I believe that oil prices have provided enough signs that an important low is in. We should now expect this reversal to unfold into a bigger move higher.

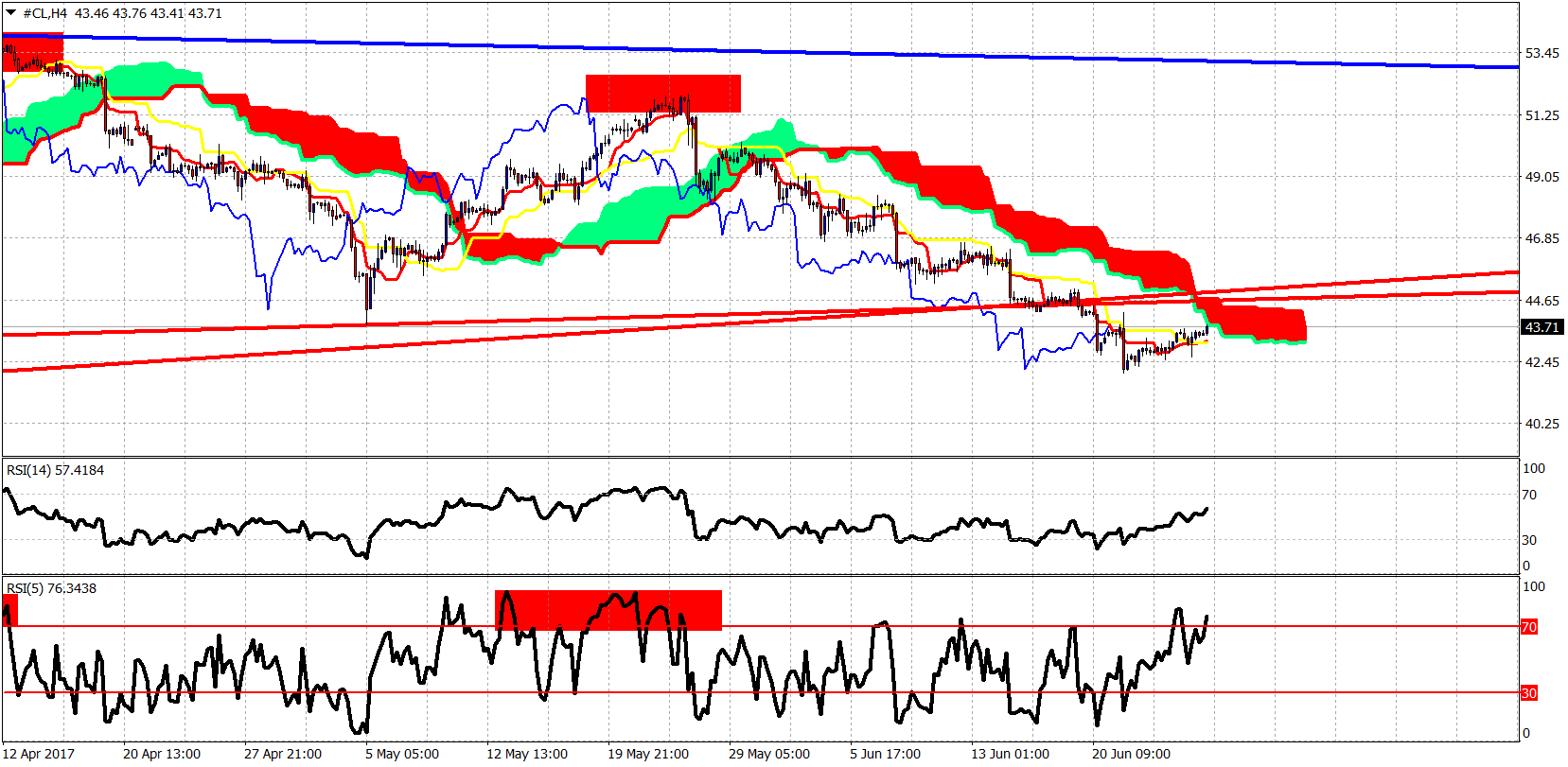

Key short-term resistance is found at $44. Breaking above it will confirm my view that the low is in. Price is trading still below the Ichimoku cloud in the 4 hour chart but the form the of the latest rise is telling me something new has started.

