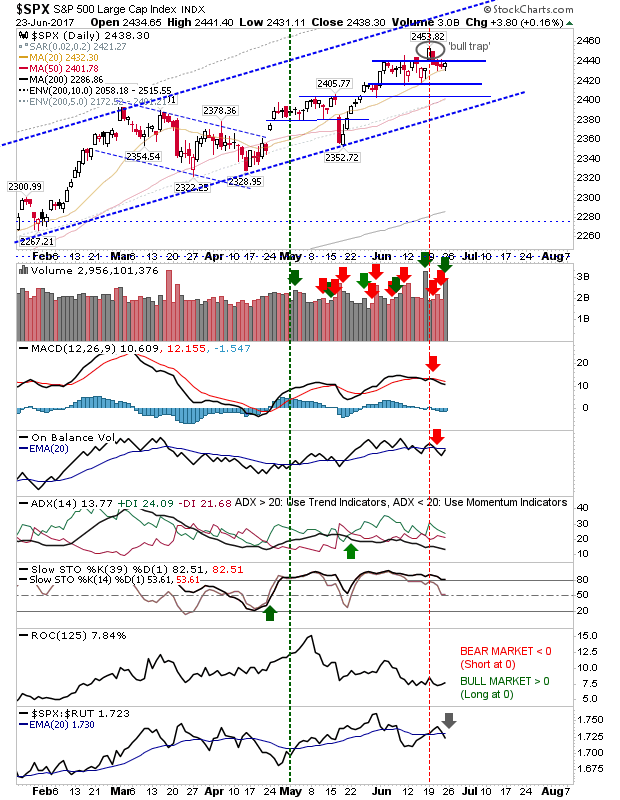

Markets finished Friday with a little flourish on higher volume accumulation. How much pressure varied between indices.

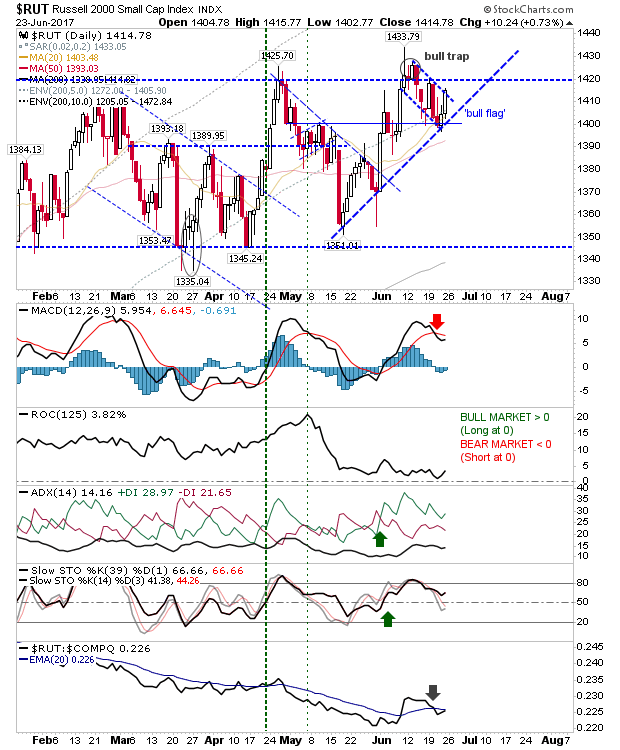

The Russell 2000 rallied off rising support as a 3-week bull flag takes shape. Watch for the confirmation breakout which will coincide with a challenge on the early June 'bull trap'. I'm liking action in this index.

