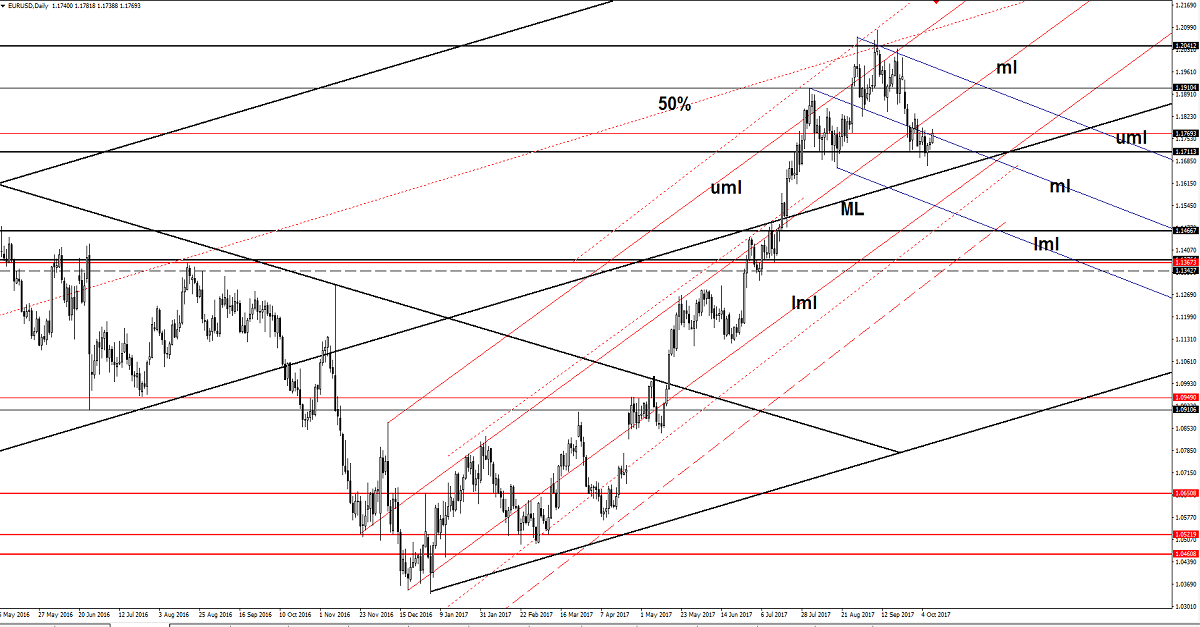

EUR/USD Throwback In Play

The EUR/USD increased in the morning and resumes in the last two day’s bullish movement. Price rallies and tries to take out a dynamic resistance as the USD is punished by the USDX’s drop. The index is at the third decreasing day and is pressuring an important dynamic support.

A USDX’s drop somewhere below the 93.30 level will confirm a further drop in the upcoming period and a USD depreciation. USDX could come down only to retest a support level before will climb higher again, is still expected to reach new highs as the FED is expected to hike the rate in December. I’ve said in the previous week that the USDX could develop an Inverse Head and Shoulders pattern, a retest of the 92.49 will signal that the pattern is developing, but only a valid breakout above the 93.81 will confirm it.

Price has managed to jump above the median line (ml) of the descending pitchfork and could approach the median line (ml) of the minor ascending pitchfork. EUR/USD should increase further after the failure to close below the 1.1712 horizontal support and after the failure to reach and retest the median line (ML) of the major ascending pitchfork. The pair could still develop a Head and Shoulders pattern if will stay within the descending pitchfork’s body. A further increase will be confirmed only after a valid breakout above the 1.2041 major resistance.

