Its no secret that Bitcoin has taken the world by storm. A huge number of new and interesting ways to spend and invest with Bitcoin are coming online, from Bitcoin IRA solutions to buying houses with Bitcoin.

This explosive growth has led to some speculation that Bitcoin is moving to replace gold as a safe haven asset. Even substantially well-respected analysts like Fundstrat founder Tommy Lee have suggested that such a transition could conceivably occur, moving Bitcoin into a dual role as both currency and investment.

For all the positive news, however, there are an equal or greater number of detractors, suggesting that Bitcoin is a scam, both as asset and investment, since it is founded on nothing but consensus.

Jamie Dimon, CEO of JPMorgan Chase (NYSE:JPM), famously called Bitcoin a ‘fraud’, suggesting that the lack of financial support makes the cryptocurrency purely speculative. Other analysts have echoed Dimon, noting that the cryptocurrency is backed by nothing but consensus, which could change in a moment, rendering the currency worthless.

So with all the conflicting opinions, should investors be long on Bitcoin? Or stick to traditional safe-haven investments like gold?

Advantage Gold?

Gold has been the traditional hedge investment for safe-haven investing during times of financial uncertainty or geopolitical crisis. This investment strategy has not changed much for the last 100 years.

Gold is used as a safe haven because it has been thought to have intrinsic value. Gold is gold, regardless of what happens globally or financially. The price of gold is linked to its intrinsic quality, which can be evaluated simply by comparison with fiat currency. Gold has shown remarkable resiliency as a stable asset for store of value. For this reason, the precious metal is often used as a stable asset fixed against fluctuations in markets.

The value of gold, however, is more of a concept than an intrinsic reality and varies with market climate. The general value of gold is based on its anonymity and ease of transport for large financial exchanges. Plus, as a source of value during uncertainty, gold is able to weather governmental and political turbulence.

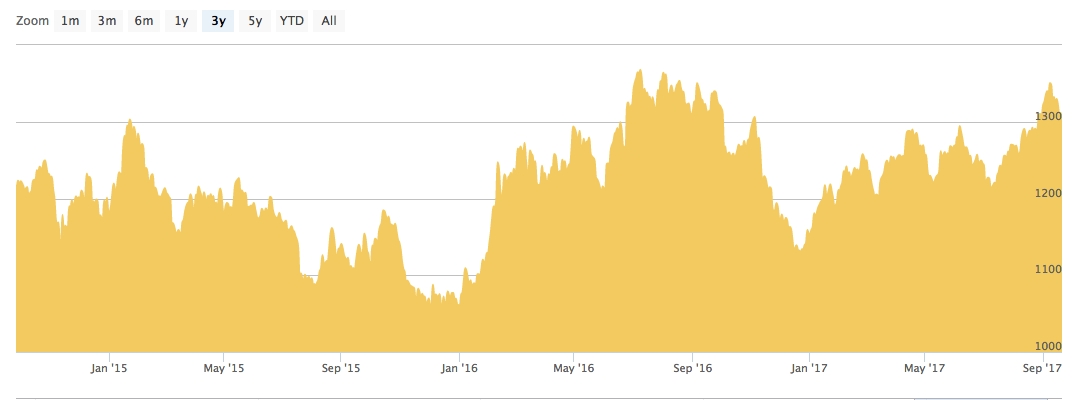

For this reason, gold can be a relative hedge against risk and can therefore provide a method for investor portfolio risk-aversion. Which is why the price of gold remains generally stable, especially when considered against other more volatile vehicles.

Advantage Bitcoin?

Bitcoin also holds many of the same properties as gold as a financial class. The fact that Bitcoin is widely regarded as having value effectively makes it like gold in its value, based on consensus.

The cryptocurrency faithful argue that gold has value based only on consensus. The metal has intrinsic value simply because people have assigned it that value. They argue that since value is consensus-based, other assets can have the same value as gold, simply based on general consensus, with the most notable example being the ancient price of salt.

While Bitcoin carries consensus, it is nevertheless wildly volatile. This volatility is generally thought to be fully contrary to a store of value hedge against market risk. However, because Bitcoin is not tied to any government, it can nevertheless function well as a hedge investment, while still offering the potential of substantial returns.

Since Bitcoin carries increasingly wide consensus as a currency, it should be considered as such, regardless of what governments may say. In this way, Bitcoin shares the anonymity that has made gold a safe-haven asset.

With consensus and decentralized anonymity, Bitcoin functions essentially as a gold-like investment vehicle. Bitcoin faithful Bobby Lee has even called it ‘digital gold,’ referring to its status as an asset.

Which To Choose?

Bitcoin carries the risk factor of volatility and a lack of intrinsic value. Gold is stable and intrinsic but does not provide opportunity for return the way that Bitcoin and other cryptocurrencies do.

Some companies are trying to bridge the gold/Bitcoin gap using blockchain technology to create tokenized gold assets. In many ways, this moves the intrinsic value of gold into the cryptosphere, effectively digitizing gold as an asset.

For example, Goldmint has created a system where ‘GOLD’ tokens are created by bringing gold items to a local Custody Bot created by Goldmine. The Custody Bot is a machine that weighs and grades gold objects and then sends the appropriate amount of GOLD tokens to the user’s wallet.

The GOLD tokens can then be converted to Bitcoin or fiat currency through digital exchanges, or held by investors as a gold-backed store of value. Such a system unites the power of gold as stable asset with the liquidity and market potential of Bitcoin.

Whether investors choose gold or Bitcoin in the coming years remains to be seen, but the reality for an investor as a hedge against the instability facing the world these days is clear.