- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

British Pound Spikes Higher As UK Unemployment Falls To 7.1 Percent

The British Pound traded sharply higher on Wednesday morning after the U.K. Office for National Statistics (ONS) reported that the U.K. unemployment rate from September to November of 2013 fell to 7.1 percent. The figure beat analyst expectations of 7.3 percent. According to ONS data, for September to November 2013 there were 2.32 million unemployed people in the United Kingdom, down 167,000 from the three-month period through Novenmber 2013.

The Claimant Count Change, which measures the change in the number of people claiming the Jobseeker's Allowance (JSA), fell by 24,000 in December. The figure missed analyst expectations of a fall of 35,000.

Average hourly earnings also missed expectations, rising by a modest 0.9 percent versus 1.0 percent forecast.

In the wake of the employment data, the British Pound rallied to it's highest levels since January 2013 against the Euro and surged to a near three-week high against the U.S. dollar.

The Bank of England (BOE) has said that it will consider raising interest rates from the record low level of 0.5 percent when the U.K. unemployment rate falls to a target threshold of 7 percent.

However, the latest minutes from this month's meeting of the Bank of England Monetary Policy Committee (MPC) led by Governor Mark Carney, showed that reaching the 7 percent threshold will not automatically trigger a rate hike.

Also published on Wednesday, the minutes stated; "Inflation had returned to the 2% target, however, and cost pressures were subdued. Members therefore saw no immediate need to raise Bank Rate even if the 7% unemployment threshold were to be reached in the near future. Moreover, it was likely that the headwinds to growth associated with the aftermath of the financial crisis would persist for some time yet and that inflationary pressures would remain contained. Consequently when the time did come to raise Bank Rate, it would be appropriate to do so only gradually."

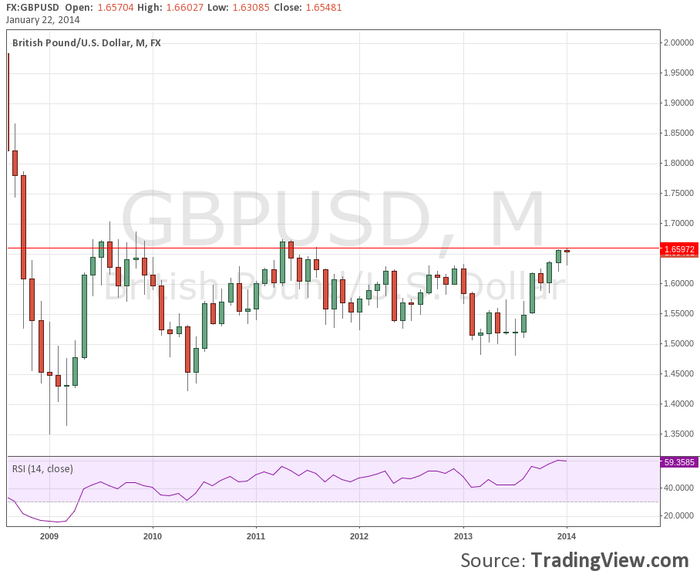

GBP/USD Monthly Chart

Looking at the GBP/USD monthly chart we can see that price is nearing the recent high of 1.6600. A break above that price would mark the highest levels seen since August of 2011.

GBP/USD" title="GBP/USD" align="bottom" border="0" height="242" width="474">BY Dan Blystone

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.