- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Best Buy (BBY) Is A Must-Add Stock To Your Portfolio

Best Buy Co., Inc. (NYSE:BBY) is on a roll, buoyed by its strategic initiatives, store-in-a-store concept and solid earnings surprise history.

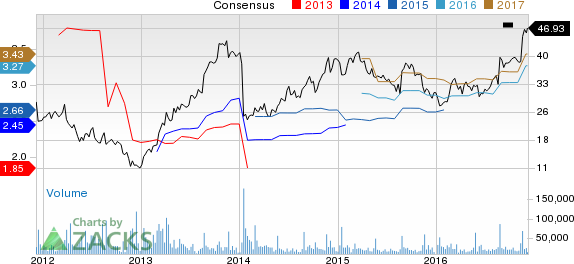

Best Buy has exhibited a bullish run in the index. So far in 2016, this Zacks Rank #1 (Strong Buy) stock has surged a whopping 59.3%, apparently outperforming the Zacks-categorized Retail–Consumer Electronic industry growth of 32.2%. Yesterday, the stock hit a 52-week high of $48.56, closing at $48.52. We believe that there is still much momentum left in the stock, which is quite evident from its VGM Score of “A” and long-term earnings growth rate of 11.9%.

Growth Drivers

Best Buy’s “Renew Blue” program achieved tremendous success in fiscal 2016. Notably, the company reached $300 million and intends to improve its annualized operating income by $400 million over the next three years. However, the savings will be offset by incremental investments for future growth.

Best Buy banks on the store-in-a-store concept as it is more viable and profitable to reach its target group. We perceive that this strategy is proving a game changer as it facilitates the display of different brands under one roof, ensuring a larger footfall. The company is leaving no stone unturned to attract consumers and attain incremental revenues, as is evident from its strategic action of opening over 1,400 "Samsung (KS:005930) Experience Shops" within its stores.

Looking at Best Buy’s performance, we observed that the company continued with its positive earnings surprise streak for the 16th quarter in a row, as it reported third-quarter fiscal 2017 results. Also, revenues beat the estimate for the third straight quarter and both top and bottom lines increased year over year. Further, online comparable sales increased 24.1%, driven by improved traffic and conversion rates. (Read more: Best Buy Stock Gains on Q3 Earnings & Sales Beat)

Following the sturdy results, the Zacks Consensus Estimate has been witnessing an uptrend over the past 30 days as analysts raised their estimates. Analysts polled by Zacks are convinced about the stock’s upbeat performance. Over the said time frame, the Zacks Consensus Estimate of $3.27 and $3.43 for fiscal 2017 and fiscal 2018 has increased 23 cents and 24 cents, respectively.

Stocks to Consider

Other favorably ranked stocks in the retail space include The Children's Place, Inc. (NASDAQ:PLCE) , Tilly's, Inc. (NYSE:TLYS) and Zumiez Inc. (NASDAQ:ZUMZ) , all flaunting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here..

The Children's Place, with a long-term earnings growth rate of 10.3%, has gained roughly 97.6% year to date.

Tilly’s, with a long-term earnings growth rate of 15.5%, has skyrocketed 126.9% in the past six months.

Zumiez, with a long-term earnings growth rate of 15%, has jumped 65% year to date.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks' private trades >>

ZUMIEZ INC (ZUMZ): Free Stock Analysis Report

CHILDRENS PLACE (PLCE): Free Stock Analysis Report

BEST BUY (BBY): Free Stock Analysis Report

TILLYS INC (TLYS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.