FY17 results clearly demonstrate that Coats Group's (LON:COA) industrial operations have good momentum and a transformation plan is to enhance this further over the next couple of years. Group earnings and free cash generation were both up by double-digit percentages in FY17. While partly anticipated in the current rating, we believe that Coats is focusing on faster-growing segments and, having clarified group pension requirements, has the financial capacity to achieve this in a number of ways.

Good progress, ahead of expectations

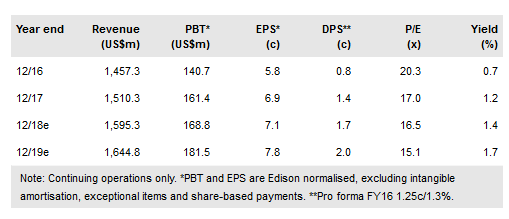

Coats’ FY17 results exceeded our estimates at both the PBT (by c 4%) and EPS levels (c 7%), with DPS in line. As shown above, all three metrics were well ahead y-o-y. Industrial division revenue growth was well founded, with progress from both subsegments, and we believe that the performance in all three reporting regions was ahead of local GDP benchmarks. Margin improvement here drove a strong divisional profit uplift and, although this was partly offset by a disappointing Crafts outturn, the progress made was substantially retained. A much reduced pension deficit/normalised balance sheet and reset financing facilities reduce the distractions in this area, and underlying cash generation is coming more to the fore.

To read the entire report Please click on the pdf File Below: