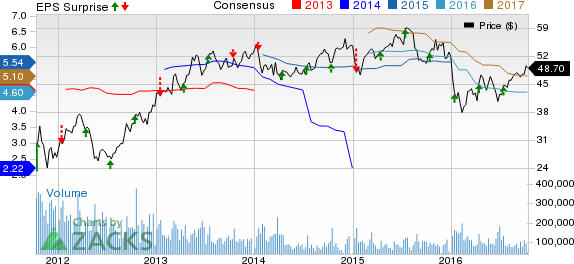

Driven by decline in operating expenses, Wall Street banking giant Citigroup Inc. (NYSE:C) delivered a positive earnings surprise of nearly 8% in third-quarter 2016. The company’s earnings from continuing operations per share of $1.25 for the quarter outpaced the Zacks Consensus Estimate of $1.16. However, earnings compared unfavorably with the year-ago figure.

Income from continuing operations was $3.89 billion, down 10% from the prior-year quarter.

Though profitability was hit by decline in overall revenues, the company recorded higher fixed income markets revenues, supported by an improved trading environment. Both rates and currencies and spread products improved. Also, investment banking revenues improved owing to increased industry-wide debt underwriting activity during the reported quarter.

Further, Citigroup’s costs of credit for the third quarter were down 5% year over year to $1.74 billion mainly due to reduced provision for benefits and claims and a decline in net credit losses. However, the quarter recorded net loan loss reserve build, mostly tied with North America cards, against a net loan loss reserve release in the prior-year period.

Improved Trading Revenues & Continued Cost Reduction

Adjusted revenues of Citigroup decreased 4% year over year to $17.76 billion in third-quarter 2016. The fall reflected lower revenues at Citi Holdings while revenues at Citicorp improved year over year. The revenue figure outpaced the Zacks Consensus Estimate of $17.38 billion.

At Citicorp, adjusted revenues came in at $16.89 billion in the quarter, up 1% year over year. Revenues at Institutional Clients Group (ICG) increased 2% year over year. Notably, revenues from fixed income markets and investment banking surged 35% and 15% on a year-over-year basis, respectively. However, revenues from equity markets plummeted 34% from the prior-year quarter.

Global Consumer Banking (GCB) revenues inched up 1% year over year, mainly driven by North America GCB, partially offset by a decline in international GCB revenues.

Corporate/Other revenues were $28 million, significantly down from the prior-year period. The decline mainly reflected absence of equity contribution tied with the company’s stake in China Guangfa Bank, which was divested in the reported quarter.

Citi Holdings’ adjusted revenues of $877 million reflected a plunge of 48% year over year. The fall was primarily due to persistent decline in the unit’s assets. However, Citi Holdings continued to report profitability.

Operating expenses at Citigroup expenses were down 2% year over year to $10.4 billion. The decline reflected the decrease in expenses in Citi Holdings, and benefit from foreign exchange translation, partially offset by continued investments in Citicorp.

Balance Sheet

At the quarter end, Citigroup’s end of period assets was $1.82 trillion, up 1% year over year. The company’s loans increased 2% year over year at $638 billion. Deposits increased 4% year over year to $940 billion. Citi Holdings’ assets dropped 48% from the prior-year quarter level to $61 billion.

Credit Quality Improves, Energy Headwinds Linger

Total non-accrual assets declined 8% year over year to $6.1 billion. The company reported a decrease of 26% in consumer non-accrual loans to $3.6 billion. However, corporate non-accrual loans of $2.4 billion increased significantly from the prior-year period, mainly related to energy-related loans in the ICG.

Citigroup’s total allowance for loan losses was $12.4 billion at quarter end, or 1.97% of total loans, down from $13.6 billion, or 2.21%, in the prior-year period.

Strong Capital Position

At the quarter end, Citigroup’s estimated Basel III Common Equity Tier 1 Capital ratio was 12.6%, increasing from 11.7% in the prior-year quarter. The company’s supplementary leverage ratio for the third quarter stood at 7.4%, up from 6.9% in the prior-year quarter.

As of Sep 30, 2016, book value per share was $74.51 and tangible book value per share stood at $64.71, both up 8% from the prior-year period.

Our Viewpoint

The results certainly do not reflect an impressive quarter for Citigroup, however restructuring efforts, including streamlining moves, should continue to ease its burden on the expense base. One can consider a strong brand like Citigroup to be a sound investment option over the long term, given its global footprint and attractive core business. Additionally, Citigroup exhibits its capital strength that continues to support its dividend and a share buyback program.

However, revenue pressure, several legal hassles and the thrust of new banking regulations will continue to be concerns for the company.

Citigroup carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Performance of Other Major Banks

Among major banks, JPMorgan Chase & Co.’s (NYSE:JPM) third-quarter 2016 earnings of $1.58 per share handily surpassed the Zacks Consensus Estimate of $1.40. However, the figure reflects a 6% decline from the year-ago period. Notably, the results included a legal benefit of $71 million.

Driven by a strong top-line growth, Wells Fargo & Company’s (NYSE:WFC) third-quarter 2016 earnings recorded a positive surprise of about 1%. Earnings of $1.03 per share beat the Zacks Consensus Estimate by a penny. However, it compared unfavorably with the prior-year quarter’s earnings of $1.05 per share.

The PNC Financial Services Group, Inc.’s (NYSE:PNC) third-quarter 2016 earnings per share of $1.84 handily beat the Zacks Consensus Estimate of $1.78. However, the bottom line declined 3% year over year.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

JPMORGAN CHASE (JPM): Free Stock Analysis Report

PNC FINL SVC CP (PNC): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

Original post

Zacks Investment Research