- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CenterPoint Energy Rewards Shareholders With 4% Dividend Hike

CenterPoint Energy, Inc.‘s (NYSE:CNP) board of directors has approved a quarterly dividend hike of approximately 3.7% for the company’s common stocks.

Notably, the revised quarterly stock dividend of 27.75 cents per share, up from 26.75 cents per share distributed earlier, will be payable on Mar 8, 2018, to shareholders at the close of business on Feb 15, 2018. Post the hike, the company’s new annualized dividend will amount to $1.11 per share of common stock, up from $1.07 per share of common stock distributed previously.

Consequently, the company’s current annual dividend yield is 3.9% based on the closing share price of $28.40 on Dec 13, 2017, significantly higher than the yield of 1.74% recorded by S&P 500 as well as that of industry average of 3.04%.

Dividend Hike is Common for Utilities

Utility operators generate more or less stable earnings, owing to endless need for electricity and utility services. This helps the stocks in the utility space to enjoy a steady flow of revenues. A steady flow of uninterrupted income in turn encourages the operators to reward shareholders from time to time, with notable dividend hikes.

Toward this, we have witnessed a few utilities reward their shareholders with incremental dividends in the past few weeks. Evidently, PNM Resources, Inc. (NYSE:PNM) has raised its annual dividend by 9.3%, while another utility operator – WEC Energy Group (NYSE:WEC) decided to raise its dividend by 6.3%. Most recently, The AES Corporation (NYSE:AES) hiked its dividend by 8.3%.

What led to Dividend Hike for Company?

CenterPoint Energy has been more or less a steady performer in the past, as evidenced by its performance in the last four quarters. Notably the utility was successful in beating the Zacks Consensus Estimate in two of the trailing four quarters, with an average beat of 6.4%.

Further, the company maintains a stable cash flow financial position. As of Sep 30, 2017, it had cash and cash equivalents of $201 million. Such stability in financial position has supported the company’s practice of returning value to shareholders with regular dividend hikes. In the nine months of 2017, the company paid $346 million as dividends to shareholders, up from $332 million paid in the year-ago period. The latest dividend hike marks the 13th in a row in as many years, following the 4% hike that CenterPoint Energy made this January.

Going Ahead

CenterPoint Energy aims to invest approximately $4.1 billion through the 2017-2021 period toward its Electric Transmission & Distribution division, for conducting system modernization initiatives, maintenance projects and installation of meter-reading technology. Additionally, it intends to spend $2.7 billion in natural gas utilities for replacing aging infrastructure, development of the Minnesota Belt Line Project and public improvement requirements. These investments are expected to collectively aid the company in achieving 4-6% annual EPS growth, or exceeding the upper end of its range through 2018. Notably, this will aid the company in making dividend hikes in future.

Price Movement

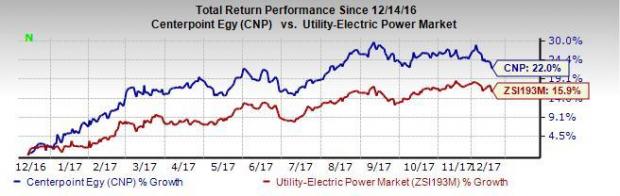

Shares of CenterPoint Energy have outperformed the industry in the last one year. The company’s shares gained 22%, compared with the industry’s growth of 15.9%.

The outperformance can be attributed to the company’s solid cash flow generating capability.

Zacks Rank

CenterPoint Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

PNM Resources, Inc. (Holding Co.) (PNM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.