- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Caterpillar November Sales Up 26%, Will The Momentum Sustain?

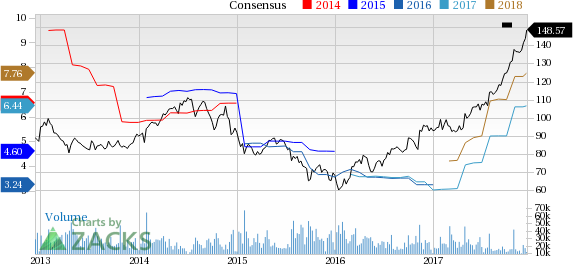

Caterpillar Inc. (NYSE:CAT) reported a rise of 26% in global retail sales for the three months ended November 2017. The company had last witnessed these levels in January 2012. This was driven by improvement across all regions with construction, mining and energy reporting the best performances year to date. Caterpillar shares hit a 52-week high of $149.05 on Dec 13, before closing the day a tad lower at $148.57.

The solid momentum in retail sales so far in 2017, strong third-quarter results and upbeat guidance are indications that the company is recovering. This instils optimism in the broader machinery sector as Caterpillar has been dominating the global manufacturing industry for long, owing to its size and scope of operations.

Caterpillar Notches 2017’s Best Performance

In November, Caterpillar’s performance was driven by a 43% increase in Asia Pacific sales. The region has been a consistent contributor for the company since it posted the first positive reading in August 2016. Latin America registered growth of 48% in October, double the pace witnessed in the preceding month. Europe, Africa and Middle East (“EAME”) sales were up 32%. North America sales also hit a 2017-high of 12%. Notably, Latin America, EAME and North America scaled peak levels in the month, while Asia Pacific lagged the high of 49% recorded in May.

Resource Industries segment delivered its best year-to-date performance with 35% growth in November sales, almost double the 18% growth in October. This was led by a surge of 85% in EAME sales. Latin America reported sales growth of 68% a massive jump from the 4% rise witnessed in October. Asia Pacific and North America reported a respective 9% and 5% growth.

Caterpillar, Inc. Price and Consensus

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Komatsu Ltd. (KMTUY): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.