Allegheny Technologies Incorporated (NYSE:) provided updates on third-quarter 2017 results. The company announced a non-cash net of tax charge of $114 million, or $1.05 per share, for goodwill impairment related to the Cast Products business.

Allegheny anticipates third-quarter results to be in line with its July outlook excluding the impairment charge. A year-over-year improvement in High Performance Materials and Components segment is expected to continue over the next few years, courtesy of the ongoing next-generation aerospace ramp.

The company’s Flat Rolled Products segment results are expected to be adversely impacted by a sharp decline in raw material prices, mainly ferrochrome and nickel. This is expected to reduce profit margins due to out-of-phase raw material surcharges, resulting in a loss in this segment.

Further, the company expects financial results to be at or near break-even in 2018, and drive profitability by the beginning of 2019.

Sales in the third quarter are expected to be in the range of $865-$875 million with a reported loss in the range of $1.11-$1.14 per share, including the $1.05 per share charge for the goodwill impairment. Excluding this charge, the reported loss is expected in the range of 6 cents-9 cents per share.

Allegheny has outperformed the

industry it belongs to over a year. The company’s shares have moved up around 47.8% during this period compared with a roughly 35% gain recorded by the industry.

Allegheny is likely to benefit from its diversified global growth markets as well as cost-reduction and restructuring measures. The company is seeing healthy demand from aerospace OEMs which should spur growth.

However, Allegheny remains exposed to certain challenges in its core Flat Rolled Products segment including weakness across some major end-use markets.

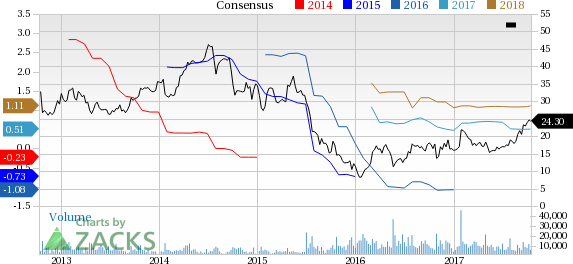

Allegheny Technologies Incorporated Price and Consensus

Allegheny Technologies Incorporated Price and Consensus | Allegheny Technologies Incorporated Quote

Allegheny currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the basic material space are The Chemours Company (NYSE:) , FMC Corporation (NYSE:) and Air Products and Chemicals, Inc. (NYSE:) .

Chemours has expected long-term earnings growth of 15.5% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FMC has expected long-term earnings growth of 11.3% and flaunts a Zacks Rank #1.

Air Products has expected long-term earnings growth of 12.1% and carries a Zacks Rank #2 (Buy).

4 Stocks to Watch after the Massive Equifax (NYSE:) Hack

Cybersecurity stocks spiked on recent news of a data breach affecting 143 million Americans. But which stocks are the best buy candidates right now? And what does the future hold for the cybersecurity industry?

Equifax is just the most recent victim. Computer hacking and identity theft are more common than ever. Zacks has just released Cybersecurity! An Investor’s Guide to inform Zacks.com readers about this $170 billion/year space. More importantly, it highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.