- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Chicago Bridge & Iron Secures Storage Award Deal From JGSPC

Chicago Bridge & Iron Company N.V. (NYSE:CBI) has recently won a $70 million contract from JG Summit Petrochemical Corporation (JGSPC) for the Stage 1 Expansion project, located in Batangas City of Philippines.

Notably, the company’s work will include the engineering, fabrication and construction of ten traditional field erected storage tanks along with one double-wall liquefied petroleum gas storage tank and three spheres. The scope of work also consists of technical evaluation to service numerous tanks on the project. Earlier the company also provided a technology license, basic engineering package as well as heater supply to the project.

Existing Business Scenario

Moving ahead, Chicago Bridge & Iron expects multiple opportunities in its key end markets, including the U.S., East Africa and the Middle East. Meanwhile, the company is well placed for major EPC and storage projects for multiple regasification terminals in the Asia-Pacific region owing to significant increase in demand for LNG worldwide. The uptick in storage and pipe fabrication awards around the world, and significant opportunities in petrochemicals and refining are expected to act as key catalysts.

Furthermore, the company is taking multiple strategic investments and collaborations in technology to boost profitability and market share. Also, Chicago Bridge & Iron’s concerted efforts to reinvent its supply chain are expected to generate returns more than the typical margins associated with engineering and construction projects.

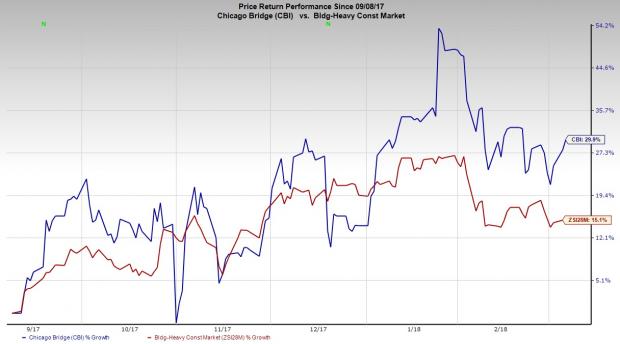

Additionally, the company seems to benefit from its diligent execution of strategies, restructuring and cost-saving initiatives culture. As a result of its continual focus on efficiency, Chicago Bridge & Iron has been able to reduce overhead costs. Notably, in the past six months, this Zacks Rank #3 (Hold) stock has gained 29.8% outperforming the industry’s rally of 15.1%.

Despite these positives, over the past few quarters, Chicago Bridge & Iron has experienced a precipitous decline in capital investments that has severely marred its financials. This apart, as of now, the company’s margins remains under pressure due to higher restructuring charges as well as execution of its other projects.

Key Picks

Some better-ranked stocks from the same space are Potlatch Corporation (NASDAQ:PCH) , EMCOR Group, Inc. (NYSE:EME) and Dycom Industries, Inc. (NYSE:DY) . While Potlatch sports a Zacks Rank #1 (Strong Buy), EMCOR Group and Dycom Industries carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Potlatch has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 36.9%.

EMCOR Group has outpaced estimates in the preceding four quarters, with an average earnings surprise of 28.1%.

Dycom Industries has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 7.1%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Potlatch Corporation (PCH): Free Stock Analysis Report

Chicago Bridge & Iron Company N.V. (CBI): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

Dycom Industries, Inc. (DY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.