Caterpillar Inc. (NYSE:) made a comeback in 2017 driven by strength in the Asia Pacific region and relentless focus on cutting costs. In fact, this is evident from the mining and equipment behemoth’s return to top and bottom-line growth. Retail sales growth entered the positive trajectory in March following an unprecedented stretch of declines for 51 months and has shown significant improvement ever since. With its end markets — construction, mining and energy showing positive momentum lately, the company is likely to report strong results for the final quarter of 2017 and seems poised for an improved 2018.

Stellar Share Performance in the Past Year

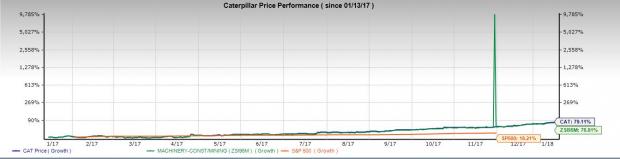

After bearing the brunt of negative trends in past few years, Caterpillar’s shares surged around 79.1% in the past year, outperforming its

industry’s growth of 76.8% as well as the S&P500’s rise of 18.2%. In fact, Caterpillar was one of the top five performing stocks in in 2017.

Notably, Caterpillar touched a 52-week high of $169.53 on Jan 11. The company has a market cap of roughly $100.7 billion and average volume of shares traded in the last three months is around 3.86 million.

What Stoked the Stellar Performance?

Caterpillar started scripting its turnaround story in 2017 with cost-cutting efforts in the wake of a weak mining sector. The company reported year-over-year improvement in the first quarter of 2017 in both top and bottom lines for the first time in 10 quarters. Backlog also improved on a year-over-year basis for the first time since third-quarter 2014. Strong Asia Pacific markets also drove the results. The company continued to report growth in both top and bottom lines in the second and third quarters as well.

Another noteworthy improvement in 2017 was Caterpillar’s retail sales growth graph returning to positive in March. Since then, retail sales growth has remained positive, averaging 11% till November. Per latest figures, Caterpillar reported a rise of 26% in global retail sales for the three months ended November 2017 — its best performance in 2017.

Given that the company had suffered a drop in earnings in 2015 and 2016 affected by weak end-user demand in most of the industries it served, this turnaround performance was indeed a relief for the investors. Upbeat results, encouraging order rates, encouraging economic indicators and an increasing backlog have fueled the share price.

Further, Caterpillar hiked guidance three times in 2017. At its first-quarter 2017 conference call, Caterpillar had issued a revenue guidance range of $38-$41 billion and earnings guidance of $3.75 per share for 2017. The latest guidance is now at $44 billion for revenues and earnings per share of $6.25. The mid-point of the revenues and earnings guidance reflects a year-over-year growth of 14% and 83% respectively. The Zacks Consensus Estimate for 2017 for revenues is at $44.52 billion and for earnings at $6.46, both ahead of the company's guidance.

Also, Caterpillar's share price got a much needed boost with the victory of President Trump as the company is touted to be one of the biggest beneficiaries from his plans of infrastructure spending.

What Turned the Tide in Favor?

In Sep 2015, Caterpillar set upon a major restructuring by retrenching employees and closing or consolidating 30 facilities globally, that would decrease manufacturing square footage by more than 10%. With actions expected through 2018, once fully implemented, the plan would aid in lowering annual operating costs by about $1.5 billion. These costs savings helped the behemoth sustain margins in the wake of weak revenues. Moreover, strength in Asia Pacific sales as well as in the Construction sector helped propel revenues.

What to Expect from Q4 Results?

For fourth-quarter 2017, the Zacks Consensus Estimate for earnings projects a year-over-year growth of 108% on the back of 25% rise in revenues. Consequently, Caterpillar is set to deliver fourth consecutive quarter of both top and bottom-line growth. The Zacks Consensus Estimate for the fourth quarter for earnings and revenues are pegged at $1.73 billion and $11.97 billion, respectively.

Caterpillar, Inc. Price and EPS Surprise

Caterpillar, Inc. Price and EPS Surprise | Caterpillar, Inc. Quote

Caterpillar has outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering a positive average earnings surprise of 53.06%. Our proven model shows that the company is likely to beat earnings in the fourth quarter when it reports results on Jan 25, as it has the right combination of two key ingredients — a positive Earnings ESP of 3.76% and Zacks Rank #2 (Buy). A positive ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Better Performance Ahead

The Zacks Consensus Estimate for 2017 and 2018 reflect healthy growth of 88.9% and 21.5%, respectively. Estimates for Caterpillar have moved up in the past 30 days, reflecting the optimistic outlook of analysts. The earnings estimate for 2017 has surged 23% while that of 2018 has moved north by 16%, in the past 90 days. The stock has an estimated long-term earnings growth rate of 10.3%.

Leading indicators of U.S. construction signal robust conditions ahead, that bodes well for Caterpillar. In China, the construction industry is improving owing to government spending. Recently, the Resource Industries segment has also shown considerable improvement. There exists key opportunities in the precious metals sector as miners resume projects that were placed in the back burner and expand current operations thanks to the recent rally in metal prices. Strength in onshore North America oil and gas will drive results. Shipments to North America gas compression customers will improve driven largely by demand for reciprocating engines. Transportation is anticipated to grow, as higher rail traffic has propped up demand for rail services. All these factors, along with savings from restricting actions will boost revenues and earnings.

We believe that implementation of Trump administration's growth policies, especially the proposed $1 trillion spending on infrastructure improvement, will be a boon for Caterpillar. Further, manufacturing is likely to get a boost this year from $1.5 trillion tax cut approved by the Republican-controlled U.S. Congress. The overhaul of the tax code resulted in the slashing of the corporate income tax rate to 21% from 35%.

Other Stocks to Consider

Other top-ranked stocks in the same sector include Deere & Company (NYSE:) , H&E Equipment Services, Inc. (NASDAQ:) and Kennametal Inc. (NYSE:) . While Deere sports a Zacks Rank #1, Astec and Kennametal carry a Zacks Rank #2.

Deere has a long-term earnings growth rate of 8.2%. Its shares have rallied 59% in the past year.

H&E Equipment Services has a long-term earnings growth rate of 18.56%. Its shares have rallied 86% in the past year.

Kennametal has a long-term earnings growth rate of 8.3%. The company’s shares have been up 49% in a year.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Kennametal Inc. (KMT): Free Stock Analysis ReportCaterpillar, Inc. (CAT): Free Stock Analysis ReportH&E Equipment Services, Inc. (HEES): Free Stock Analysis ReportDeere & Company (DE): Free Stock Analysis ReportOriginal postZacks Investment Research

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.