It’s been another slow start to trading on Monday, with markets largely picking up where they left off on Friday in the absence of any major news flow over the weekend.

Deal For Veneto Banks Lifts Sentiment in Europe

The one notable piece of news over the weekend came from Italy where an agreement was reached that will avoid winding down two Italian banks, the good assets of which will be transferred to Intesa Sanpaolo (MI:ISP). The resolution seems to have appeased both the European Commission and the Italian government, both of which have been at loggerheads as to how to deal with the failing banks, as well as investors with financials across the board being boosted by the announcement.

GBP Pops Higher as DUP Agrees to Support Minority Conservative Government

Reports this morning of an agreement between the Conservatives and Northern Ireland’s DUP have seen the pound pop higher, albeit only marginally given that the deal has been widely anticipated and doesn’t offer the kind of stability that a majority or even full coalition would. The deal will see Northern Ireland receive an extra £1 billion over the next two years in exchange for the DUPs support for May’s minority government. With the deal now agreed, the next question is whether May will remain in charge throughout that period.

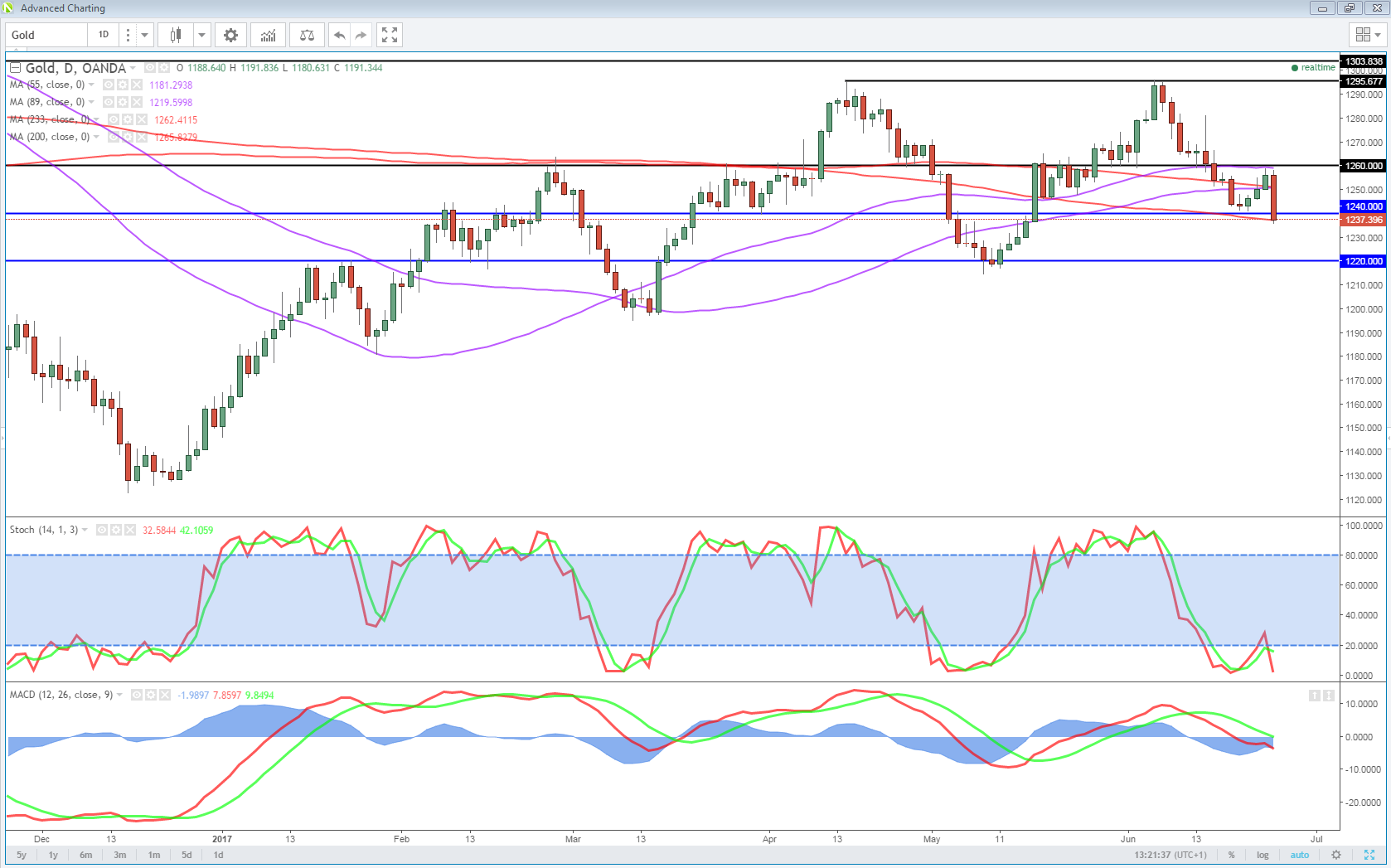

Gold Under Pressure as $1,240 is Tested

The improved sentiment in the market is weighing on safe haven assets, particularly gold which is down more than 1% on the day. Gold recovered back towards $1,260 towards the end of last week but has been sold heavily this morning, hitting its lowest level since the middle of May at one point. A sustained break below $1,240 could trigger a move back towards $1,220, which has been a very notable level on numerous occasions this year.

