Jesse Livermore was a master of price action. Bitcoin price action has been impressive in 2017. Price, however, is not the sole driver of trends. Richard Wyckoff, a master of reading volume as a critical and often ignore sub component of the tape, would define Bitcoin's price action within the cycle of accumulation and distribution. Negative divergences or, worse yet, bearish alignment of price and volume, would warn traders to reduce risk despite the majority's optimism.

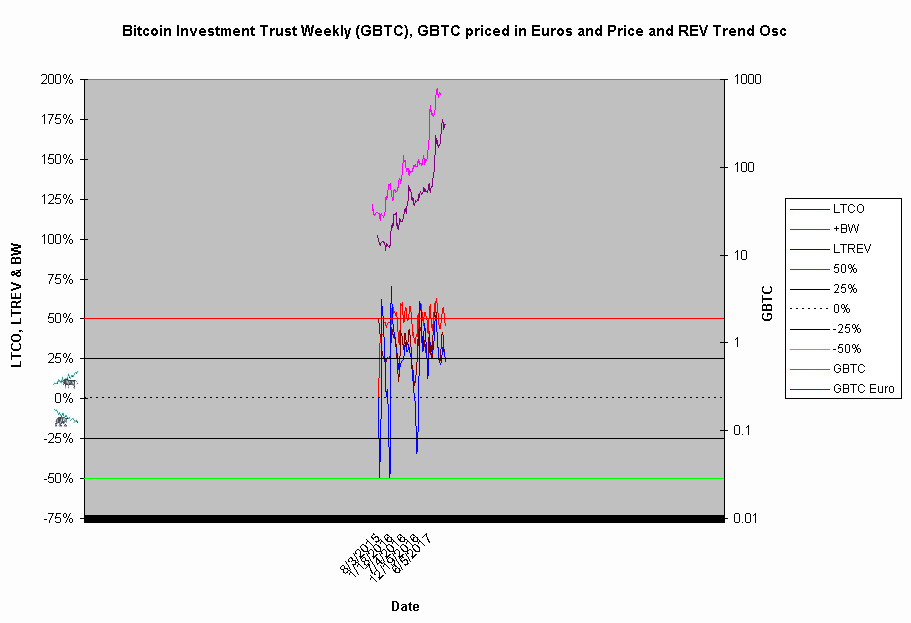

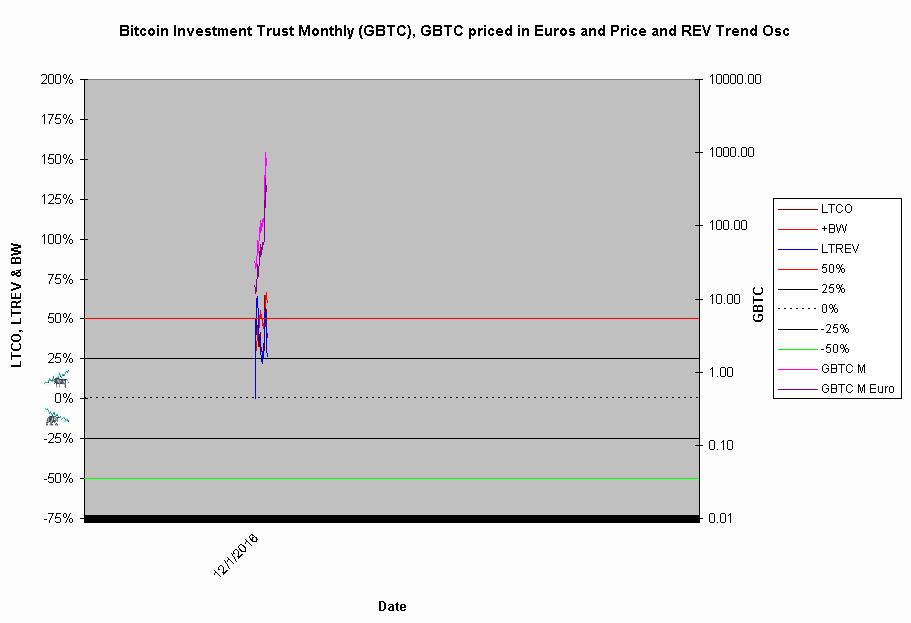

Is Bitcoin a sell today? Absolutely not. Fortunes will be made as long as bullish alignment exists (see chart 1 and 2).

Bitcoin and cryptocurrencies, regardless of what the true believers say, will neither achieve a permanent plateau of prosperity nor survive in their current form. Governments, desperate for cash to balance budgets as interest rates rise unexpectedly, will not let cyrptos, largely private today, circumvent capital controls and tax policies. Bitcoin prices could suddenly collapse once government enters the game. Good luck keeping them out.

Headline: Opinion: Why Jesse Livermore, who made a mint in the Crash of 1929, would buy bitcoin today

Buy bitcoin.That’s not my advice. It’s the advice of one of Wall Street’s most famous traders and speculators, Jesse Livermore.

And he’s been dead for 77 years.

The price of bitcoin set yet another new high Thursday, breaking through $5,000 for the first time. The so-called cryptocurrency has been in a massive boom all year, rocketing from just below $1,000 in January and crashing twice along the way.

My opinion is that bitcoin has absolutely no intrinsic value, and its long-term investment case makes no compelling sense. Many, obviously, take the opposing view. But it doesn’t really matter. This article is not about the long-term investment case.