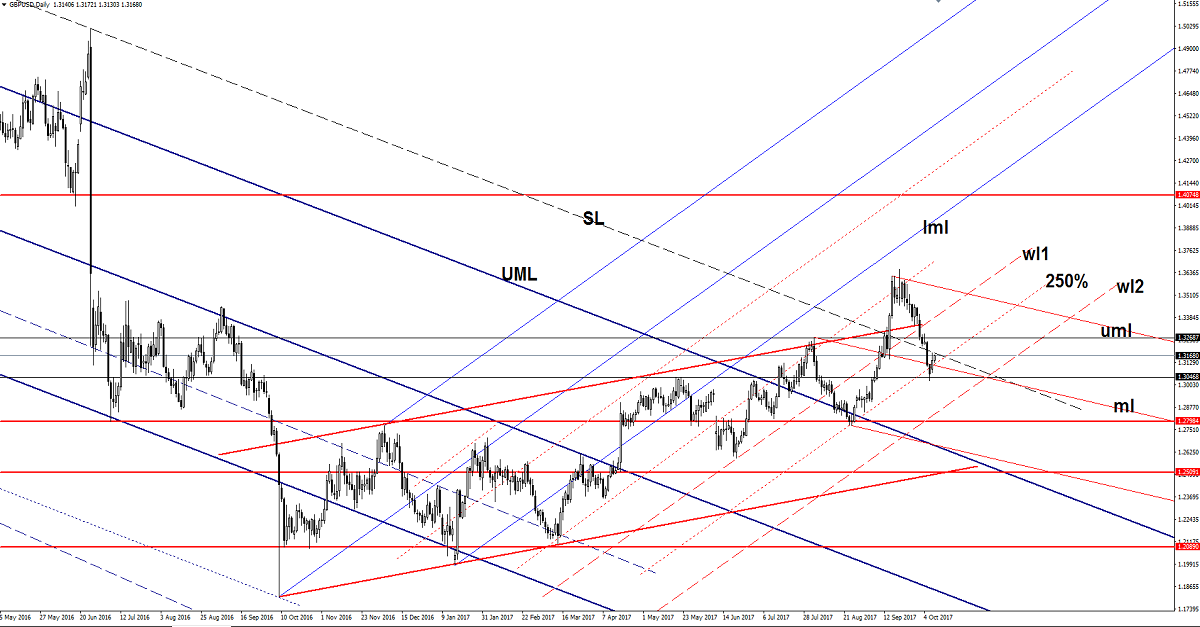

GBP/USD False Breakdown

Price increased and tries to resume the yesterday’s minor bullish candle. GBP/USD is approaching the 1.3183 yesterday’s high. GBP/USD is almost to reach the outside sliding line (SL) of the major descending pitchfork. A breakout followed by a retest will confirm a further increase. Looks like that we had a false breakdown below the 250% Fibonacci line (ascending dotted line) and below the median line (ml) of the minor descending pitchfork.

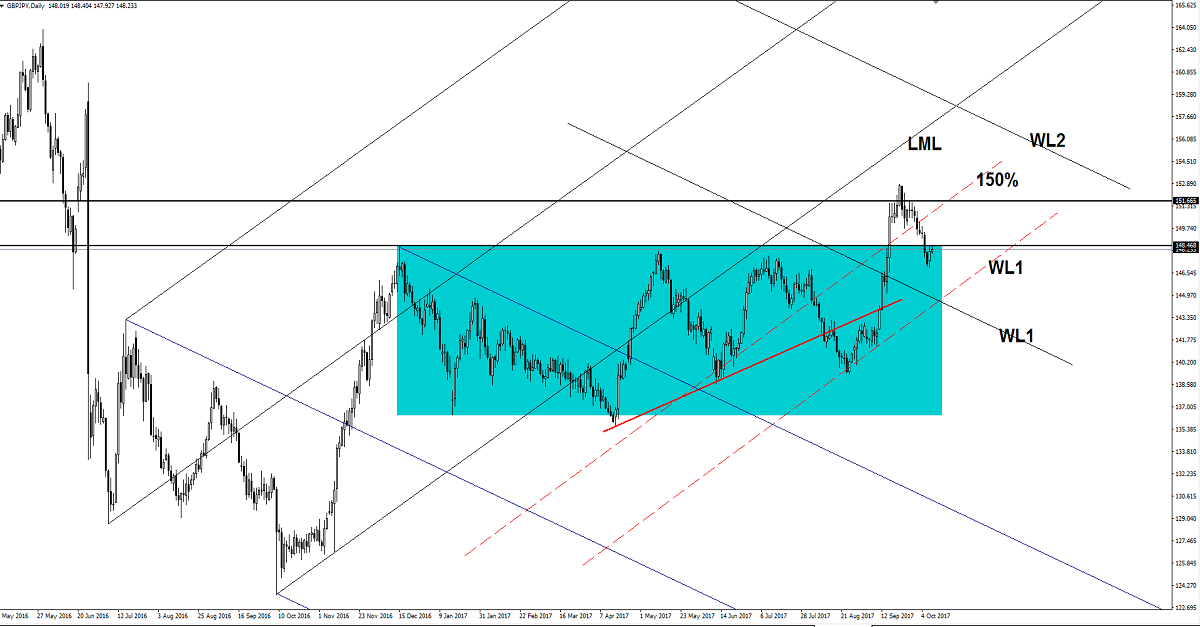

GBP/JPY More Downside In View

Price increased a little and retests the 148.46 static resistance. GBP/JPY is somehow expected to drop further on the short term after the failure to stay above the 250% Fibonacci line (ascending dotted line). The next downside target will be at the WL1of the ascending pitchfork.

Risk Disclaimer: Trading, in general, is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this website.