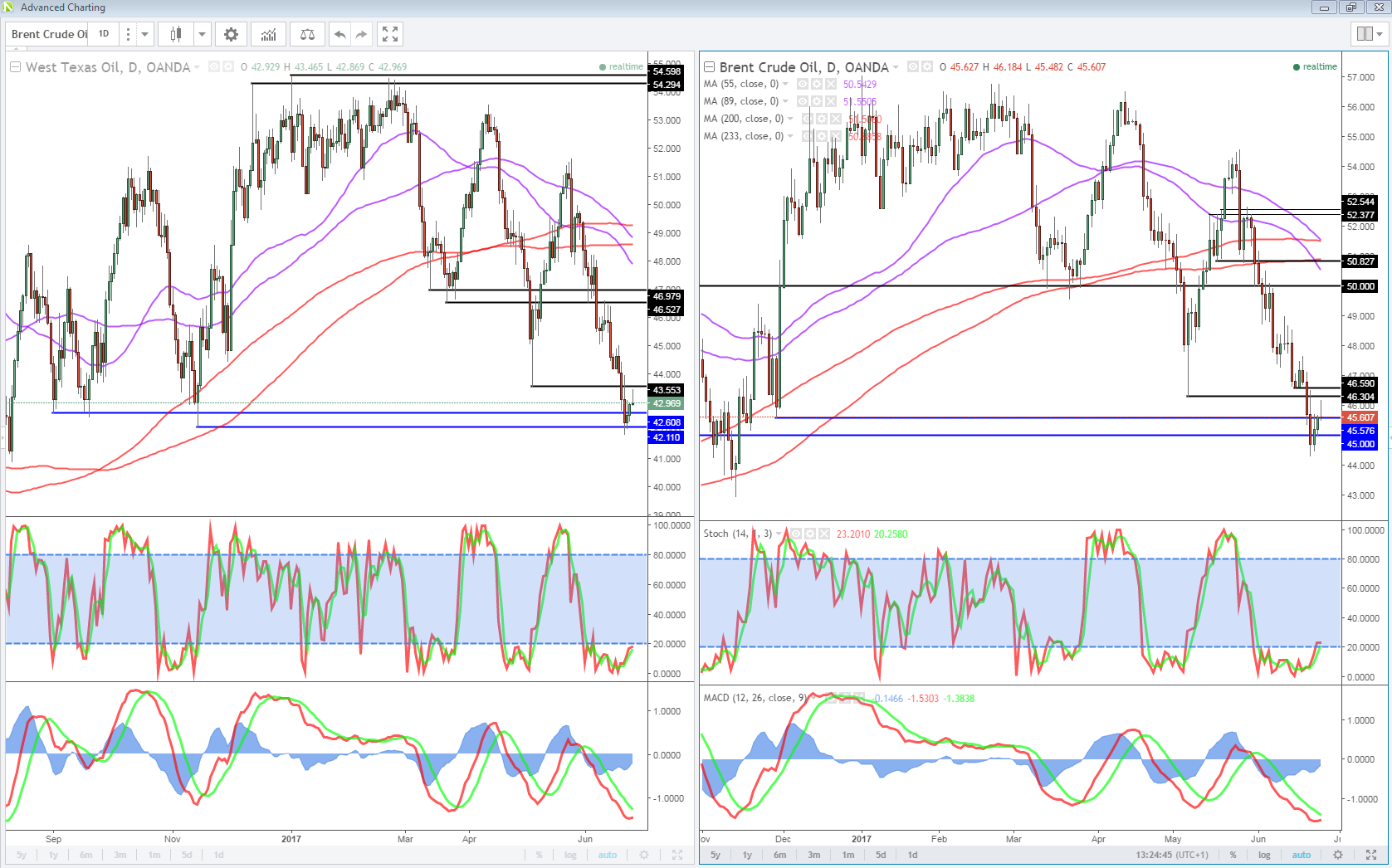

Oil Higher But Still Looks Weak

Oil is trading higher for a third consecutive session on Monday as it continues to pare losses suffered over the last month which came after producers announced an extension to their output cut. While this may give some cause for optimism, I’m seeing little to convince me that this is anything other than a dead cat bounce, with both Brent and WTI this morning already running into resistance at the first time of asking.

The first test comes from the prior lows which could offer early insight into whether there’s anything in these gains and in both cases, we appear to be falling short. A failure here is quite a bearish signal and could point to further downside in the gains ahead. That said, a break above $43.50 in WTI and $46.60 in Brent may suggest we’re seeing a broader correction, something that at this stage is looking unlikely.

While it may have been a slow start to trading, we will get durable goods numbers from the US ahead of the open on Wall Street. ECB President Mario Draghi will also appear later on as he delivers opening remarks at a forum on central banking in Portugal.