- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Centene (CNC) Reiterates '17 View & Issues '18 Guidance

Centene Corporation (NYSE:CNC) recently affirmed its 2017 guidance provided with the third-quarter 2017 earnings release. The company also announced a decent view for 2018.

2017 Guidance Reiterated

Centene expects adjusted earnings per diluted share to be in the range of $4.86-$5.04 compared with the previously guided range of $4.70-$5.06. This reflects 11.7% year-over-year growth. Total revenues are expected to be in the range of $47.4-$48.2 billion compared with the previously guided range of $46.4-$47.2 billion. This reflects 17.7% year-over-year growth. This raised guidance boosts investors' optimism in the stock. The company expects to report 2017 earnings on Feb 6, 2018.

Strong 2018 Outlook

For 2018, Centene expects adjusted EPS in the range of $5.47-$5.87. The midpoint of the range is 3.5% higher than the Zacks Consensus Estimate of $5.48. This newly guided range is also 14% higher than the midpoint of the range projected for 2017 adjusted EPS.

The company issued guidance for revenues in the band of $60-$60.8 billion, 17% ahead of the Zacks Consensus Estimate of $51.55 billion. This is also 26% higher than the midpoint of the range guided for 2017 revenues.

Apart from earnings and revenue guidance, the company also expects health benefits ratio of approximately 86.3% to 86.8% (down from the range of 87-87.4% projected for 2017).

Adjusted selling, general and administrative expenses are expected to lie between 9% and 9.5%, compared with the range of 9.3-9.7% guided for 2017.

The company expects diluted shares outstanding to range of 201.1 million to 202.1 million. This is well ahead of the projection of 176.3-177.3 million for 2017.

The earnings outlook for 2018 is impacted by the company’s assumption of its Fidelis acquisition to be closed on Apr 1, 2018. The company also expects a $2.3 billion of new equity financing outstanding on Feb 1, 2018 and $1.6 billion of new debt financing outstanding on Mar 1, 2018.

If the Fidelis buyout closing date and related financing is assumed to be Jan 1, 2018, both the top and bottom end of the GAAP and adjusted diluted earnings per share guidance range would increase by 18 cents and 23 cents, respectively. Also, the top and bottom end of the total revenue guidance range would increase around $2.8 billion.

Growth Potential

The company’s has a solid record of beating earnings estimates. Centene has delivered positive surprises in each of the last four quarters with an average beat of 10.6%.

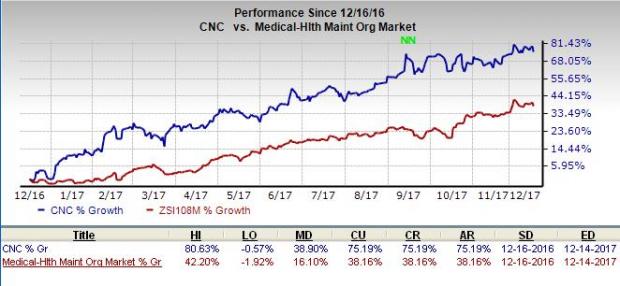

Centene’s strong and consistent performance is likely to have generated confidence among investors. It has seen substantial inorganic growth in the last five years. The acquisition of Health Net in 2016 bolstered the company’s growth, expansion and asset base. Its solid financial position provides a major boost to its capital deployment initiatives. The company’s strong Managed Care segment also contributes to its strong results. In a year’s time, the stock has gained 75.2%, significantly higher than the industry’s rally of 38.2%.

Zacks Rank & Other Stocks to Consider

Centene carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the same space can also consider some other stocks like Triple-S Management Corporation (NYSE:GTS) , Wellcare Health Plans Inc (NYSE:WCG) and Magellan Health, Inc. (NASDAQ:MGLN) . All of the above stocks sport a Zacks Rank #1.

Triple-S Management delivered positive surprises in two of the last four quarters, with an average beat of 74%.

Wellcare Health delivered positive surprises in each of the last four quarters with an average beat of 64.3%.

Magellan Health delivered positive surprises in three of the last four quarters, with an average beat of 0.9%.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

WellCare Health Plans, Inc. (WCG): Free Stock Analysis Report

Magellan Health, Inc. (MGLN): Free Stock Analysis Report

Triple-S Management Corporation (GTS): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.