- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What's In Store For Pure Storage (PSTG) In Q3 Earnings?

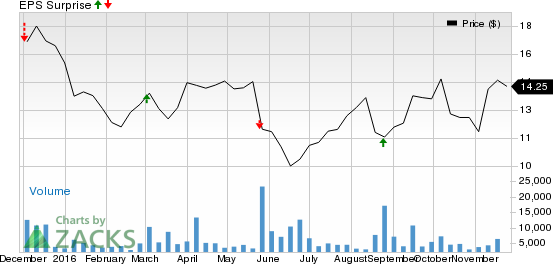

Enterprise data storage firm Pure Storage, Inc. (NYSE:PSTG) is scheduled to report third-quarter fiscal 2017 (ended Oct 2016) results after the market closes on Nov 30. In the last reported quarter, earnings beat the Zacks Consensus Estimate by 8.8%. Over the trailing four quarters, the company missed earnings estimates twice with an average negative earnings surprise of 5.01%.

Let’s see how things are shaping up for this announcement.

Key Factors in the Third Quarter

During the quarter, Pure Storage enhanced its FlashStack Converged Infrastructure Solution by collaborating with Cisco Systems (NASDAQ:CSCO) . This move facilitates easy deployment, expansion and maintenance of the solution for FlashStack customers. Pure Storage and Cisco have a number of collaborations for various technologies.

While the FlashArray product line addresses structured workloads, FlashBlade has been designed to tackle unstructured workloads. Such collaborations augur well for both the companies but are likely to have a minimal impact on the to-be-reported quarter's earnings.

The company has also announced the availability of petabyte-scale storage utilized for mission-critical cloud IT, the next-generation of FlashArray//m. This will give its customers a wider range of products to choose from and will enhance the company’s sales.

The data storage industry is touted as one of the hi-tech industries to watch out for in the coming years and is reportedly on the cusp of a revolutionary change. Storage systems, based entirely on flash chips similar to the ones used in smartphones, are expected to ultimately replace high-performance disk drive systems. With cutting-edge flash storage technology that is comparatively less expensive, Pure Storage is rapidly gaining traction and is likely to record healthy top-and bottom-line growth in the to-be-reported quarter.

The company focuses on research and development, primarily upgrading its existing products, while also developing new ones. These upgradations and innovations, however, come at a high cost. Such costs can be a drag on the company’s income in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively show that Pure Storage will beat earnings estimates in this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is pegged at 0.00%.

Zacks Rank: Pure Storage has a Zacks Rank #4 (Sell).

As it is we caution against stocks with Zacks Ranks #4 or #5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a couple of companies which per our model, have the right combination of elements to post an earnings beat this quarter:

Golar LNG Ltd. (NASDAQ:GLNG) has an Earnings ESP of +7.14% and Zacks Rank #3.

PVH Corp. (NYSE:PVH) has an Earnings ESP of +0.42% and Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time? Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks' private trades >>

GOLAR LNG LTD (GLNG): Free Stock Analysis Report

CISCO SYSTEMS (CSCO): Free Stock Analysis Report

PVH CORP (PVH): Free Stock Analysis Report

PURE STORAGE (PSTG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.