- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Chicago Bridge & Iron Gets Full Notice To Proceed From KPI

Chicago Bridge & Iron Company N.V. (NYSE:CBI) recently announced that it has received full notice to proceed from Kazakhstan Petrochemical Industries Inc. (KPI). The full notice to proceed was granted to the company for the project management services for a propane dehydrogenation unit (“PDH”) as well as a polypropylene plant located in Kazakhstan’s western Atyrau region.

Chicago Bridge & Iron’s CATOFIN propane dehydrogenation technology will be used by the PDH unit, while the polypropylene plant will utilize the company's Novolen advanced gas-phase polypropylene technology. The company will provide project management services on the different phases of this project, consequently offering its comprehensive solutions to customers in the region.

Existing Business Scenario

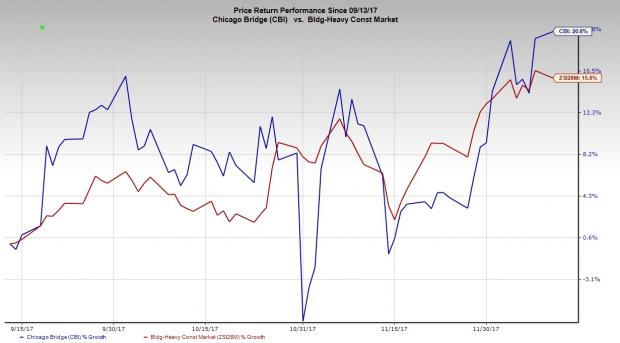

Going forward, Chicago Bridge & Iron estimates multiple opportunities in key end markets including the United States, East Africa and the Middle East. For the United States and Middle East, solid petrochemical investment on ethylene and low feedstock cost are projected to fuel growth. This apart, it has bright prospects in petrochemical projects in the Middle East as well as the U.S. Gulf Coast for both Technology and EPC, going forward. The Zacks Rank #3 (Hold) company has gained 23.5% of its value in past three months, outperforming the industry’s growth of 16.9%.

The company is likely to benefit from President Trump’s “Rebuilding America” rhetoric. We believe that the company’s Engineering and Construction segment will witness a surge in major infrastructure projects, including liquefied natural gas terminals, electric power plant projects, as well as drinking and wastewater pipeline works. Moreover, the company benefits from its diligent execution of strategies, restructuring and cost-saving initiatives culture.

Despite these positives, volatility in commodity pricing continues to be a major drag for Chicago Bridge & Iron’s profitability. Further, over the past few quarters, decreased activity on large cost reimbursable LNG projects in Asia Pacific region, the winding down of several E&C projects along with the timing of progress on projects in Fabrication Services group have remained major concerns for the company.

Stocks to Consider

Some better-ranked stocks from the same space are EMCOR Group, Inc. (NYSE:EME) , MasTec, Inc. (NYSE:MTZ) and Sterling Construction Company Inc (NASDAQ:STRL) . While EMCOR Group and MasTec sport a Zacks Rank #1 (Strong Buy), Sterling Construction Company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EMCOR Group has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 16.9%.

MasTec has outpaced estimates in the preceding four quarters, with an average earnings surprise of 28.1%.

Sterling Construction Company has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 65.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Chicago Bridge & Iron Company N.V. (CBI): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

Sterling Construction Company Inc (STRL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.