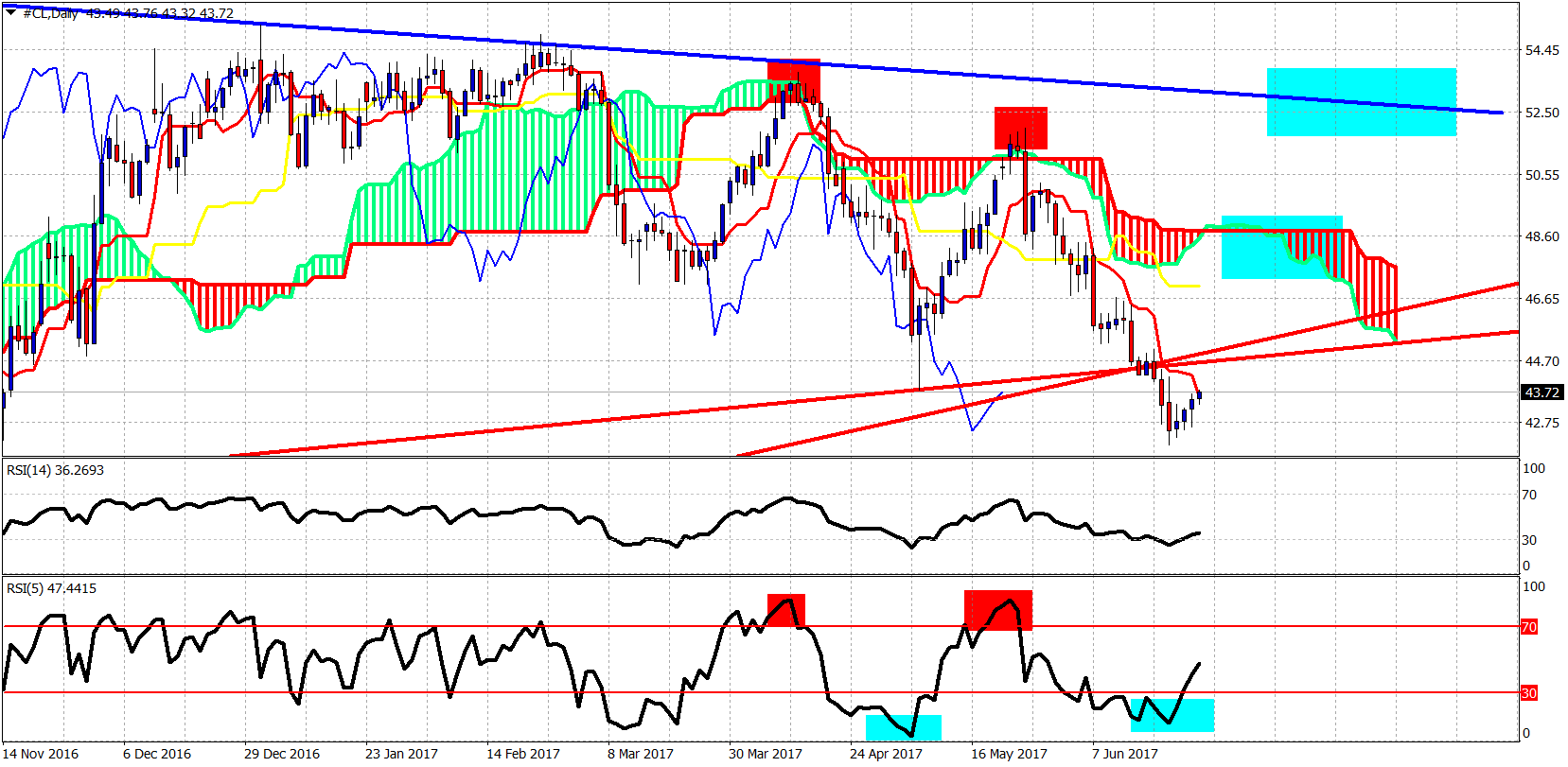

The daily chart however is more convincing regarding that a new uptrend has started.

With the first target at $48.60 and next at the blue downward sloping trend line, I’m very confident we have started at least another strong bounce similar to the ones that occurred in April and May.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.