- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Box Inks Agreement With Starboard To Appoint New Directors

Box, Inc. (NYSE:BOX) recently entered into an agreement with Starboard Value LP (Starboard) to appoint three new independent directors to its board.

The company is expected to hold 2020 annual meeting of stockholders in June. Per the agreement, Box will add three new independent directors to its board before the annual meeting.

Among the three, Jack Lazar will join as the new director effective immediately. The second director will be selected from a list of candidates provided by Starboard, while the third director will be chosen by the board before the annual meeting.

Starboard is an investment firm that owns approximately 7.7% of Box’s outstanding shares.

Box also announced that two existing board members will not stand for re-election at the 2020 annual meeting. Following the meeting, the board will comprise 9 directors.

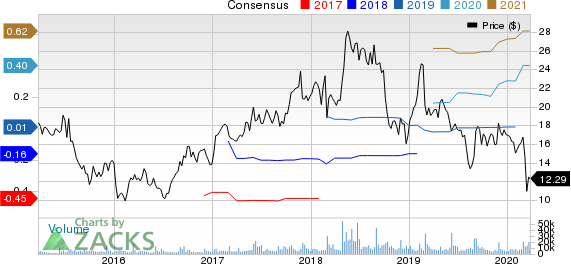

The company’s shares have lost 35.5%, underperforming the industry’s decline of 21.5% over the past year.

Box, Inc. Price and Consensus

Existing Business Scenario

Box continues to be a leader in the Enterprise Content Management and enterprise file synchronization and sharing spaces. Given effective management execution, new add-on products and impressive count of its Fortune 500 clients, the stock should do well in the near future.

Box should continue to benefit from partnerships with enterprise software companies and large public cloud providers, among others. The company’s partnerships with technology giants like Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) have increasingly been adding AI capacities to Box’s platform, thus aiding top-line growth. These partnerships should continue to be incremental to Box’s business. However, any change in partner dynamics could hurt its growth trajectory.

Increasing competition from Dropbox is a concern. Also, companies like Microsoft and Google are offering enhanced online storage services to expand their share. Nonetheless, Box’s retention rate should remain strong, driven by impressive seat growth in existing customers and strong attach rates of new products.

Zacks Rank & Other Stocks to Consider

Box currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Stamps.com Inc. (NASDAQ:STMP) , eBay Inc. (NASDAQ:EBAY) and Atlassian Corp. (NASDAQ:TEAM) . While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Atlassian carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Stamps.com, Atlassian Corp. and eBay is currently projected at 15%, 22.3% and 11.3%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

eBay Inc. (EBAY): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.