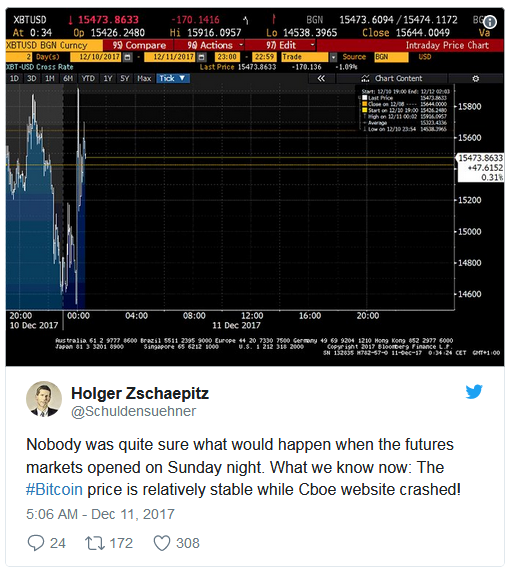

Nobody was quite sure what would happen when the futures markets opened on Sunday night. We now know.

This evening, CBOE futures launched. These Tweets describes the result.

The Wall Street Journal reports Bitcoin Futures Begin Trading With a Bang, CBOE Website Stalls.

The first bitcoin futures started trading Sunday, sparking a swift run-up in the price of the digital currency as the exchange provider’s website experienced outages from heavy traffic.

Trading of the hotly anticipated U.S. bitcoin futures began at 6 p.m. Eastern Standard Time on Sunday on an exchange run by Cboe Global Markets Inc., while its larger rival CME Group Inc. (NASDAQ:CME) plans to introduce its own bitcoin futures a week later.

Bitcoin Volatility

Bitcoin hourly changes have been as much as 20%. The moves have been so intense that futures trading would frequently halt numerous times daily on circuit-breaker rules.

Moreover, Bitcoin has traded at wildly different prices simultaneously, such as $15,000 on one exchange and $19,000 on another.

Bitcoin Price Varies Wildly by Exchange

Bitcoin traded above $19,000 on Thursday, but you may have missed it. As it was reaching $19,500 just after 11 a.m. on the GDAX exchange, which is run by the popular bitcoin brokerage firm Coinbase, bitcoin was still stuck in the high $15,000's on other trading platforms. Similarly, most U.S. traders woke up on Thursday to news that bitcoin was above $15,000, unless they were following it on Bitfinex, where it didn't cross $15,000 until soon before 10 a.m.

This is nothing new. Bitcoin trades on dozens of exchanges, and the prices get out of whack at times. But as the price of bitcoin rises more rapidly into the tens of thousands, the gap seems to be getting worse. It was particularly bad on Thursday, when for several hours in the morning the difference between the price of bitcoin on the exchanges remained thousands of dollars, more than the total price of bitcoin just a few months ago.

Some Kinds of Volatility Will Decline

On a futures exchange-based market, such volatility is guaranteed to decline. Otherwise, there would be an enormous arb opportunity, buying at $15K on one exchange and selling at $17K on another, knowing full well the spread would close.

In addition, hour-to-hour volatility may decline because futures circuit breakers require "time outs".

However, futures trading will not reduce long-term volatility associated with bubbles.