the United States for an undisclosed amount.

Lev provides strategic consulting, architecture design, technical optimization and application integration services. Businesses use Lev’s solutions to simplify and modernize their marketing campaigns. Notably, Lev is a Salesforce Platinum Partner, specialized in custom cloud solutions.

The deal will expand Cognizant’s Salesforce practice. Moreover, it adds to the customer base as Lev supports major brands in healthcare, life sciences, entertainment, technology, utilities, financial services and education among other industries.

Cognizant expects the deal to close in the first quarter of 2020, subject certain closing conditions.

Acquisitions to Aid Cognizant’s Growth

Acquisitions always played an important part in charting out Cognizant’s growth trajectory. The acquisitions are strengthening the company’s digital capabilities, client base and market footprint.

In February, the company announced its plan to buy French operations of EI-Technologies, a Paris-based, privately-held digital technology consulting firm and a leading independent Salesforce specialist in France. The transaction not only consolidates Cognizant’s Salesforce practice but also its European customer base.

In 2019, Cognizant completed five acquisitions, namely Mustache, Meritsoft, Samlink, Zenith and Contino, which expanded its footprint into SaaS, financial services including banking capabilities, biopharmaceutical and medical device space, enterprise DevOps and cloud transformation.

Acquisitions contributed $234 million in 2019 revenues that totalled $16.78 billion, up 4.1% over a year.

For 2020, Cognizant expects revenues to grow between 2% and 4% year over year at cc. Management also anticipates its top line to suffer a 60-bps headwind from the exit of certain content services business.

Zacks Rank & Stocks to Consider

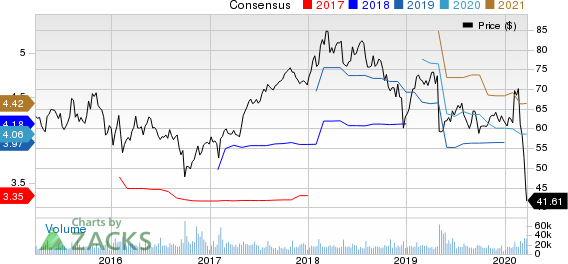

Cognizant currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector are Microsoft (NASDAQ:MSFT) , SAP SE (NYSE:SAP) and Garmin (NASDAQ:GRMN) , all three sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Microsoft, SAP and Garmin is currently pegged at 13.2%, 9.5% and 7.4% each.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.