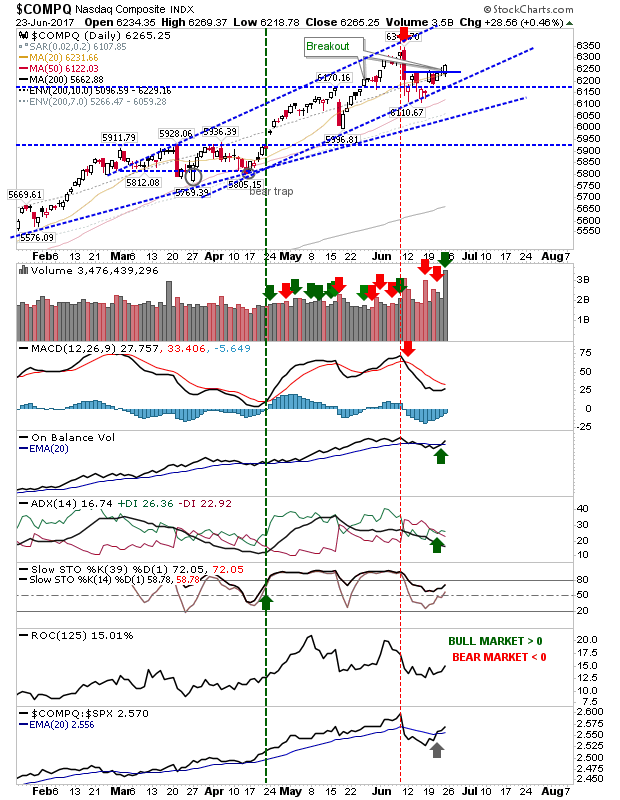

The NASDAQ enjoyed a small gain which was enough to register as a breakout. More importantly, this gain will have any shorts who entered in the last couple of weeks holding on to losses.

The S&P experienced a tight intraday spread which did enough to defend the 50-day MA without pushing to challenge the 'bull trap'. However, the higher volume accumulation did enough to suggest bulls hold the edge and if markets can push to 2,442 then a break of 2,453 would look likely.

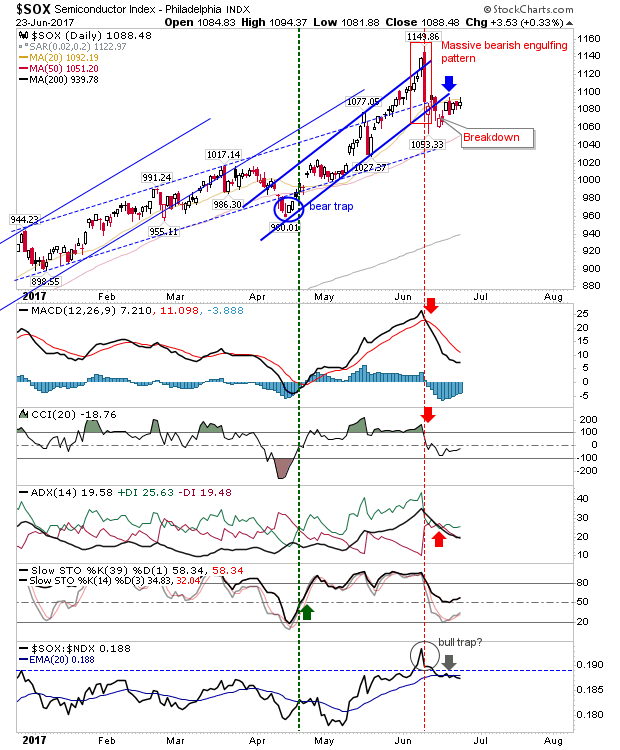

Shorts still have one play. The Semiconductor Index is struggling to return above former channel support and remains heavily influenced by the bearish engulfing pattern. Shorts may get stung by a whipsaw rally above 1,095 but this may be the last hurrah for buyers (and perhaps a better opportunity to go short should it happen).

For today, shorts should watch the Semiconductor Index. Bulls have the NASDAQ, Russell 2000 and S&P each offering slightly different setups; a 'bull flag' for the Russell 2000, a short squeeze breakout in the NASDAQ and a poised coil in the S&P. Take your pick!