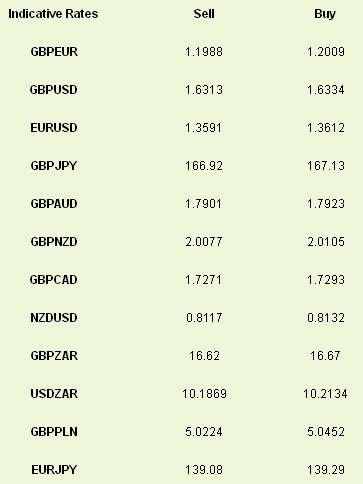

Anytime that the US is closed for a public holiday there is an inevitable drying up of liquidity, and Thanksgiving is no different. Yesterday’s drought allowed sterling to march to fresh highs versus the dollar and other currencies on the back of the latest Bank of England Financial Stability Report.

The main headline from the report was that the Bank of England felt it necessary to remove completely the Bank’s Funding for Lending Scheme support for banks and bank lending for house purchases. The key line from the Carney press conference that followed was that the Bank of England were “concerned about prospective evolution of the housing market without changes”. Simply put, whilst “bubble like” symptoms are not being seen quite yet, the Bank feels that the need for them to further stir housing demand via the FLS scheme is no longer warranted.

This is a fair shift for bank funding, especially given the differences in where bank lending is going. The FLS will remain ongoing but only for the purposes of business lending; the lending that the government and the Bank of England hope will bring about a rebalancing of the economy. In the meantime, however, we see four effects of the BOE’s decision.

The first is that sterling popped higher. Any decision to reduce the amount of monetary stimulus into the UK economy and normalise monetary policy is a currency positive. All of these things contribute to a wiping of the policy slate before the inevitable rate rises we expect in 2015. The second effect is that bets on when the Bank of England will raise rates became more near term. The BOE has cut its FLS scheme for fear of fuelling another housing bubble; the implicit fear that dictates the cut is enough to move markets to price in higher rates along the curve.

The third is an unpleasant, but necessary, development. Mortgage rates will move higher in the UK as a result of the move to cut FLS. Simple economics will tell us that a cut in supply coupled with strong demand will see the price rise. In this case the asset is money and the price is the mortgage rate. Someone told me that the FLS has been worth around 1.2% in mortgage rates on an average 25yr loan – expect banks and building societies to make sure that the price reflects the lack of supply. Fourthly, we’re not going to see a house price crash as a result of this decision as buyers will have the government’s Help To Buy scheme to fall back on.

The Nationwide building society this morning confirmed that house prices in the UK continue to march higher. House prices rose by 0.6% in November according to the latest survey with prices 6.5% higher than they were this time last year. Mark Carney spoke yesterday of how “unfortunately” younger people have to buy houses at higher prices with large mortgages from older people with none. Such is the British housing market.

Data this morning has put euro on a weaker footing. German retail sales fell by 0.8% in October; a huge slip compared to market expectations of a 0.5% rise whilst French producer prices joined their German counterparts in deflationary territory, falling by 0.2% on the month. The key euro news, however, was that Spain’s credit rating outlook was raised by S&P from negative to stable whilst the Netherlands lost its AAA rating from the same agency. The agency remarked upon a resumption of economic growth as the main reason for the upgrade; something we believe is lost behind the persistent and record unemployment.

Today we wait on the latest Eurozone inflation data that is expected to show continual, low CPI. This number, according to the ECB, was the release that prompted the decision to cut rates earlier this month. While this won’t have made an impact yet as far as lending and funding goes, the emphasis of the low inflation and low growth will see the ECB loosen policy further sooner rather than later. The figure is due at 10am.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BoE Housing Market Fears Hit GBP Bid

Published 11/29/2013, 04:11 AM

Updated 07/09/2023, 06:31 AM

BoE Housing Market Fears Hit GBP Bid

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.