The CAC index has posted slight losses in the Wednesday session. Currently, the index is at 5414.30, down 0.24% from the Tuesday close. In the eurozone, Employment Change remained unchanged at 0.4%, matching the forecast. Industrial Production rebounded with a gain of 0.2%, above the forecast of 0.0%. The Federal Reserve meets for its monthly policy meeting, and is widely expected to raise rates to a range between 1.25% to 1.50%. On Wednesday, the eurozone releases manufacturing PMIs, and the ECB will make a rate announcement.

With a host of key French indicators on Thursday, we could see some movement from the CAC index after their release. France will publish services and manufacturing PMIs, as well as Final CPI. The PMI reports are expected to indicate expansion, continuing the trend we’ve seen throughout 2017. The French economy has been marked by stronger growth and lower unemployment, and investor and business confidence has been boosted by the election of pro-business Emmanuel Macron as president. Still, inflation remains a sore point in France, reflective of low inflation levels across the eurozone. French Final CPI is expected to post a negligible gain of 0.1%, unchanged from the previous reading.

All eyes are on the Federal Reserve, which will release a rate statement later on Wednesday. The CME Group (NASDAQ:CME) has priced in a quarter-point rate hike at 87%, so it would be a huge surprise if the Fed doesn’t raise the benchmark rate. Even though this move has been priced in, rate hikes tend to trigger a surge of confidence among investors, and a rate hike could boost global stock markets. Today’s move could be the start of a series of incremental hikes, as the odds of a January increase stand at 86%. The Fed has hinted that it could raise rates up to three times in 2018, but the pace of increases will depend to a great extent on the strength of the economy and inflation levels. The US labor market remains at full capacity and various sectors in the economy are reporting a lack of workers. Still, this has not translated into stronger wage growth, despite predictions from Janet Yellen and other Fed policymakers that a lack of workers is bound to push up wages.

Economic Calendar

Wednesday (December 13)

- 5:00 Eurozone Employment Change. Estimate 0.4%. Actual 0.4%

- 5:00 Eurozone Industrial Production. Estimate 0.0%. Actual 0.2%

- 14:00 US Federal Funds Rate. Estimate

Thursday (December 14)

- 2:45 French Final CPI. Estimate 0.1%

- 3:00 French Flash Manufacturing PMI. Estimate 57.2

- 3:00 French Flash Services PMI. Estimate 59.8

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 59.8

- 4:00 Eurozone Services Manufacturing PMI. Estimate 56.0

- 7:45 Eurozone Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

*All release times are GMT

*Key events are in bold

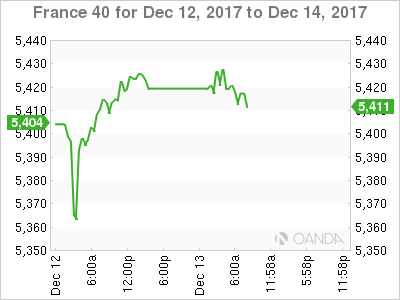

CAC, Wednesday, December 13 at 7:35 EDT

Open: 5417.80 High: 5430.80 Low: 5410.50 Close: 5414.30