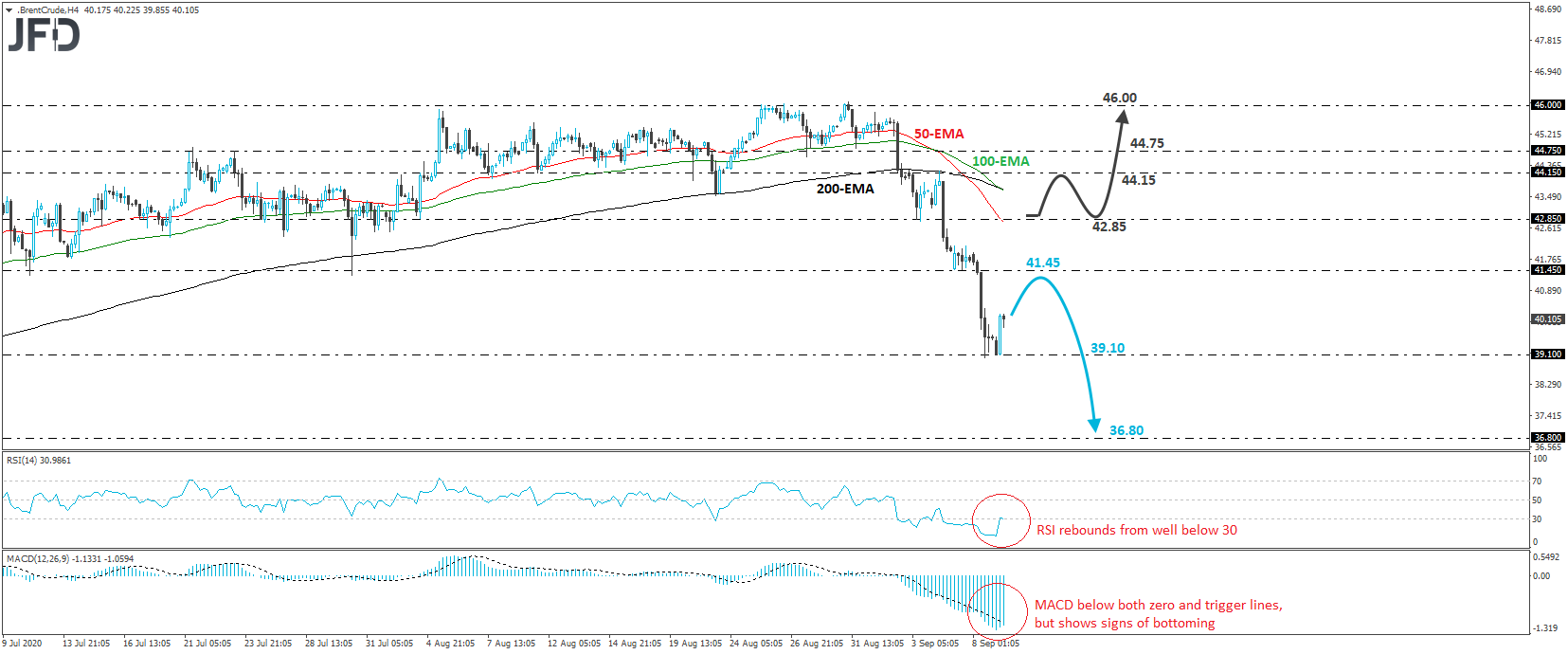

Brent oil tumbled again on Tuesday, hitting support near the 39.10 territory. Today, the liquid rebounded, but bearing in mind that the price structure remains of lower highs and lower lows since August 31st, we would consider the near-term outlook to still be negative, even if today’s recovery continues for a while more.

As we already noted, the current recovery may continue for a while more, perhaps for Brent to test the 41.45 zone as a resistance this time. That zone is marked as a support by Monday’s low, as well as by the lows of July 10th and 30th. The bears may recharge from near that hurdle and perhaps drive the battle back down for another test near 39.10. If this time that zone is broken, the tumble may continue towards the 36.80 territory, marked by the low of June 12th.

Taking a look at our short-term oscillators, we see that the RSI rebounded from well below 30 and has just poked its nose above that line, while the MACD, although below both its zero and trigger lines, shows signs of bottoming as well.

On the upside, we would like to see a rebound back above 42.85, marked by the last Thursday’s low, before we start examining the liquid’s potential to recover all its recent losses. The first resistance to consider after such a break may be Friday’s peak, at around 44.15, where another break may open the path towards the 44.75 area, which provided support on August 27th. Another move north, above 44.75, may set the stage for extensions towards the 46.00 zone, which stopped the price from moving higher between August 25th and 31st.