Bitcoin broke yet another all-time record this week, opening with a positive gap above the USD 6000 level. A likely explanation for the surge may be that investors are betting on the upcoming hard fork (SegWit2x) boosting prices even further. The fork is scheduled for mid-November. As we highlighted recently, such speculation is to be expected given the results of the recent hard forks, both of which benefited the original holders of Bitcoin by giving them Bitcoin Cash and Bitcoin Gold respectively, in addition to their Bitcoins.

That said, we have to reiterate our sceptical view on the subject. Even though BTC prices could continue to gain ahead of the upcoming fork on speculation for a similar reaction, an old expression says “past performance is no guarantee of future results”. We think this applies well to this situation, bearing in mind that a noteworthy part of the crypto-community is urging caution as the upcoming fork is fundamentally different from the previous ones, implying that the outcome on prices may differ as well.

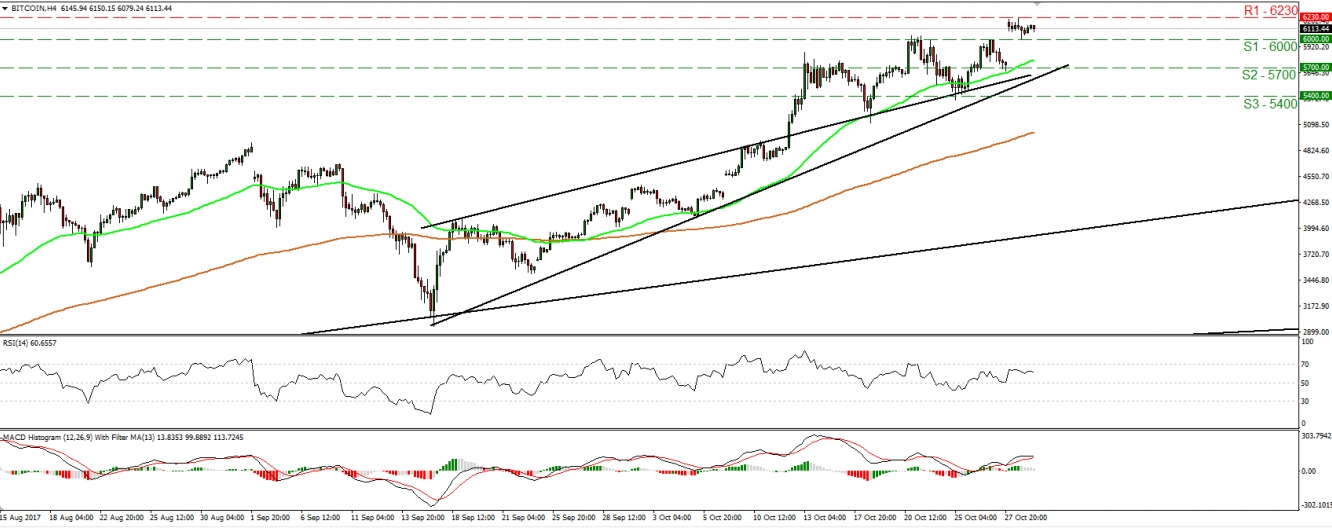

Bitcoin gapped up on Monday, to break above the round figure of 6000 (S1). The cryptocurrency hit a new all-time high at around 6230 (R1) and thereafter it continued oscillating between those two barriers. Given that the price is still trading above the uptrend line drawn from the low of the 15th of September, we believe that the prevailing trend remains positive. Therefore, a clear break above 6230 (R1) may open the way for new highs, perhaps near the next psychological zone of 6500 (R2).

Having said that though, taking a look at our short-term oscillators, we have to sound a note of caution as a corrective setback may be looming before the bulls decide to take charge again. The RSI has flattened after it hit resistance slightly below its 70 line, while the MACD, although positive, shows signs of topping.

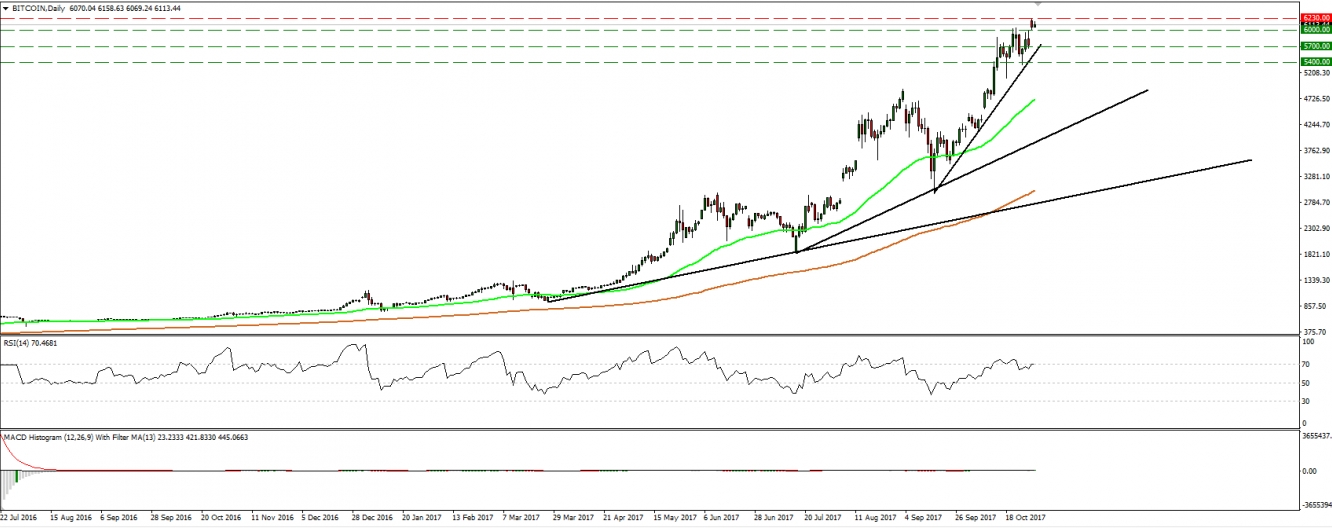

Switching to the daily chart, we see that Bitcoin continues to trade in an uptrend that is accelerating exponentially since the March.