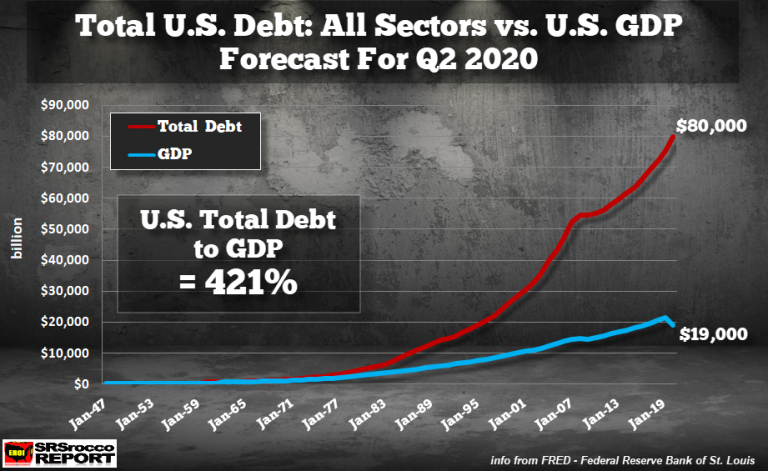

When the results are released, the second-quarter economic data will be the worst on record. With the massive money printing by the U.S. government, public debt has ballooned more than $3 trillion since the lockdown of the domestic economy. The total U.S. public and private debt will likely surpass $80 trillion in Q2 2020.

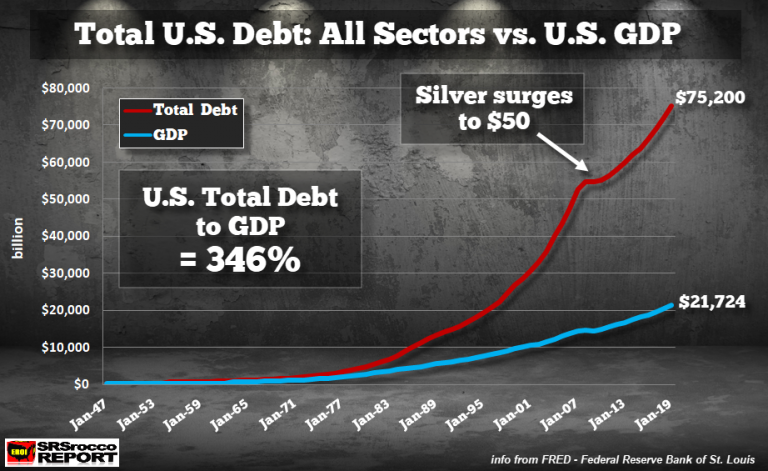

Here is my last update for the U.S. Total Debt All Sectors versus the GDP, for the beginning of 2019:

Total U.S. debt for Q4 2019 was $75.2 trillion. However, the Fed updated the figure to $75.4 trillion. As of Q1 2020, total U.S. debt stood at $77.6 trillion, up a cool $2.4 trillion in just one quarter. If we assume that the U.S. public debt will be up by at least $2.5 trillion by Q2 2020, then the total will reach at least $80 trillion:

I forecasted that U.S. GDP would fall to $19 trillion in Q2 2020. If true, then the total U.S. Debt to GDP would be 421%, up from 346% just two quarters ago. At some point, all this debt will matter.

You will notice that since around 1970, the Total Debt has increased a great deal more than the GDP. I believe this was due to the peaking of U.S. conventional oil production. As U.S. oil production peaked and declined, the U.S. funded their economic growth more with debt. Now, we can see that the debt is moving up exponentially while the GDP will start to flatten and decline.

This is terrible news for Americans who hold most of their wealth in STOCKS, BONDS, and REAL ESTATE.